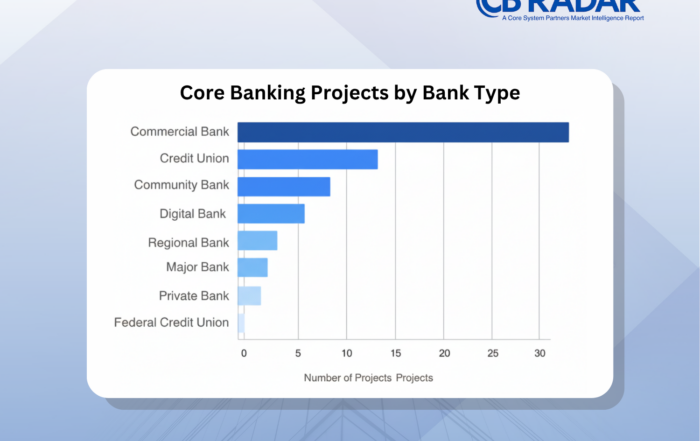

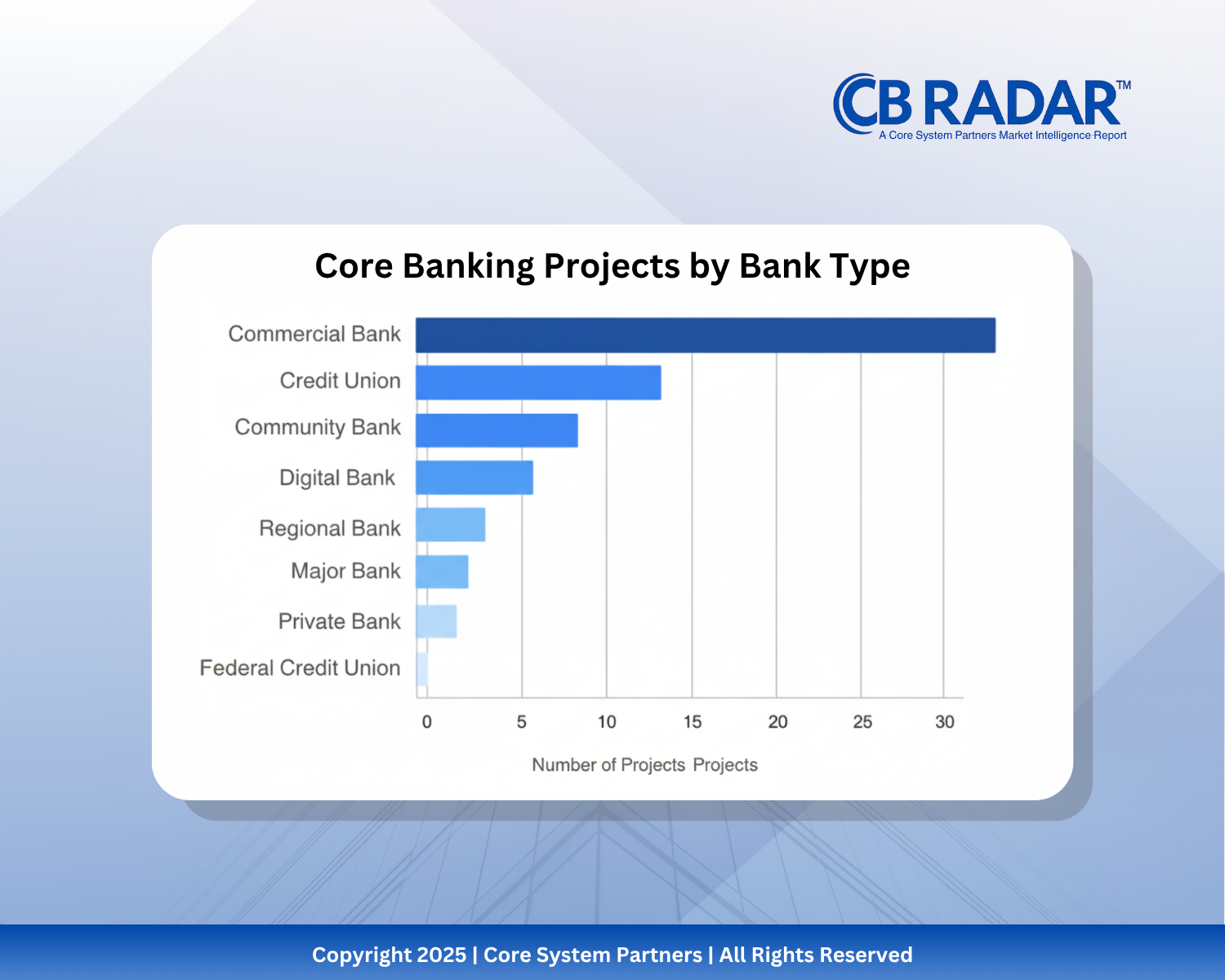

CB RADAR™ 2025 shows that commercial banks lead core transformation activity, while credit unions and community banks also show growing momentum.

Every transformation feels unique, until you see the data.

CB RADAR™ 2025 brings that data into focus, giving banks a chance to see where they truly stand in relation to 113 global peers who’ve modernized or are in the process of doing so.

What emerges is a pattern that’s both sobering and encouraging: while most institutions are moving forward, few are moving as far or as fast as they think.

“Transformation feels personal, but in reality, it’s highly predictable.”

The Power of Perspective

When you’re deep inside a transformation, it’s easy to lose perspective. Timelines stretch, goals evolve, and benchmarks blur.

CB RADAR™ provides an external mirror, a way to compare your progress not against aspiration, but against actual performance across the industry.

That’s why we built the Core Banking Readiness Scorecard: a diagnostic tool designed to help banks benchmark their readiness, execution maturity, and post- implementation impact against global norms.

“What gets measured gets improved and what gets benchmarked gets believed.”

What the Data Says

Across the CB RADAR™ dataset, three benchmark dimensions emerged:

- Readiness Gaps: Many institutions underestimate the time and talent required before launch.

- Execution Drift: Scope changes and vendor dependencies are the most common causes of delay.

- Outcome Ambiguity: Even after go-live, fewer than half of respondents had defined ROI or efficiency targets.

The Scorecard helps banks quantify these realities — not as pass/fail judgments, but as baselines for improvement.

Why Benchmarking Matters

Without benchmarking, every project exists in a vacuum.

With it, transformation becomes part of a global learning curve, where lessons compound and success is contextualized.

Banks that use comparative data early in the planning phase make better vendor choices, set more realistic timelines, and avoid the traps of overconfidence.

“Benchmarking turns transformation from a guess into a discipline.”

From Data to Dialogue

Benchmarking isn’t about ranking, it’s about conversation.

When executives and delivery teams see where they stand, discussions shift from opinion to evidence.

This creates alignment, clarity, and accountability — the three elements every successful transformation depends on.

It also helps boards and regulators see transformation as measurable progress, not abstract ambition.

The Advantage of Knowing

CB RADAR™ isn’t just a report; it’s a context engine.

It helps leaders connect their institution’s journey to a broader, evidence-based narrative.

When combined with the Core Banking Readiness Scorecard, it gives banks a clear, data-backed roadmap for where to focus next.

“The smartest transformation leaders don’t aim to be first, they aim to be certain.”

What CB RADAR™ Reveals

CB RADAR™ 2025 shows that transformation success improves dramatically when banks know how they compare.

Self-awareness is the new competitive advantage and benchmarking is how you earn it.

/fusion_text]

And if you want to benchmark your own institution’s readiness against the market, you can also try our Core Banking Transformation Readiness Scorecard, which helps you see how your bank stacks up against the themes revealed in CB RADAR™.

CB RADAR™ is not a vendor pitch. It’s a reality check. And in a market where every decision carries long-term consequences, clarity is your strongest advantage.

#CoreBankingTransformation #CoreBankingBenchmarks