Core banking is no longer a single system—it’s an evolving ecosystem, where platforms like nCino shape transformation even beyond the transaction core.

One of the more surprising findings in CB RADAR™ 2025 was the frequent mention of nCino as a “core banking system.”

Technically, it isn’t.

But its inclusion says a lot about how banks are redefining what core really means.

“The definition of ‘core banking’ is shifting from system to ecosystem.”

A Sign of the Times

nCino’s presence in the dataset reflects how blurred the boundaries of the banking stack have become.

Many institutions that listed nCino as their core were, in fact, using it as a front- to-middle office platform for lending, onboarding, or workflow orchestration — deeply integrated with the true transaction core underneath.

Still, from the perspective of executives leading transformation, nCino represented

the visible center of change.

That perception shift is significant.

“For many banks, the system that drives transformation feels like the core — even if it isn’t one.”

The Expanding Definition of Core

Historically, the “core” was easy to identify — it handled deposits, loans, and ledgers.

But as modernization continues, that line has blurred:

- Cloud-native vendors provide modular services that overlap with traditional core functions.

- Integration platforms connect legacy systems through real-time APIs.

- Digital orchestration layers now sit between customers and transactions, acting as the new heart of the bank.

This ecosystem-based model means “core” is no longer one system — it’s a

collaboration of platforms delivering end-to-end capability.

Why It Matters

This redefinition changes how banks evaluate, buy, and measure transformation. It’s no longer about choosing a single monolithic replacement.

It’s about composing a functional core from multiple interoperable systems — each one best-in-class for a specific purpose.

That’s why CB RADAR™ treats “core” not as a technology category, but as a strategic function.

The banks that lead transformation view core modernization as modular architecture, not a product choice.

“Modernization isn’t a single-platform decision — it’s an ecosystem design exercise.”

The Vendor Perspective

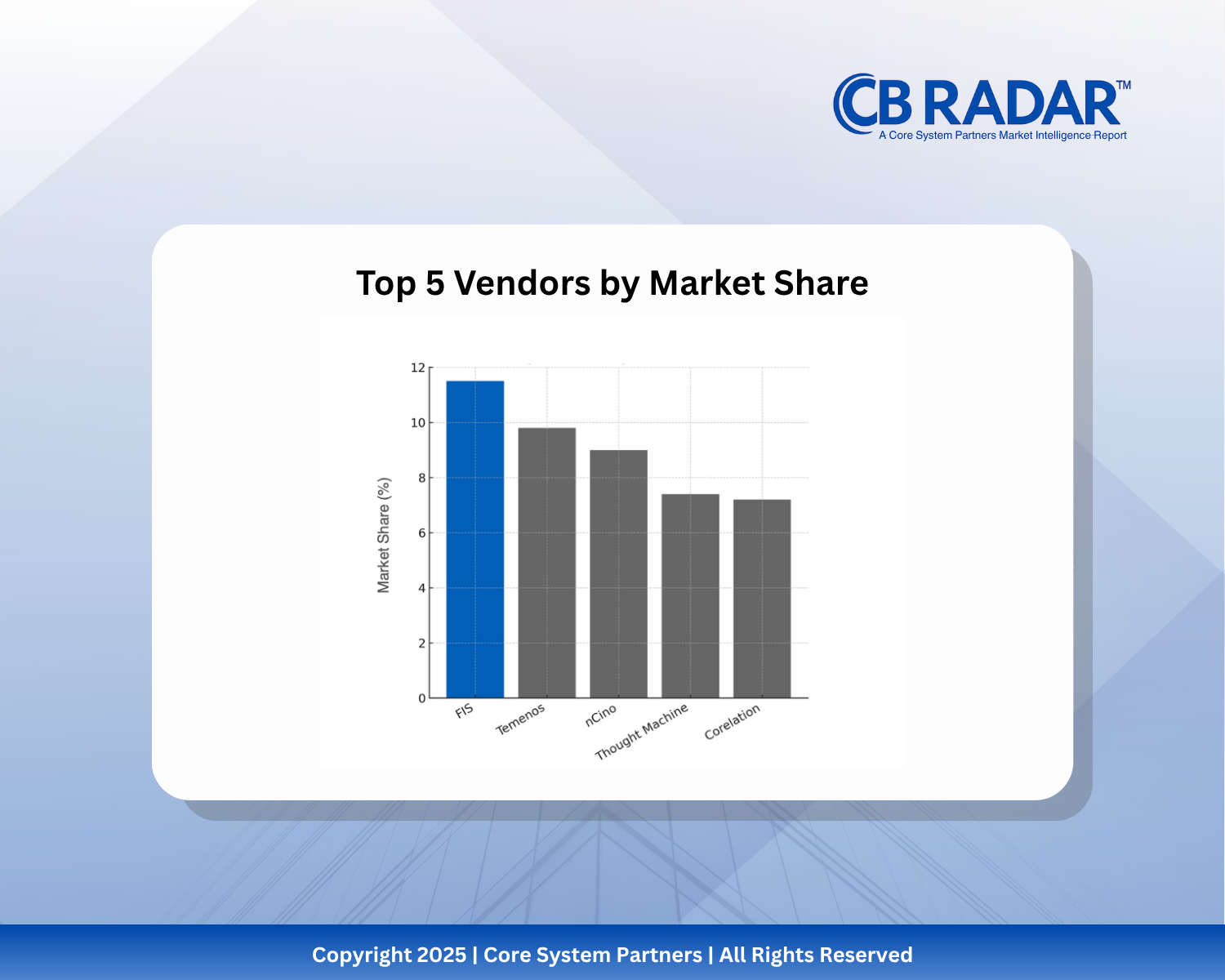

Vendors like nCino, Mambu, Thought Machine, and Temenos are converging in capability but diverging in architecture.

As the definition of “core” expands, adjacent platforms are being pulled into the conversation — and in some cases, taking center stage.

For traditional vendors, that’s both an opportunity and a warning: the market is no longer theirs to define.

For banks, it’s a reminder to design before they select.

“The question is no longer ‘What’s your core?’ but ‘What’s at the core of your strategy?’”

What CB RADAR™ Reveals

CB RADAR™ 2025 captures a pivotal moment in the evolution of banking architecture.

What once lived in a single box is now distributed, composable, and contextual. The rise of adjacents like nCino isn’t a misclassification — it’s a signal of where the industry is headed.

Read the full CB RADAR™ 2025 report to explore how banks are redefining the boundaries of core banking — and what it means for future vendor ecosystems.

And if you want to benchmark your own institution’s readiness against the market, you can also try our Core Banking Transformation Readiness Scorecard, which helps you see how your bank stacks up against the themes revealed in CB RADAR™.

CB RADAR™ is not a vendor pitch. It’s a reality check. And in a market where every decision carries long-term consequences, clarity is your strongest advantage.

#CoreBankingTransformation #CoreBankingBenchmarks