Banking executive walks toward a cloud labeled transformation, only to find it resting on a traditional data center, representing fake cloud adoption.

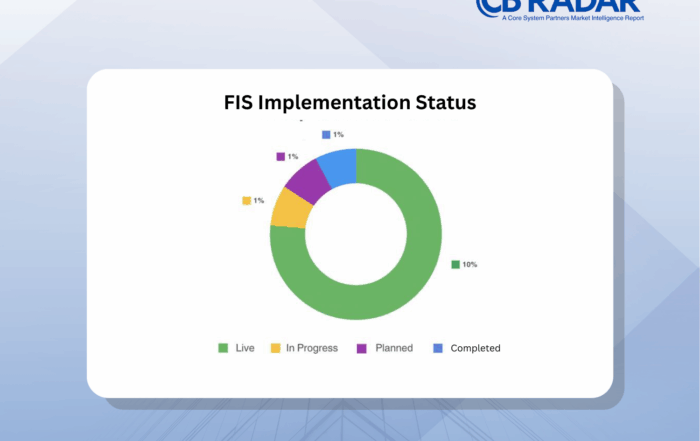

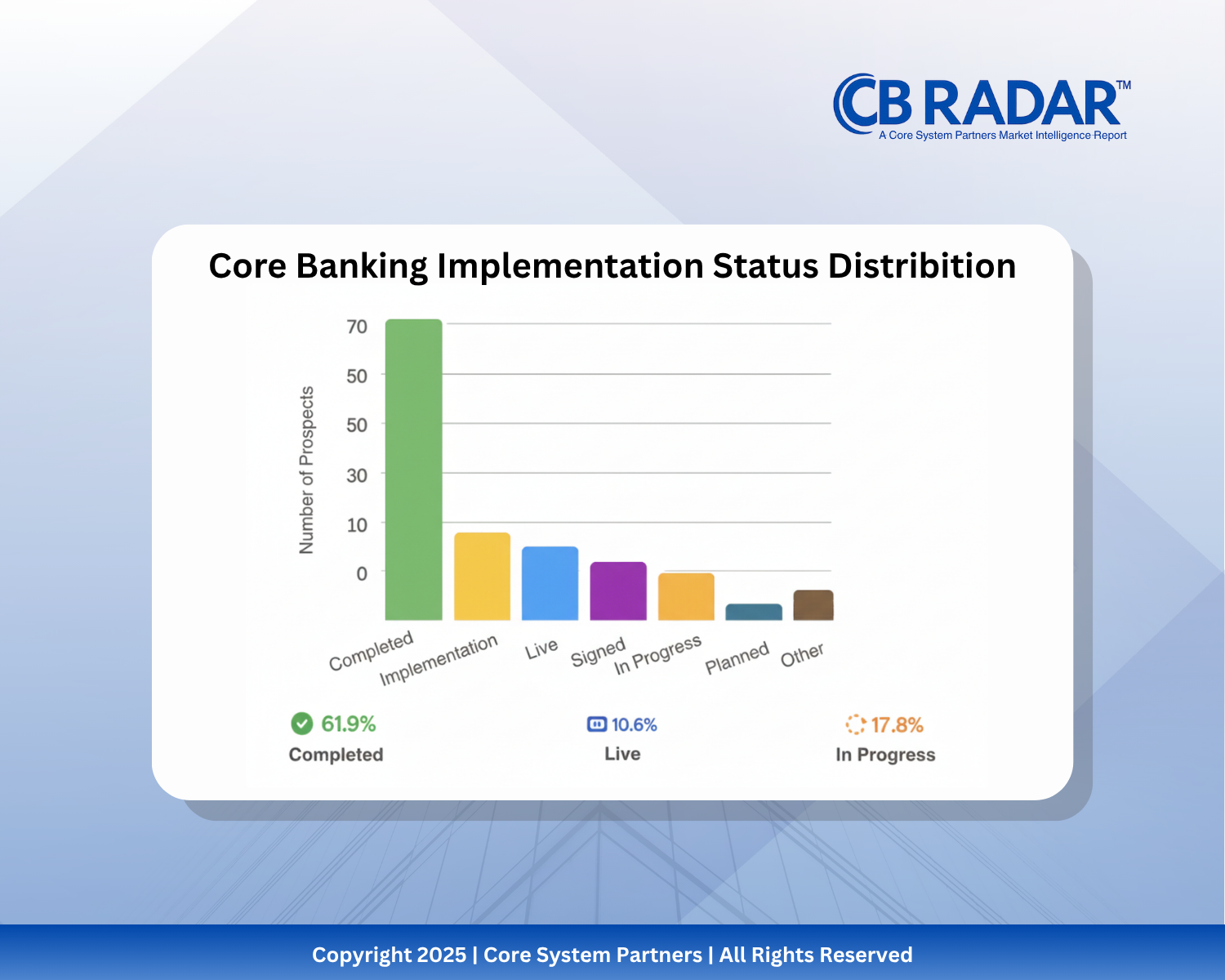

In CB RADAR™ 2025, 72.5% of banks reported their core banking transformation as a “success.” That number sounds encouraging, until you compare it to decades of research showing that 60–75% of major transformations fail to deliver their intended outcomes.

How can both be true? The answer lies in how banks define success.

“Most projects declare victory the moment they go live, not when they deliver value.”

The Optics of Success

In the transformation world, “success” is often shorthand for survival.

If the system didn’t crash, the migration completed, and customers can still access their accounts, the project is deemed successful.

That definition is convenient, but incomplete. Going live is a milestone, not a finish line.

In CB RADAR™, a significant number of respondents used operational completion as their benchmark for success, not business impact. Yet when probed further, many admitted the new core still hadn’t delivered the promised agility, cost savings or product innovation.

“Transformation success is often measured by completion, not consequence.”

The Quiet Cost of “Good Enough”

The real problem isn’t failure, it’s false success.

When programs are labeled “complete,” funding and executive attention move on. Meanwhile, teams are left to stabilize, integrate, and retrofit features that never made the original release.

This creates a subtle but costly gap: transformation fatigue sets in and the organization loses momentum just when the system could start to yield returns.

Some banks even institutionalize this cycle, running five-year programs that end right where the next one begins.

Why It Happens

Success metrics in large transformations are rarely standardized.

IT teams track uptime and performance; business leaders focus on product speed or cost reduction; regulators care about stability.

Each group has its own success story and when those stories conflict, the narrative defaults to the safest version: “We went live.”

“The most dangerous outcome isn’t failure — it’s believing you’ve already succeeded.”

What True Success Looks Like

The banks that outperform in CB RADAR™ share one common trait: they define success in layers.

- Technical success: Stable, secure, compliant.

- Operational success: Faster releases, simplified integration.

- Business success: Measurable improvement in growth, cost, and customer metrics.

Each layer builds on the last. Without the business layer, the transformation remains a technical achievement, not a strategic one.

The Path Forward

Success is not a declaration; it’s a discipline.

Executives who treat go-live as the beginning of transformation, not the end, see far better outcomes over time.

That shift requires three things:

Clear, measurable success metrics before kickoff.

Governance models that track outcomes beyond implementation.

A willingness to treat transformation as ongoing, not episodic.

“Go-live should be the start of transformation, not the end of it.”

What CB RADAR™ Reveals

CB RADAR™ 2025 highlights the widening gap between reported success and real

success.

When banks stop equating stability with strategy, their transformation journeys move from survival mode to value creation.

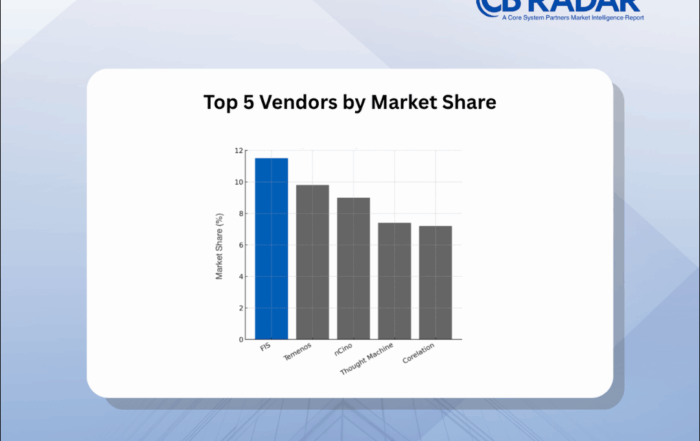

Read the full CB RADAR™ 2025 report to explore how 113 institutions defined and measured success and what separates lasting impact from premature celebration.

And if you want to benchmark your own institution’s readiness against the market, you can also try our Core Banking Transformation Readiness Scorecard, which helps you see how your bank stacks up against the themes revealed in CB RADAR™.

CB RADAR™ is not a vendor pitch. It’s a reality check. And in a market where every decision carries long-term consequences, clarity is your strongest advantage.

#CoreBankingTransformation #CoreBankingBenchmarks