AI is no longer a trend in banking—it’s the infrastructure for transformation. The question is, will you scale it, or get left behind?

You can feel it. The ground’s shifting under the banking industry. Political instability, economic headwinds, regulatory pressures—none of that’s new. But the real wildcard in 2025? It’s not another macro trend. It’s AI. And not just in the lab or a pilot sandbox. We’re talking about AI as an enterprise-wide force multiplier.

IBM’s latest Global Outlook for Banking and Financial Markets lays it out clearly: the gap between tech-forward banks and the rest is only getting wider. The question isn’t whether you’ll adopt AI. It’s whether you’ll make it scale—or get left behind.

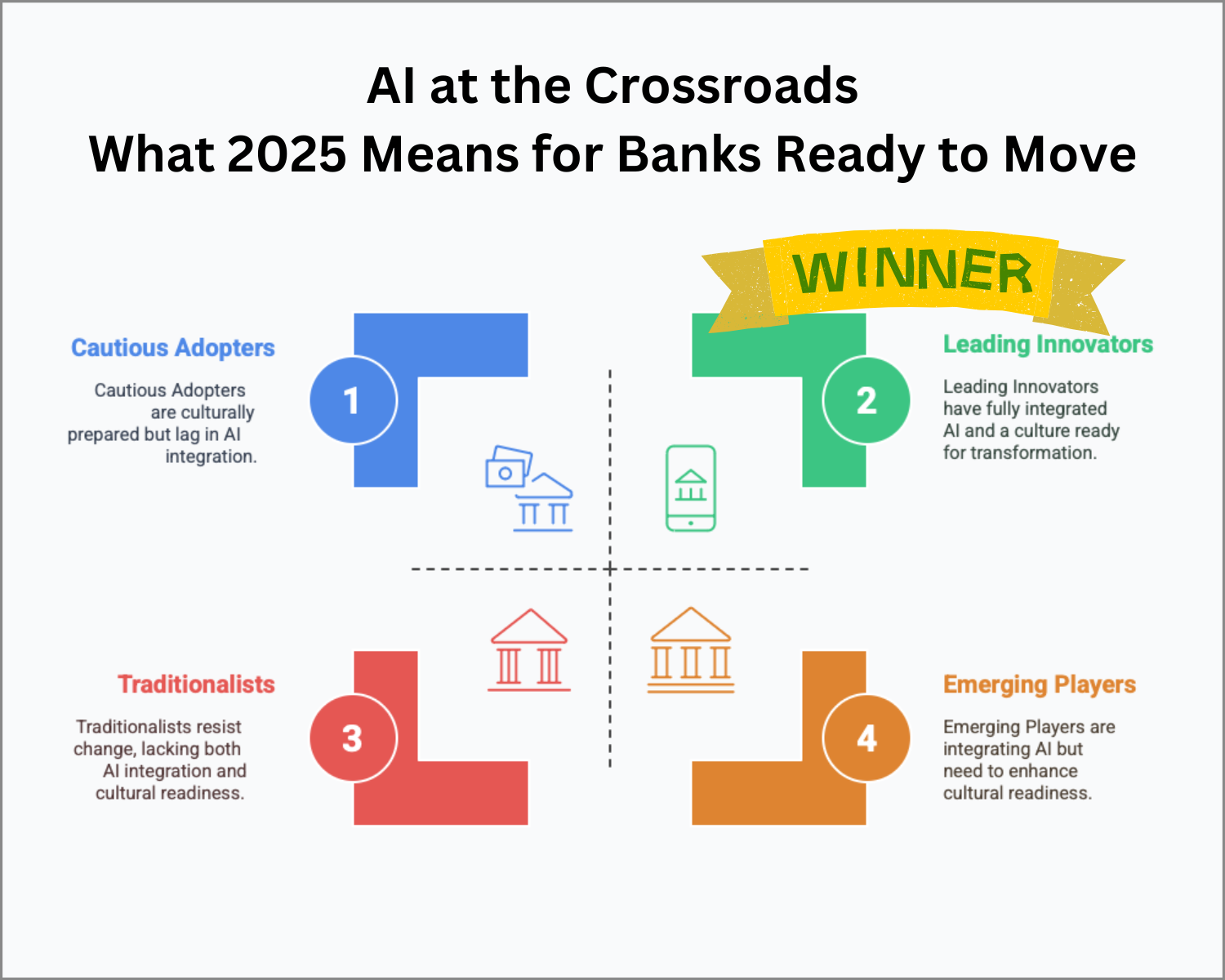

The AI Divide Is Real

Some banks are already pulling ahead. They’ve done the hard work:

- Built strong tech foundations.

- Embedded AI throughout operations.

- Reimagined business models with data at the core.

- Taken a seat at the market leader’s table—not just by size, but by speed and smarts.

These are the players treating AI not as a side project but as the operating system of the enterprise. They’re not tinkering. They’re transforming.

CEOs Know the Stakes

IBM’s data shows that over 60% of banking CEOs understand what’s at stake. They know they have to take calculated risks if they want to stay competitive—and automation and AI are the biggest bets on the table.

But here’s the rub: most organizations aren’t culturally ready to handle those risks. Not yet. Building a culture of risk fluency around AI is now just as critical as managing liquidity or cyber threats. That means giving everyone—from product managers to operations teams—a working understanding of how AI intersects with ethics, compliance, and reputational risk.

Generative AI: The Hype is Real, But So Is the Learning Curve

Last year, only 8% of banks were developing generative AI in a systematic, enterprise-level way. The rest? Tactical experiments. Proofs of concept.

Now we’re seeing a shift. Banks are moving beyond the pilot phase. But that’s where the real work begins—governance models, talent alignment, rethinking processes end-to-end. There’s no scaling without structural change.

So What Now?

Here’s what we’re telling our clients and partners:

- Stop asking “if” and start asking “how.” AI isn’t a trend. It’s infrastructure.

- Build risk management into your AI strategy from day one. Not as a gatekeeper, but as a design principle.

- Think like a product company. If you want AI to drive revenue and efficiency, treat models and tools like products—built, tested, iterated.

- Make AI fluency part of your culture. Not just in data science teams, but across the board.

Where We Come In

At Core System Partners, we live in this space. Transformation isn’t theory—it’s daily work. Whether you’re rethinking your core, modernizing your tech stack, or trying to wrangle governance into something scalable, we bring the frameworks, experience, and brutal honesty it takes to get it done.

2025 is here. The opportunity’s real. So is the risk.

If you’re ready to move from experimenting to scaling, let’s talk.

#CoreBankingTransformation #AIinBanking