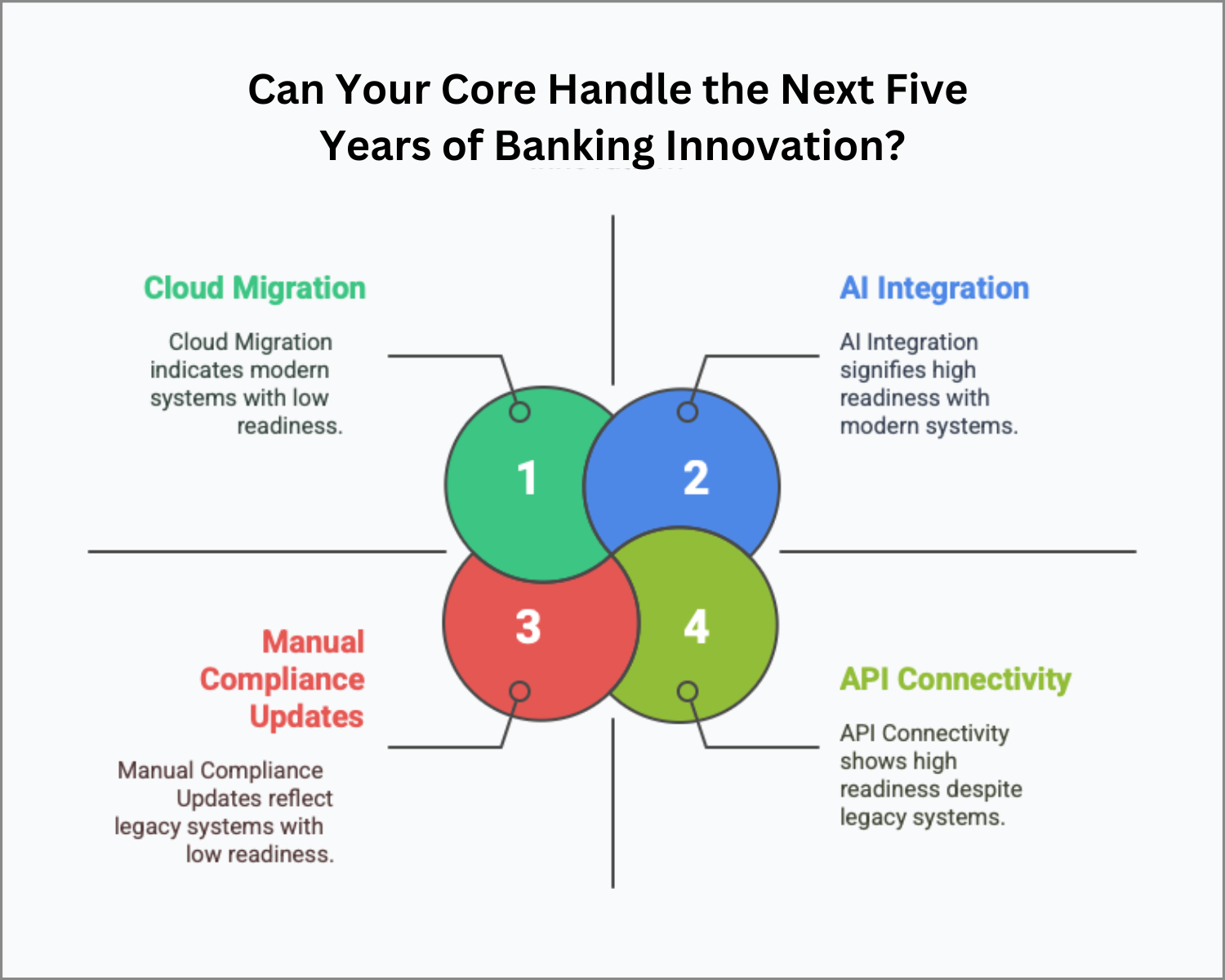

Can your core system handle the next five years of banking innovation? Explore how cloud, AI, compliance, and API integration determine readiness.

TL;DR – Can Your Core Handle the Next Five Years of Banking Innovation?

-

Tech Expectations Are Evolving Fast – AI, open banking, and embedded finance are redefining what a “modern” bank looks like.

-

Legacy Systems Limit Agility – Older cores often can’t support rapid product launches or personalized services.

-

Integration Is Mission-Critical – A future-ready core must easily connect to ecosystems, APIs, and cloud platforms.

-

Scalability and Resilience Are Non-Negotiable – Your core must scale securely as customer demand and data volume surge.

-

Why It Matters – Evaluating your core today helps you stay competitive, compliant, and innovative tomorrow.

Banking Is Changing Fast—Is Your Core Ready?

Banking is moving faster than ever. AI is reshaping how we serve customers. Regulators are tightening standards. Fintech partnerships are the new normal. And cloud? It’s not just a buzzword—it’s where the industry is headed.

In the next five years, banks that can adapt quickly will thrive. Those that can’t? They’ll struggle to compete. Which brings us to the real question: Is your core system ready for what’s coming?

Let’s take a closer look at five innovation trends set to redefine banking—and what your core needs to do to keep up.

1. AI & Automation: From Nice-to-Have to Non-Negotiable

What’s Happening:

- AI is becoming essential—from fraud detection to personalized product recommendations.

- Predictive analytics are giving banks a leg up in underwriting, risk, and customer retention.

- As one major bank CFO put it, “AI is going to touch everything.”

Is Your Core Ready?

- Can your system integrate AI tools without massive rework?

- Are you able to process data in real time for smarter decision-making?

- Or are your teams still stuck manually keying in tasks AI could handle automatically?

Quick Tip: You don’t need to rip and replace. Many banks are layering AI through modular integrations or API connectors that work with their current core.

2. Cloud Is No Longer the Future—It’s the Present

What’s Happening:

- Cloud-native platforms are changing the rules—scalable, faster, and more cost-effective.

- Legacy systems are becoming harder to maintain—and harder to secure.

- Fintech challengers are launching cloud-only banks with weeks-to-market delivery.

Is Your Core Ready?

- Are you still tied to on-premise hardware that limits your agility?

- Can your system scale without a capital expenditure headache?

- Do you have a roadmap to migrate—or are you stuck hoping the old infrastructure holds?

Quick Tip: A full migration isn’t the only option. Many institutions are adopting hybrid models that bring key capabilities to the cloud while maintaining operational continuity.

3. Open Banking & API Connectivity: Compete or Get Cut Out

What’s Happening:

- Regulators are pushing for greater financial data sharing and interoperability.

- Customers expect to link their bank to budgeting apps, investment tools, and more.

- Banks embracing open APIs are creating new revenue streams and customer engagement models.

Is Your Core Ready?

- Can you launch API-driven features without a six-month dev cycle?

- Are you equipped to partner with fintechs, or is your integration roadmap a bottleneck?

- Does your system support real-time data exchange with external providers?

Quick Tip: If your core is limited, look at API gateways or middleware that give you open banking capability without disrupting your existing infrastructure.

4. Blockchain & Digital Ledgers: Not Just for Crypto Anymore

What’s Happening:

- Blockchain is making inroads in settlement, lending, and identity management.

- Distributed ledger tech is streamlining back-office operations and increasing transparency.

- By 2025, it’s estimated that 10% of global GDP will be stored on blockchain platforms.

Is Your Core Ready?

- Can you connect with emerging DLT and tokenized payment networks?

- Are you prepared to process digital assets and smart contracts?

- Or is your infrastructure already showing its age?

Quick Tip: While full blockchain integration isn’t urgent for every bank, starting the conversation now will keep you from scrambling later.

5. Compliance & Security: The Pressure’s Mounting

What’s Happening:

- Cyber threats are escalating—and regulators are watching more closely than ever.

- Cloud adoption is being encouraged as a compliance and risk mitigation strategy.

- Compliance isn’t just legal—it’s brand protection.

Is Your Core Ready?

- Are updates and patches automated, or do you rely on manual intervention?

- Can your core adapt quickly to new regulations, or is every change a mini project?

- Do you have visibility and control over who’s accessing your system and how?

Quick Tip: Assess whether your system can handle dynamic compliance requirements. If not, you may need enhanced risk controls or a compliance modernization plan.

Final Thought: Can Your Core Keep Pace or Is It Holding You Back?

Innovation is no longer optional—it’s table stakes. If your core system can’t handle what’s coming, you’re not just missing out—you’re falling behind.

Want to find out if your core is ready for what’s next?

Take the OptimizeCore® Scorecard to assess your system’s flexibility, scalability, and readiness for the next wave of innovation.

#CoreBankingTransformation #CoreBankingOptimization