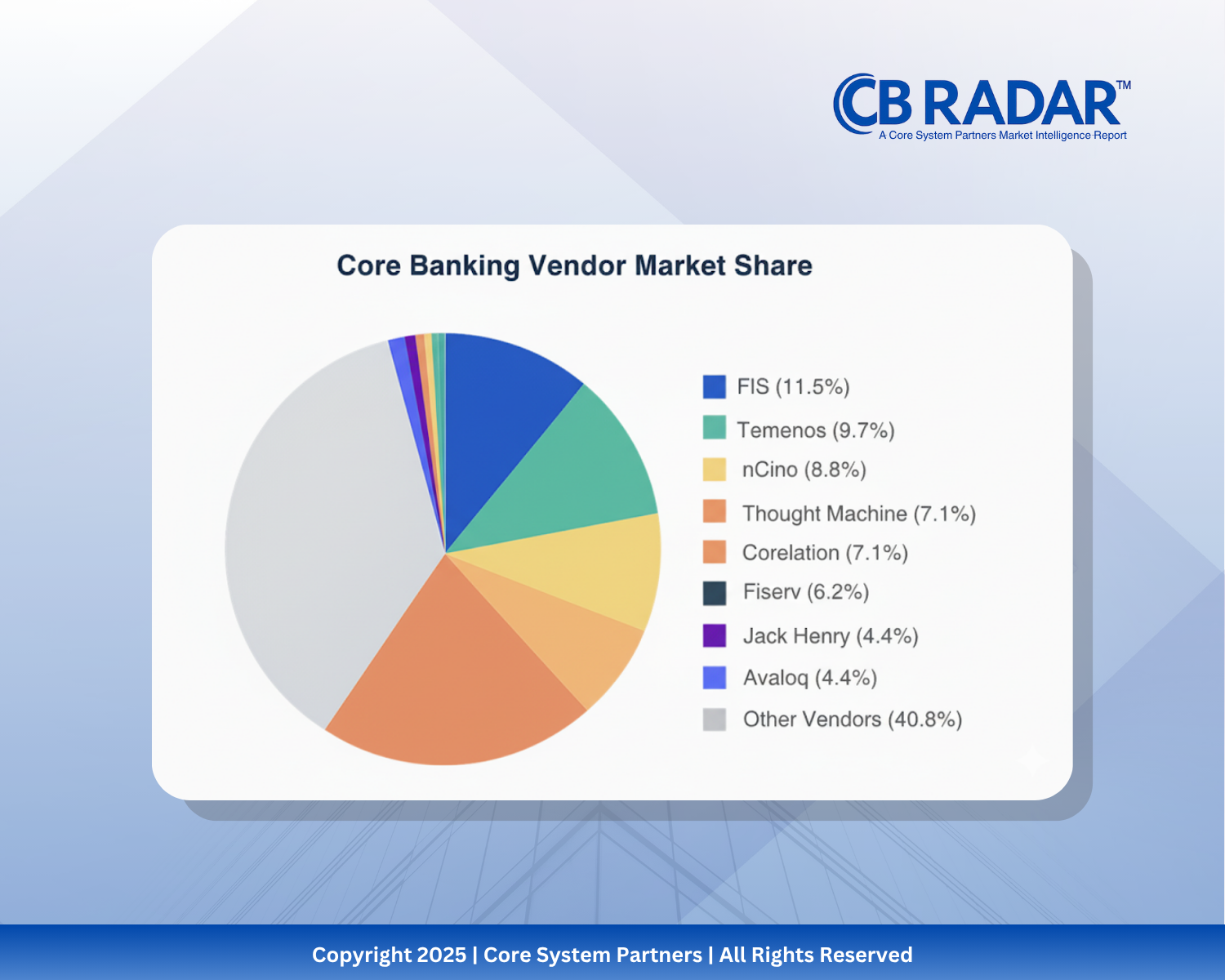

Market share breakdown of global core banking vendors from the CB RADAR™ 2025 Market Intelligence Report, showing a fragmented ecosystem where the top three vendors account for just 30.1% of total tracked projects.

TL;DR – CB RADAR™ 2025: A Clearer View of Core Banking Transformation

-

The Pressure is On – Banks are navigating rising customer expectations, legacy system fatigue, and tighter regulatory demands—all at once.

-

Transformation Isn’t One-Size-Fits-All – The CB RADAR™ 2025 Report reveals how modernization strategies like modular cores, APIs, and AI adoption differ across regions and bank sizes.

-

Execution Beats Ambition – Many banks have bold transformation goals, but success hinges on readiness—strong leadership, clear priorities, and aligned execution.

-

The Future Is Incremental – Winners are those taking smart, phased modernization steps, not high-risk overhauls.

-

Why It Matters – This year’s CB RADAR™ insights help banks benchmark their readiness, identify capability gaps, and move confidently toward sustainable digital growth.

CB RADAR™ 2025: A Clearer View of Core Banking Transformation

Core banking transformation has become the defining challenge of modern banking. It’s high-stakes, high-cost, and for many executives, it feels like a one-shot deal. Get it right, and your institution gains agility and resilience. Get it wrong, and you risk years of wasted effort and millions in sunk costs.

The problem? Too often, transformation conversations are dominated by vendor marketing or broad industry surveys that don’t reflect what banks are actually experiencing on the ground.

That’s why we created CB RADAR™ — an independent market intelligence report that tracks real-world projects. For the first time, we now have a dataset of 113 core banking transformations worldwide, spanning 2021 through 2025. And the findings reveal a market that is moving faster, but also with more complexity, than many realize.

Why We Built CB RADAR™

Over the past few years, one question kept coming up in our conversations with CIOs, COOs, and transformation leads:

“What’s really happening out there? Which vendors are actually winning? Are projects really succeeding, or just being declared complete?”

The industry didn’t have an independent answer. Success was often self-proclaimed. Vendor share was opaque. Global patterns were anecdotal at best.

So we decided to fill the gap. Our team reached out to banks worldwide, from large commercial players to credit unions and digital challengers. Many declined to share details. Some gave us partial responses. But in the end, we built a dataset large enough to see the contours of the market with clarity.

What the Data Shows

The CB RADAR™ 2025 dataset doesn’t paint a simple picture. But several themes stand out:

- 113 Transformations Tracked: From 2021 through mid-2025, we documented 113 projects worldwide. That’s a steady acceleration in pace — the industry is no longer asking if modernization will happen, but when and how.

- Cloud as the Baseline: 84.5% of projects reported cloud adoption. But definitions varied. Some went fully cloud-native, others SaaS-lite, others hybrid. Cloud is now the expectation — but it’s not a single model.

- Success vs. Reality: 72.5% of banks reported their projects as “successful.” On paper, that looks impressive. But optimism bias is strong. Many define success simply as “we went live,” not “we delivered ROI, agility, or CX improvements.” Compare that to industry surveys, where 60–75% of projects are labeled failures, and the truth is clearly more nuanced.

- Vendor Fragmentation: The top three vendors captured just 30.1% of projects. The rest was spread across 20+ providers. This makes vendor evaluation harder, not easier — and it’s why so many institutions struggle to choose.

- U.S. Dominance, Global Signals: Nearly half of all tracked projects came from the U.S. That reflects vendor concentration and regulatory clarity. But don’t overlook early moves in APAC and Africa. Banks in Vietnam, Nigeria, and Kuwait are beginning to leapfrog directly to digital-first models, bypassing some of the hurdles U.S. and European banks face.

Why This Matters for Executives

Every core banking transformation carries a mix of ambition and risk. But the CB RADAR™ findings underline three truths every banking leader should keep front of mind:

- Going live isn’t the finish line. Too many institutions celebrate technical cutovers without measuring whether the business case has been delivered. True success is ROI, agility, and better customer experience.

- Vendor choice is more complex than ever. With over 20 credible players in the market and blurred lines between “core” and adjacent platforms, evaluation and negotiation are skills in their own right.

- Cloud adoption is uneven. “Cloud-first” doesn’t mean the same thing everywhere. Choosing the right model is as strategic as choosing the right vendor.

For executives, the implication is clear: transformation decisions need sharper benchmarking, better intelligence, and less reliance on vendor narratives.

What’s Next: The CB RADAR™ Series

This article is just the beginning. Over the coming weeks, we’ll be publishing short insights from the CB RADAR™ dataset — one theme at a time — here on our blog and on LinkedIn.

- We’ll unpack why optimism bias distorts reported success rates.

- We’ll dive into cloud adoption models and what “cloud-first” really means.

- We’ll explore the fragmented vendor landscape and what it means for evaluation.

- We’ll highlight the U.S. dominance — and why emerging markets might leapfrog.

Think of it as a guided tour through the data. Each post will connect to the broader story: banks worldwide are transforming, but the path is more complicated — and more instructive — than the headlines suggest.

Get the Full Report

The full CB RADAR™ 2025 Market Intelligence Report is available now. It includes the complete dataset, charts, and analysis, along with commentary on what these findings mean for the future of core banking.

And if you want to benchmark your own institution’s readiness against the market, you can also try our Core Banking Transformation Readiness Scorecard, which helps you see how your bank stacks up against the themes revealed in CB RADAR™.

CB RADAR™ is not a vendor pitch. It’s a reality check. And in a market where every decision carries long-term consequences, clarity is your strongest advantage.

#CoreBankingTransformation #CoreBankingBenchmarks