Highlighting the critical role of operational resilience in banking, focusing on enhancing core systems for agility, embracing digital payments, and adopting innovative technologies to thrive in the digital age.

The banking industry is undergoing a rapid transformation, and operational resilience has become the linchpin for success in this digital age. As core banking systems evolve to accommodate the shift towards digital payments, banks must prioritize building operational resilience to thrive in this changing environment.

Operational resilience is no longer just a buzzword; it is the foundation upon which a bank’s ability to withstand shocks and remain relevant in providing essential services rests. In an era of looming cyber threats and rapid technological advancements, ensuring the robustness of core banking systems is paramount.

Customizing Core Systems for Agility

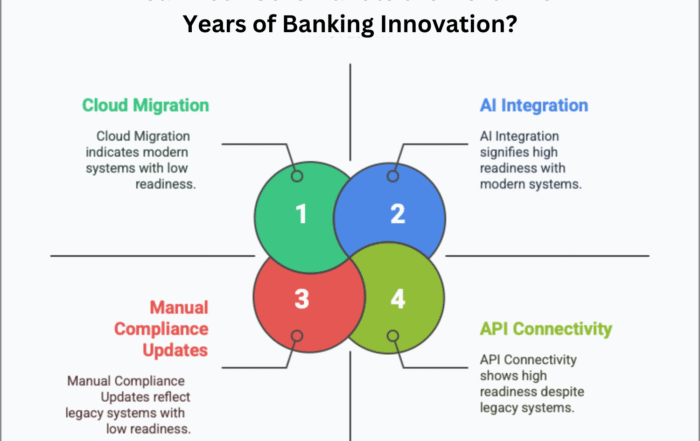

The digital era has driven the need for core banking systems to become more flexible and agile. Traditionally considered monolithic and difficult to change or adapt, the rise of modular and cloud-based solutions has introduced a new dimension of scalability and innovation. By embracing these technologies, banks can better position themselves to build operational resilience, enabling them to respond quickly to new market demands and regulatory requirements.

Embracing the Future of Digital Payments

The very essence of this transformation lies in the digitization of payments within banks. Major shifts have occurred in the payments landscape, with increased adoption of mobile banking, contactless payments, and even cryptocurrencies. To remain resilient, banks must secure and streamline these transactions, both now and in the future. By leveraging data analytics and artificial intelligence, banks can gain deeper insights into customer behavior, allowing them to adapt their payment solutions and stay ahead of the curve in this ever-changing environment.

Best Practices for Operational Resilience

To build operational resilience in the digital age, banks should focus on the following key areas:

1. Cybersecurity: Implement strict security policies to safeguard the organization against cyber threats. Regular security assessments, workforce training, and active threat detection are essential.

2. Business Continuity Planning: Develop comprehensive plans to ensure critical services remain uninterrupted in the event of emergencies. This involves identifying potential risks, such as natural disasters or system failures, and establishing control and regulatory protocols.

3. Regulatory Compliance: Maintaining confidence and avoiding penalties requires banks to stay up-to-date with changing regulations and ensure compliance. Banks should strive for flexible regulatory compliance to adapt to new requirements.

The Role of Innovation

Innovation plays a crucial role in enhancing operational resilience in the digital age. By harnessing new technologies, banks can improve efficiency, reduce business risks, and deliver superior customer experiences. For example, blockchain technology ensures secure and transparent transactions, while machine learning can refine fraud detection and risk management.

Operational resilience is not merely about surviving the digital age; it is about leading the charge. By embracing the future of digital payments and championing innovation, banks can assure their longevity and relevance in this rapidly changing world. The banks that lead the journey towards operational resilience will empower the industry’s digital revolution and thrive in the digital age.

Found this article interesting? Check out these three related reads for more.

- Core banking transformation for operational resilience

- Future-proof your bank with core banking transformation

- Navigating digital banking regulatory challenges

#ResilientBanking #DigitalPayments