Core banking transformation: Catalyzing efficiency, innovation, and customer satisfaction in the digital age.

Core banking transformation refers to the process of upgrading a bank’s main system that handles daily transactions and interactions with customers. This core system encompasses various banking products and services, such as deposit accounts, loans, mortgages, and more.

Undertaking a core banking transformation is crucial for several reasons:

1. Meeting Changing Customer Expectations

Today’s customers demand seamless experiences across multiple channels, including online, mobile, ATMs, and in-person. Legacy core systems often struggle to deliver this level of omnichannel service, while modern platforms provide the flexibility to serve customers however they want.

2. Accelerating Time-to-Market

Introducing innovative new products and services can give banks a competitive edge. However, outdated systems are inflexible and require significant IT efforts even for minor changes. New core banking platforms are configurable, allowing for much faster deployment of new offerings.

3. Enhancing Data and Analytics

Core banking systems house valuable customer data, but older systems often have fragmented data silos across different products. Modern technologies enable a unified view of data, facilitating meaningful insights through advanced analytics and AI.

4. Improving Operational Efficiency

Maintaining aging legacy systems is resource-intensive and costly. By consolidating systems onto a single platform, banks can significantly reduce IT complexity and administrative costs.

5. Future-Proofing the Bank

Frankly, legacy core banking systems are outdated and lack the capabilities to thrive in an increasingly digital world. Modern platforms provide assurance that a bank can compete and remain relevant in the future.

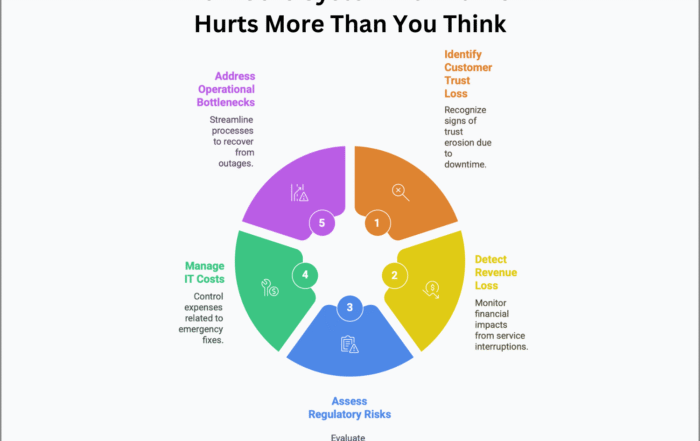

While core banking transformations offer substantial strategic value, they also present significant challenges, such as complex legacy systems, secure data migration, intricate system integrations, potential business disruptions, user adoption hurdles, and compliance risks.

To succeed in a core banking transformation, banks must adopt a structured approach that addresses both technical and organizational obstacles. This includes collaborating across stakeholders, prioritizing data migration and integration, focusing on usability for employee and customer satisfaction, taking an incremental approach, tracking progress against defined goals, and maintaining regular communication.

In summary, core banking transformation is a demanding yet essential undertaking for banks to remain competitive, meet evolving customer needs, and future-proof their operations in the digital age. By thoughtfully navigating the challenges and capitalizing on the potential benefits, banks can position themselves for long-term success.

Found this article interesting? Check out these three related reads for more.

- 10 reasons why core banking transformations are not just IT projects

- Why is it referred to as a core banking transformation instead of just a migration?

- Core banking transformation best practices

#CoreBankingTransformation #BankingStrategy