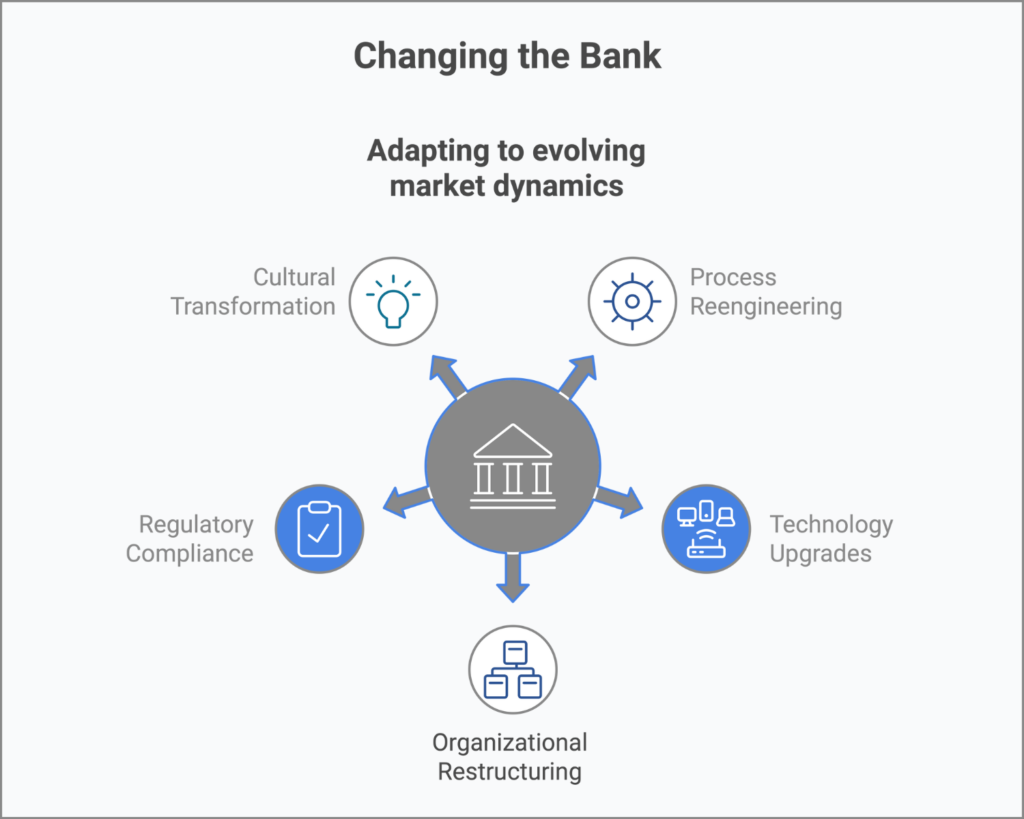

Strategic pillars of banking transformation: Adapting to market dynamics through technology upgrades, regulatory compliance, process reengineering, and organizational restructuring.

The article “Changing the Bank: Adapting to Evolving Market Dynamics” explores strategies for banks to remain competitive in a rapidly shifting financial landscape.

TL;DR – Changing the Bank: Adapting to Evolving Market Dynamics

- Embrace Digital Transformation – Leverage technology to streamline operations and enhance customer experiences.

- Agile Methodologies – Implement flexible frameworks to respond swiftly to market changes.

- Customer-Centric Approach – Align services with evolving client expectations to foster loyalty.

- Regulatory Compliance – Stay ahead of regulatory changes to mitigate risks and maintain trust.

- Continuous Innovation – Cultivate a culture that encourages ongoing improvement and adaptation.

By focusing on these strategies, banks can effectively navigate market dynamics and achieve sustainable growth.

In the dynamic world of banking today, being at the top of the ladder does not simply mean matching the pace but, in fact, outpacing others. A world in which market conditions fluctuate by the day, customers’ expectations continue to change, and newer technologies enter the fray-the banks have to keep innovating just to stay competitive. We call this process of adaptation “Changing the Bank.” In contrast to the business-as-usual operations that are all about stability and efficiency, changing the bank is about transformation-reconfiguring processes and systems, and sometimes even organizational structures, to meet new challenges and capitalize on opportunities.

What is “Changing the Bank”?

Change of bank involves all strategies aimed at transforming the style of operation of a bank. Whether it be in small incremental improvements or in top-down overhauls, it depends on the objectives of the bank or the external environment. It will ensure that the bank can take the bank to turn easily according to changes that occur, whether it concerns technology, regulation, or changes in competition or customer behavior.

In this regard, let’s consider the major areas that were involved in the change of the bank:

- Process Reengineering: This is smoothing or redesigning existing processes for more efficiency, cost reduction, or enhancement in customer service. You might be adopting new technologies, getting rid of redundant steps, or rethinking how various departments interact. Think about an involuted, tortuous path that is straightened-it’s all about making things easier and quicker.

- Technology Upgrades: Introduce new technology systems or upgrade current systems for the smooth running of operations and the enhancement of security for protected information to ensure customers have a better experience. Technology also forms the very core of transformation-be it migration to cloud-based systems, AI-driven analytics, or cybersecurity enhancement. Think of it like an upgrade from a basic car to one that offers high performance, which could take you further, faster, and safer.

- Organizational Restructuring: At times, the organizational structure may see an alignment with the strategic objectives, although it may be just readjusted from time to time. The blending would require the creation of new departments, amalgamation of different departments, and/or working in a more agile way in order to be responsive to be collaborative. Think of it like the moving of chess pieces so that you are in a superior advantage position against your opponent.

- Regulatory Compliance Adjustments: Meet changes in regulatory requirements by updating policies, procedures, and systems to maintain the bank in compliance while sustaining minimum operational impact. It is just like being in a maze-the walls around you move, and one’s got to be ever so present.

- Cultural Transformation: The change required in the organizational culture to realign it with the new strategic directions and employee motivation about the transformation of the bank involves changes that may be required to push the Bank towards its strategic directions. Therefore, it is about instilling a kind of culture where change is not feared but embraced because change presents an opportunity for growth.

The Challenges of Changing the Bank

Changing how the bank operates is no cakewalk, and in turn, it presents its own set of problems:

- Change Resistance: Probably the toughest barrier for change is resistance. Employees who have gotten used to working in an existing structure or system resist a change in their method of working. For overcoming resistance, what is required is effective change management, clear communication, and strong leadership. Imagine trying to turn a huge ship-trying to veer off course requires time, but with the proper guidance this can be done without much hiccups.

- Complexity and Coordination: For most Banks, changing the bank involves various departments and multiple stakeholders with different priorities and challenges. In such cases, the need is for detailed planning, appropriate governance, and a shared vision that would ensure all are pulling in the same direction. This is similar to conducting an orchestra: each section needs to play harmoniously to create a symphony.

- Balancing Stability with Transformation: While transformation is quite key, one does not want to upset core operations that keep the bank running. Finding the right balance between maintaining day-to-day stability and effecting change is a delicate task, where timing and proper sequencing of initiatives would play a major role. You can only imagine trying to renovate a house while living in it-you want to make sure the essentials stay intact.

- Managing Risks: Transformational changes can bring into their fold a host of new risks from technological failures to compliance issues. Effective risk management will, therefore, deal with the identification of such pitfalls to mitigate them before they grow into gigantic problems. It is about being proactive, not just reactive, to make sure this transformation journey does not take detours.

- Time and Resource Constraints: Large-scale transformations consume a lot of time and resources. These can be a costly affair for the currently operating bank, and it is of paramount importance that these resources are managed in such a way that allows transformation projects to finish according to plan and within allocated budgets. It’s like running a marathon-you need to pace yourself and use your energy wisely to reach the finish line.

Best Practices for Changing the Bank

In trying to navigate through the complications of changing the bank, some best practices include:

- Clear Vision and Strategic Alignment: Clearly align the transformation initiatives with overall strategic objectives set for the bank. A well-stated vision leads each decision-making process and keeps all focused on the result of interest. Just like you would set your GPS before commencing your journey, even though the route may change on the way, at least you know your destination.

- Effective Change Management: Use effective change management to help them be ready and prepared to accept new ways of performing processes and using new systems. This will include very regular communication, training programs, and other support mechanisms that would facilitate a smooth transition. Think of this as giving a map and compass to your team to then navigate through uncharted territory.

- Agile Methodologies: Agile methodologies should be followed to provide flexibility and responsiveness to transformation efforts. This shall enable the bank to make iterative changes, course correct as may be required, thereby bringing quicker delivery of value. It is somewhat similar to building a house room by room instead of waiting for the entire structure to be finished to see whether it meets your needs.

- Stakeholder Engagement: Engage all relevant stakeholders early and often to build buy-in and ensure that transformation initiatives meet the needs of all parts of the organization. Regular feedback loops can help flag issues early and keep the transformation on course. This approach is about keeping the communication lines open and making sure everyone has a say in it.

- Continuous Monitoring and Adjustment: Institute regular monitoring so that any progress is noted about transformation initiatives, while at the same time being prepared to make an adjustment should one be called for. This way, transformation stays right on course and in good position to take advantage of, if any unexpected challenges or opportunities were to present themselves. Much as a pilot checks constantly on the instruments so he knows what the right path is.

The Strategic Imperative of Changing the Bank

This is not merely a reaction to these pressures but proactive-takes an initiative-to shape the bank’s future. In so doing, through strategically transforming its processes, systems, and structures, the bank can hope to be well-placed to flourish in a constantly changing environment. Successful transformation does, however, require very careful planning, effective change management, and a commitment to continuous improvement.

This would fit into the wider context of banking strategy where changing the bank provides the bridge from maintaining operational excellence-running the bank-to pioneering new opportunities-innovating the bank. It will ensure that the bank becomes agile and responsive to change with the market and changing needs of customers.

This series concludes with a look at the final pillar, which is Innovating the Bank. It is about how banks can create an environment that innovates and ensures that it leads the pack toward sustainable growth on top of being able to run and change the bank.

Found this article interesting? Want a deeper dive? Check out our book on how to create the Strategic Flywheel or, Continue reading some of our articles

#CoreBankingTransformation #ChangingTheBank