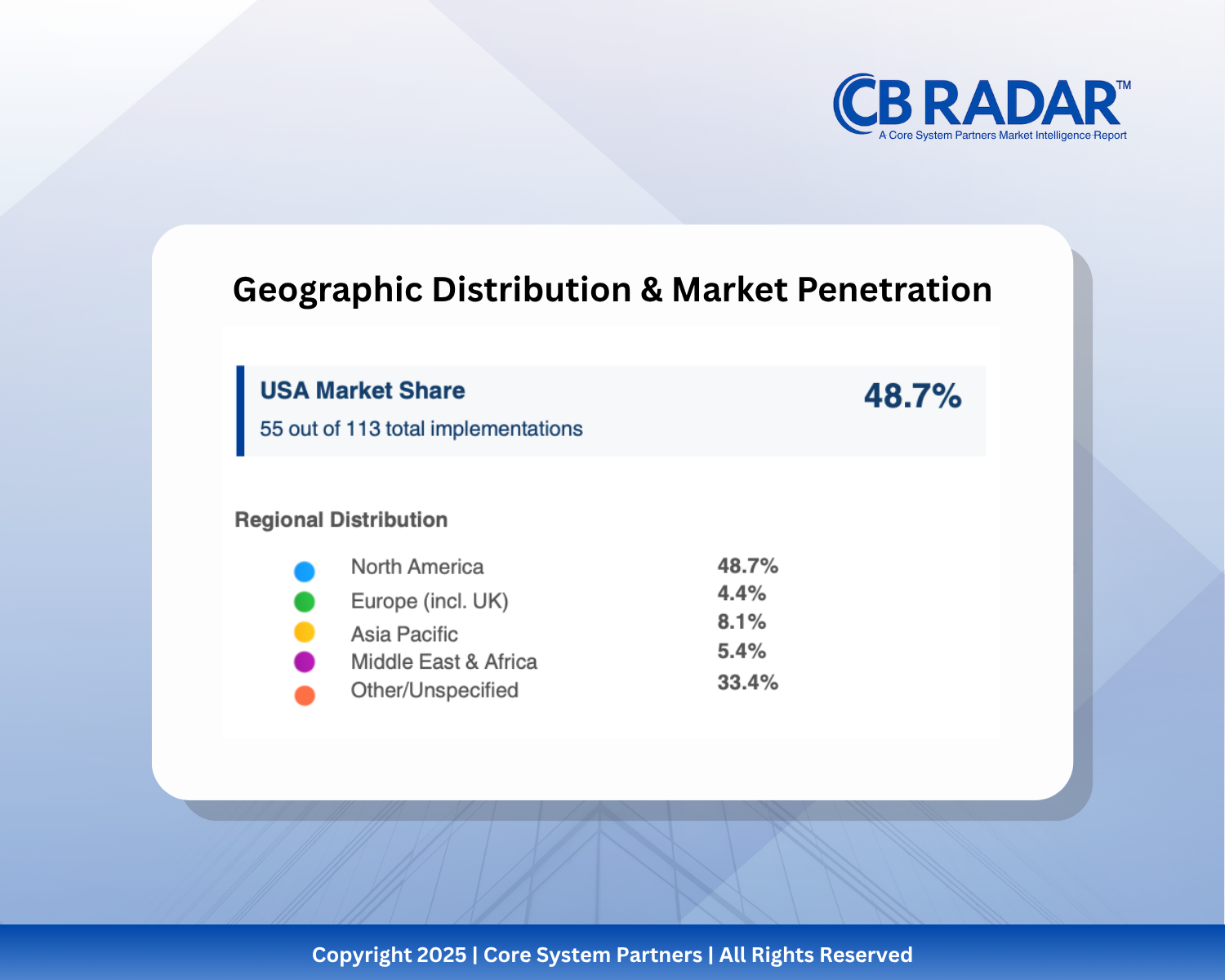

CB RADAR™ 2025 shows the U.S. leads with 48.7% of global core banking implementations—but scale doesn’t always equal speed.

Nearly half of all core banking transformations tracked in CB RADAR™ 2025 occurred in the United States. That dominance reflects the country’s concentration of vendors, mature regulatory environment, and access to capital.

But as strong as the U.S. showing is, there’s a new question emerging:

Is the U.S. leading transformation or just modernizing late? “The U.S. leads in volume, but not always in velocity.”

A Market Driven by Scale

The U.S. core banking landscape is massive. Thousands of mid-tier and regional institutions still run legacy cores dating back decades.

For many, modernization is not about innovation — it’s about survival.

Large-scale projects continue to be driven by infrastructure risk, compliance pressure, and cost reduction rather than customer experience or product agility. That pragmatism keeps the market active, but also conservative.

“Transformation in the U.S. is often reactive, not revolutionary.”

Why the U.S. Dominates the Numbers

Several structural factors explain America’s lead in CB RADAR™ data:

- Vendor proximity: U.S.-based providers maintain strong banking relationships and delivery networks.

- Regulatory clarity: Defined frameworks make it easier to scope and fund large projects.

- Capital availability: Even mid-size banks can secure the budgets to modernize.

In short, the U.S. dominates because it has the most opportunities to modernize. But that doesn’t necessarily mean it’s ahead of the curve.

The Global Catch-Up

Outside the U.S., smaller and newer banks are leapfrogging legacy altogether.

In markets like Vietnam, Nigeria, and Kuwait, institutions are adopting cloud- native cores as their first core system — skipping decades of accumulated technical debt.

These banks are nimble by necessity, and their smaller size allows faster cycles of experimentation and adoption.

“Emerging markets aren’t catching up — they’re leapfrogging.”

What the U.S. Can Learn

U.S. banks have the advantage of scale but often lack the agility to capitalize on it. The most progressive institutions in our dataset share three habits:

1. Modular thinking: Breaking down transformation into discrete, measurable components.

2. Cloud fluency: Moving from hybrid stopgaps to operating-model redesign.

3. Partner ecosystems: Building delivery alliances rather than vendor dependencies.

The result is a new hybrid: American scale, delivered with startup speed.

The Outlook

The U.S. will continue to lead in transformation volume — but not necessarily in innovation.

If emerging markets maintain their current pace, the next CB RADAR™ report may show a shift in where meaningful modernization is happening fastest.

“Leadership in transformation isn’t about geography — it’s about mindset.”

What CB RADAR™ Reveals

CB RADAR™ 2025 highlights both the strength and the vulnerability of the U.S. banking sector.

Scale has fueled progress, but legacy inertia remains its shadow.

The question for the next few years isn’t whether the U.S. will modernize — it’s whether it will redefine what modernization means.

Read the full CB RADAR™ 2025 report to explore regional trends, market fragmentation, and the strategies shaping the next wave of global transformation.

And if you want to benchmark your own institution’s readiness against the market, you can also try our Core Banking Transformation Readiness Scorecard, which helps you see how your bank stacks up against the themes revealed in CB RADAR™.

CB RADAR™ is not a vendor pitch. It’s a reality check. And in a market where every decision carries long-term consequences, clarity is your strongest advantage.

#CoreBankingTransformation #CoreBankingBenchmarks