Spot the illusion. A refreshed app or sleek website doesn’t equal transformation. Real progress requires core changes, integration, and reengineered processes.

TL;DR – From Digital Illusions to Real Transformation: Spotting the Red Flags

-

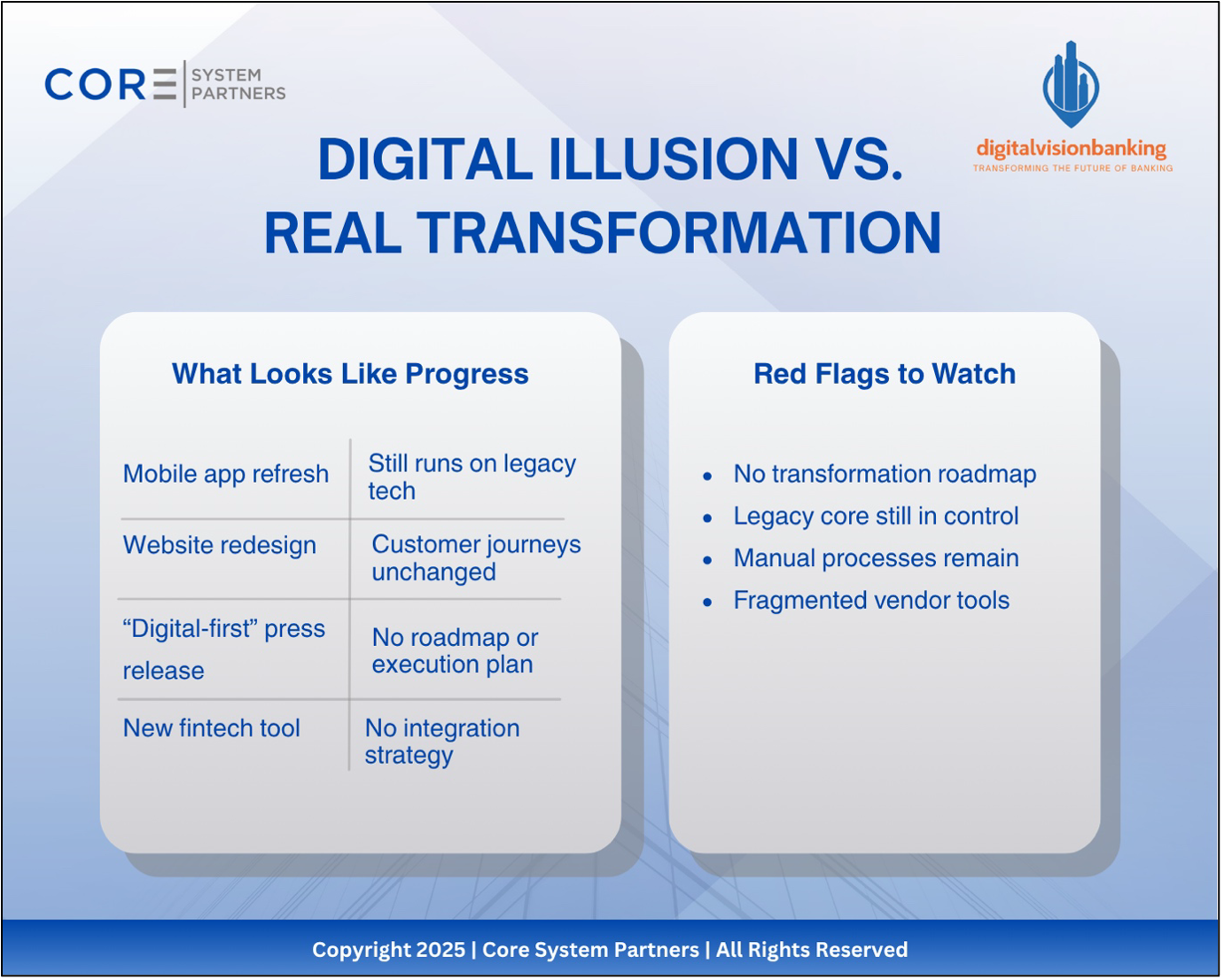

Shiny projects ≠ true transformation – A mobile app or flashy website doesn’t mean your bank is digitally mature.

-

Red flags are easy to spot – No roadmap, legacy cores, manual processes, and disconnected vendors are signs of digital illusion.

-

The cost of false progress is high – Banks risk customer attrition, operational inefficiency, and talent loss by mistaking upgrades for strategy.

-

Real transformation starts with better questions – Winning banks align strategy, tech, and execution—and measure where they truly stand.

-

Why it matters – Spotting digital illusions early helps community banks build scalable, future-ready operating models.

It starts the same way at too many community banks. Leadership feels the pressure—shrinking deposits, aging customers, competitors moving faster. So they greenlight a “digital project.” (But do they truly understanding what that means and how deep their commitment needs to be throughout the entire organization?)

A new mobile app. A refreshed website. Maybe even a press release announcing a “digital-first strategy.”

And then they breathe a sigh of relief. They believe they’ve transformed.

They haven’t.

They’ve digitized the surface, not the substance. It’s a digital illusion—and it’s more common than most leaders want to admit.

The Red Flags of False Progress

Every week we talk with banks that point to shiny projects as proof of transformation. But when we look closer, the same warning signs show up again and again:

No transformation roadmap. Leadership can’t show how today’s initiatives ladder up to long-term business outcomes.

Legacy core still in control. The same constraints that slowed them down yesterday are still calling the shots today.

Processes untouched. Manual workarounds continue behind the scenes, while customers see only cosmetic improvements.

Fragmented vendor ecosystem. Banks pile on new tools with no integration strategy, creating more complexity instead of less.

If you’re seeing these patterns in your own institution, it’s not transformation. It’s a temporary patch.

Why the Illusion Is Dangerous

The danger isn’t just wasted budget—it’s wasted time. While leaders convince themselves they’ve “checked the digital box,” competitors are moving ahead with real operating model changes.

The cost shows up in four ways:

Customer attrition. Younger generations want seamless onboarding and instant service. They’ll go elsewhere when they don’t get it.

Operational drag. Manual processes keep clogging growth, no matter how sleek the front end looks. No tangible movement to ROI.

Deposit flight. Rate-chasing becomes the norm when convenience and value aren’t paired together.

Talent frustration. Your best people won’t stick around if they’re forced to fight outdated systems.

And here’s the bigger risk: over the next three to five years, AI, and fintech.

partnerships, cloud-native cores, automation, and even blockchain will converge. Cosmetic fixes won’t prepare you for that reality. They’ll leave you further behind.

What Real Transformation Looks Like

The banks that are pulling ahead aren’t the ones with the flashiest apps. They’re the ones asking better questions:

What business outcomes are we trying to drive?

What customer experiences do we want to deliver?

What does the future of our operating model look like?

What does my next generation of customers look like, and where are they coming from?

They measure where they stand using tools like the CSP Transformation Scorecard, not gut feelings. They build discipline around governance, execution, and vendor alignment. And when they launch new capabilities, they do it on top of a foundation that can scale.

That’s the difference between digitized and digital.

Your Next Step

If you’re not sure where your bank actually stands, start simple. Download our Core Banking Starter Guide. It’s a straightforward, no-fluff resource that lays out what actually works—and what doesn’t—when it comes to transformation.

And if you’re ready to go deeper, take the CSP Transformation Scorecard. It will show you where your blind spots are and how you compare to peers. Seek the assistance of a Digital Innovation Expert who can help to uncover areas of concern and opportunities.

The first step toward real transformation is spotting the illusions. The second is refusing to settle for them.

Next in the series: The illlusion of progress – Why banks overestimate their digital transformation

Return to: The Wake-Up Call – Hub Article

Co-Author Credit

Co-authored with Richard Rotondo,

Chief Digital Strategist at Digital Vision Banking.

#CoreBankingTransformation #DigitalBanking