The 500-password policy shows how outdated security rules frustrate employees and fail to improve protection.

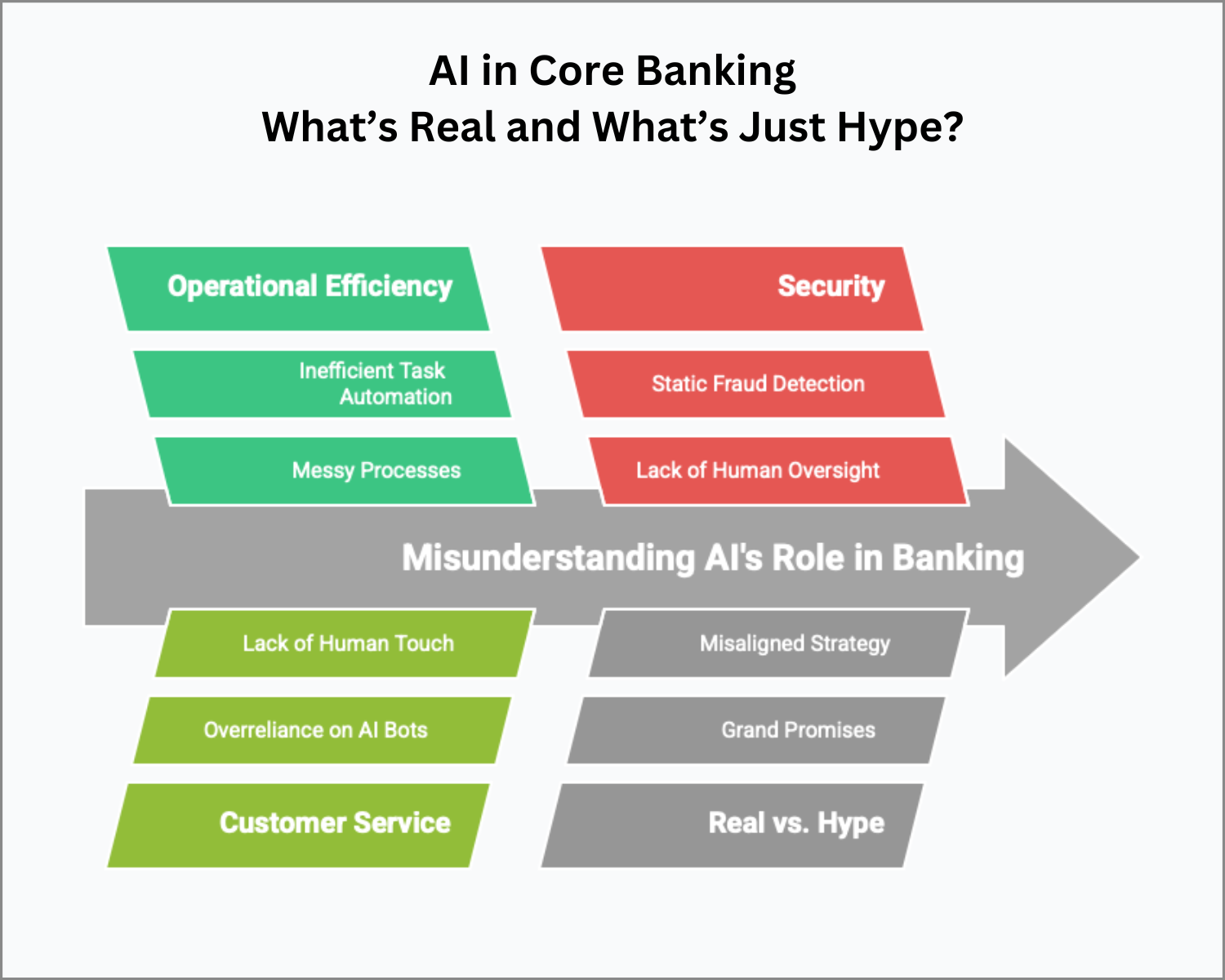

TL;DR – AI in core banking: What’s real and what’s just hype?

-

AI Can Boost Efficiency—If You Prep First – Streamlined processes plus AI lead to faster operations; messy workflows just create faster inefficiencies.

-

Customer Service Needs Balance – Chatbots shine for routine tasks, but real trust comes from blending AI with human expertise.

-

Fraud Detection Is the Real Deal – AI is highly effective in spotting anomalies, but works best when paired with human oversight.

-

Don’t Buy the Hype – Ground AI projects in clear strategy, measurable outcomes, and pilot testing before scaling.

-

Why It Matters – AI isn’t magic—it’s a powerful tool when aimed at real problems, aligned with strategy, and paired with people.

Have you ever sat through a vendor pitch that promised AI would “revolutionize everything,” only to leave you wondering, what exactly are we signing up for here?

You’re not alone.

Artificial Intelligence is the hot topic in banking circles right now—and for good reason. Done right, AI can simplify complex processes, improve customer service, and even help us sleep better at night knowing fraud is under control. Done wrong? It’s just another shiny object draining budgets and burning out teams.

So, let’s cut through the noise. What’s real, what’s hype, and how do you actually make AI work for your bank?

1. Boosting Operational Efficiency—Yes, It Works (When You Aim Right)

What Banks Often Get Wrong:

- Thinking AI will “fix” inefficiency without first cleaning up messy processes.

- Assuming that throwing AI at a task automatically makes it smarter.

- Forgetting that AI still needs training—garbage in, garbage out.

The Reality:

AI can absolutely streamline routine tasks, from loan approvals to compliance checks. And when it works, it frees up teams to focus on strategic initiatives. But if your workflows are clunky, AI just automates inefficiency—and faster.

(Source: AppInventiv + NexGen Banking)

How to Make It Work:

- Start with clean, standardized processes before applying AI.

- Use AI to eliminate low-value tasks—think data entry, document checks, and basic decision-making.

- Free up human resources for complex problem-solving where they shine.

Quick example: One bank I worked with cut loan processing times in half by automating credit checks and document verification. Simple AI tools, huge impact.

2. Revolutionizing Customer Service—With a Human Touch

What Banks Often Get Wrong:

- Replacing all human interaction with AI-powered bots.

- Assuming customers prefer chatting with machines (hint: not always).

- Failing to train AI chatbots on real customer issues.

The Reality:

AI-powered chatbots are fantastic for basic inquiries—account balances, transaction histories, FAQs. But they aren’t a cure-all. Customers still want human support when things get complicated (think mortgage issues or fraud alerts).

(Source: Stefanini + SBS Software)

How to Make It Work:

- Deploy AI-driven chatbots for common customer queries, ensuring they’re fast and accurate.

- Design smart escalation routes—bots handle the basics; humans step in when nuance matters.

- Use AI to analyze customer behavior, helping you offer proactive, personalized services.

Practical insight: One regional bank we worked with used AI to flag dormant accounts and auto-prompt relationship managers to reach out. Result? Reactivated customers and stronger loyalty.

3. AI for Security—No Hype Here, It’s the Real Deal

What Banks Often Get Wrong:

- Thinking fraud detection is a one-time setup.

- Believing AI doesn’t need human oversight.

- Forgetting that fraudsters evolve—AI needs to keep up.

The Reality:

AI-driven fraud detection is one of the most mature and reliable uses of AI in banking today. It identifies anomalies in real time—catching fraud that manual monitoring would miss.

(Source: Wikipedia + Industry Reports)

How to Make It Work:

- Use AI to analyze transaction patterns, spotting irregularities instantly.

- Implement real-time alerts for suspicious activity—don’t wait for daily batch reviews.

- Combine AI insights with human judgment to verify flagged issues and fine-tune models.

A lesson learned: One client slashed fraud losses by 30% in six months, but only after they paired AI with a dedicated fraud response team.

4. Separating AI Fact from Fiction—Don’t Fall for the Flash

What Banks Often Get Wrong:

- Buying into grand promises without a solid business case.

- Assuming AI will deliver ROI on Day One.

- Neglecting to align AI initiatives with core strategy.

The Reality:

Not every AI solution is right for your bank. Some are still experimental. Others promise more than they deliver. It’s vital to stay grounded, focus on practical applications, and avoid jumping on every AI bandwagon.

(Source: Wikipedia + Industry Insights)

How to Make It Work:

- Prioritize AI projects that solve specific pain points or create clear value.

- Ask the tough questions: What problem does this AI solve? How does it align with our strategy? What’s the timeline for ROI?

- Start small. Pilot projects first, scale later once you prove the value.

Reality check: One bank spent millions on an AI-powered credit scoring system that didn’t deliver any better insights than their old model. Why? They hadn’t defined the problem clearly in the first place.

Final Thoughts: AI Can Be a Game Changer—If You Keep It Real

AI isn’t magic. It’s a tool, and like any tool, it works best when you’ve got skilled people wielding it wisely. Banks that succeed with AI are those that:

- Tackle real problems, not theoretical ones.

- Blend AI with human expertise, not replace it.

- Keep expectations grounded, but think big when it comes to long-term potential.

Ready to explore where AI can deliver real value for your bank?

Take the OptimizeCore® Scorecard to identify high-impact AI opportunities tailored to your institution’s needs.

#CoreBankingTransformation #CoreBankingOptimization