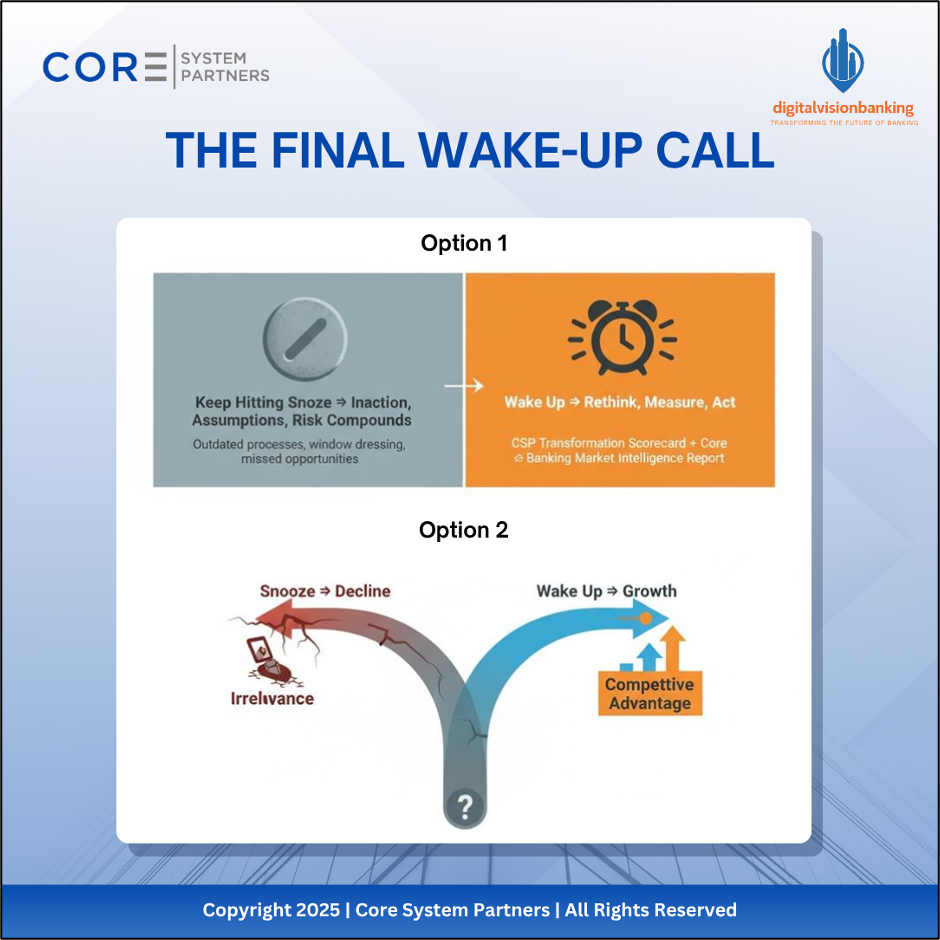

Banks face two choices: keep hitting snooze and risk decline, or wake up, measure readiness, and lead transformation for lasting growth.

TL;DR – Final Wake-Up Call: Stop Hitting Snooze on Transformation

-

Waiting is the riskiest strategy – Every delay widens the gap between leaders and laggards, especially as younger generations move their deposits elsewhere.

-

Mindset is the real barrier – Incremental upgrades are not transformation; banks must rethink how their entire operating model works.

-

Most banks misjudge their readiness – The gap between perception and reality fuels compounded risk across execution, customer experience, and competitiveness.

-

Benchmarking reveals the truth – Only 22% of community banks have a real digital roadmap; the rest are operating blind against market trends.

-

Why it matters – The banks that confront reality now will own the next decade of growth, relevance, and customer loyalty.

At this point, the excuses are familiar.

“We’re too small.”

“We’ll wait for the next budget cycle.”

“Our customers aren’t asking for this yet.”

But the reality is this: the clock is already ticking, and the longer banks put off transformation, the steeper the climb becomes.

With the great transfer of wealth underway to younger generational cohorts, the deposits will just disappear and never return…and you may not even know until its too late.

Prepare and future-proof your institution for better relevance and competitive positioning.

Rethink Your Assumptions

The biggest barrier isn’t budget or technology—it’s mindset. Too many institutions still assume that incremental upgrades equal transformation. They don’t.

True transformation requires leaders to rethink how they define their bank, how they serve their customers, and how they align people, processes, technology, and strategy into one operating model. Anything less is window dressing. And, that mindset needs to permeate the entire organization, top to bottom.

Assess Your True Readiness

You can’t fix what you won’t measure. Most banks overestimate how “digital” they are, and that gap between perception and reality is exactly where risk compounds.

That’s why we built the CSP Transformation Scorecard—to give banks a structured way to measure readiness across strategy, execution, customer focus, and vendor alignment. It’s not about scoring points—it’s about getting a clear picture of where you stand before the market decides for you.

Benchmark Against Reality

Transformation doesn’t happen in a vacuum. To see where you stand, you need to compare yourself to the market.

Our latest Core Banking Market Intelligence Report, based on interviews and surveys with more than 113 banks worldwide, reveals that only 22% of community banks have a documented digital roadmap tied to business outcomes. The rest are flying blind.

This isn’t about fear—it’s about clarity. The data shows where leaders are heading, and it shows exactly where laggards are falling behind.

The Choice

Every bank is at a crossroads. Keep pressing snooze and risk becoming irrelevant or wake up, rethink, and act.

The banks that win the next decade won’t be the ones with the flashiest apps. They’ll be the ones that faced hard truths early, measured their readiness honestly, and used that insight to lead with confidence.

The wake-up call has already come. The only question is whether you’re ready to answer it.

Return to: The Wake-Up Call – Hub Article

Co-Author Credit

Co-authored with Richard Rotondo,

Chief Digital Strategist at Digital Vision Banking.

#CoreBankingTransformation #DigitalBanking