Vendor lock-in isn’t just inconvenient—it’s a silent strategy killer. Smart banks design for flexibility, modularity, and exit-readiness from day one to stay in control.

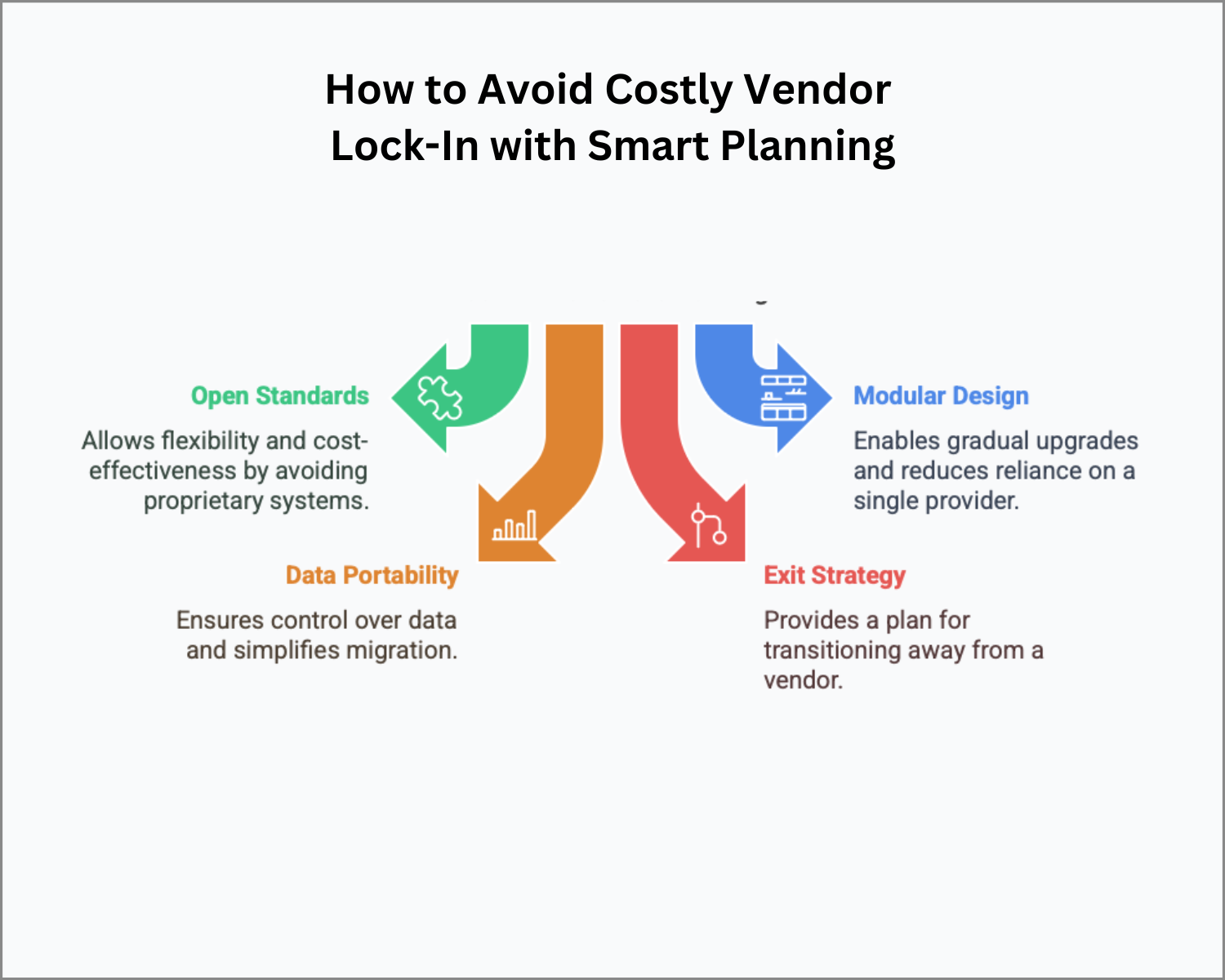

TL;DR – How to avoid costly vendor lock-In with smart planning

-

Think Long-Term, Not Just Go-Live – Short-term convenience can trap you in inflexible contracts and proprietary tech.

-

Design for Interoperability – Choose vendors and architectures that support open APIs, modular upgrades, and easy switching.

-

Negotiate With Leverage – Build exit strategies and performance benchmarks into your vendor agreements from day one.

-

Avoid Over-Customization – Excessive tailoring makes it harder (and costlier) to pivot or replace vendors later.

-

Why It Matters – Smart vendor planning protects your agility, controls long-term costs, and gives you real choice as your needs evolve.

Vendor Lock-In: The Quiet Trap That Can Cost You Big

Ever been in a long-term contract you thought was great… until it wasn’t? That’s what vendor lock-in feels like—except instead of a bad cable deal, it’s your bank’s entire core system. One minute, you’re excited about a shiny new platform. The next, you’re stuck, paying premium prices, with limited options and no easy exit.

In core banking, vendor lock-in doesn’t just slow you down—it stifles innovation, ties your hands when you need flexibility, and can seriously inflate your long-term costs. And many banks don’t realize they’re trapped until they’re staring down hefty exit fees and migration nightmares.

But there’s good news. Smart planning can keep you in the driver’s seat. Let’s dive into five strategies to stay flexible, maintain control, and avoid getting locked into an expensive corner.

1. Embrace Open Standards & Technologies

What We Often Get Wrong:

- Falling for proprietary solutions that seem convenient upfront.

- Overlooking open-source platforms because they feel riskier.

- Getting cozy in vendor ecosystems that limit integration options.

The Reality:

Banks that adopt open standards and open-source technologies keep their options open. It’s like building with Legos instead of pouring concrete—you can reconfigure things when your needs change. And when you’re not stuck with proprietary systems, switching vendors becomes a business decision, not a logistical nightmare.

What Smart Banks Do:

- Prioritize open-source solutions where possible. They’re flexible and often more cost-effective over time.

- Use APIs and adhere to open banking standards for easy integration and data portability.

- Negotiate clear policies on code access and data export upfront. Read the fine print—twice.

2. Design for Modularity (Think: Loosely Coupled Systems)

What We Often Get Wrong:

- Assuming monolithic systems are the only answer for core banking.

- Building ecosystems where everything depends on one vendor.

- Forgetting to plan for future upgrades—until they’re impossible.

The Reality:

A modular, microservices-based architecture lets you upgrade piece by piece instead of ripping out the whole system every time you want to innovate. Think of it like updating your kitchen without bulldozing the entire house. Modular systems reduce your reliance on a single provider and make future upgrades less painful.

What Smart Banks Do:

- Break down functions into modules that can be swapped out independently.

- Use microservices to isolate key components, making system maintenance and upgrades easier.

- Avoid vendor-proprietary middleware that traps you in their world.

3. Make Data Portability a Non-Negotiable

What We Often Get Wrong:

- Storing data in proprietary formats that are tough to migrate.

- Overlooking ownership rights—who actually controls your data?

- Assuming data migration will be simple—until it isn’t.

The Reality:

If your data is locked in someone else’s proprietary format, you’re not in control. And when you decide to move, the process can be painfully slow and expensive. Standardizing your data now makes migration later a breeze (or at least less of a nightmare).

What Smart Banks Do:

- Use standardized, non-proprietary data formats whenever possible.

- Keep meticulous data documentation so you’re not reinventing the wheel during migration.

- Negotiate data access and portability in contracts. You want to leave when you want to, not when they let you.

4. Have an Exit Strategy—Before You Need One

What We Often Get Wrong:

- Signing multi-year contracts without clear exit clauses.

- Assuming everything will go smoothly and not planning for a breakup.

- Forgetting vendors can be acquired, pivot, or even disappear.

The Reality:

Without a well-documented exit strategy, you’re stuck. We’ve seen banks caught flat-footed when vendors changed ownership, policies, or pricing models. Don’t wait until things go south—have your plan in place from day one.

What Smart Banks Do:

- Negotiate exit clauses early, including support for migration and clear fee structures.

- Ensure data ownership rights are unambiguous and airtight.

- Vet vendor stability and succession plans—what happens if they’re acquired or shut down?

5. Evaluate Vendors for the Long Haul, Not Just the Honeymoon

What We Often Get Wrong:

- Falling in love with the features and price tag, ignoring long-term implications.

- Overlooking hidden fees and restrictive terms that bite later.

- Assuming today’s great deal will still look good in five years.

The Reality:

Some vendors offer irresistible short-term pricing, but lock you into expensive renewals and closed ecosystems. Look beyond the demo and ask: Will this partner still be the right fit as your needs evolve?

What Smart Banks Do:

- Dig deep into vendor business practices, not just their tech.

- Prioritize open APIs and interoperability—future flexibility matters.

- Scrutinize renewal terms so you don’t get trapped in a financial vise five years down the road.

Final Thoughts: Planning Ahead Keeps You in Control

Vendor lock-in is sneaky. It doesn’t happen overnight. But if you’re not proactive, it can quietly box you into a corner—costing you money, flexibility, and opportunities for innovation.

The smartest banks plan for freedom from the start. They build with modularity, open standards, and data portability in mind, and they have a clear exit strategy baked into every vendor agreement.

Ready to see where your core system stands on vendor flexibility?

Take the OptimizeCore® Scorecard to assess your system’s risk of lock-in, integration readiness, and long-term adaptability.

#CoreBankingTransformation #CoreBankingOptimization