Most banks say they’re cloud-first, but without true cloud execution, it’s progress in name only.

In CB RADAR™ 2025, an overwhelming 84.5% of banks said their core transformation programs were “cloud-first.” It’s an impressive number — until you dig into what cloud-first really means.

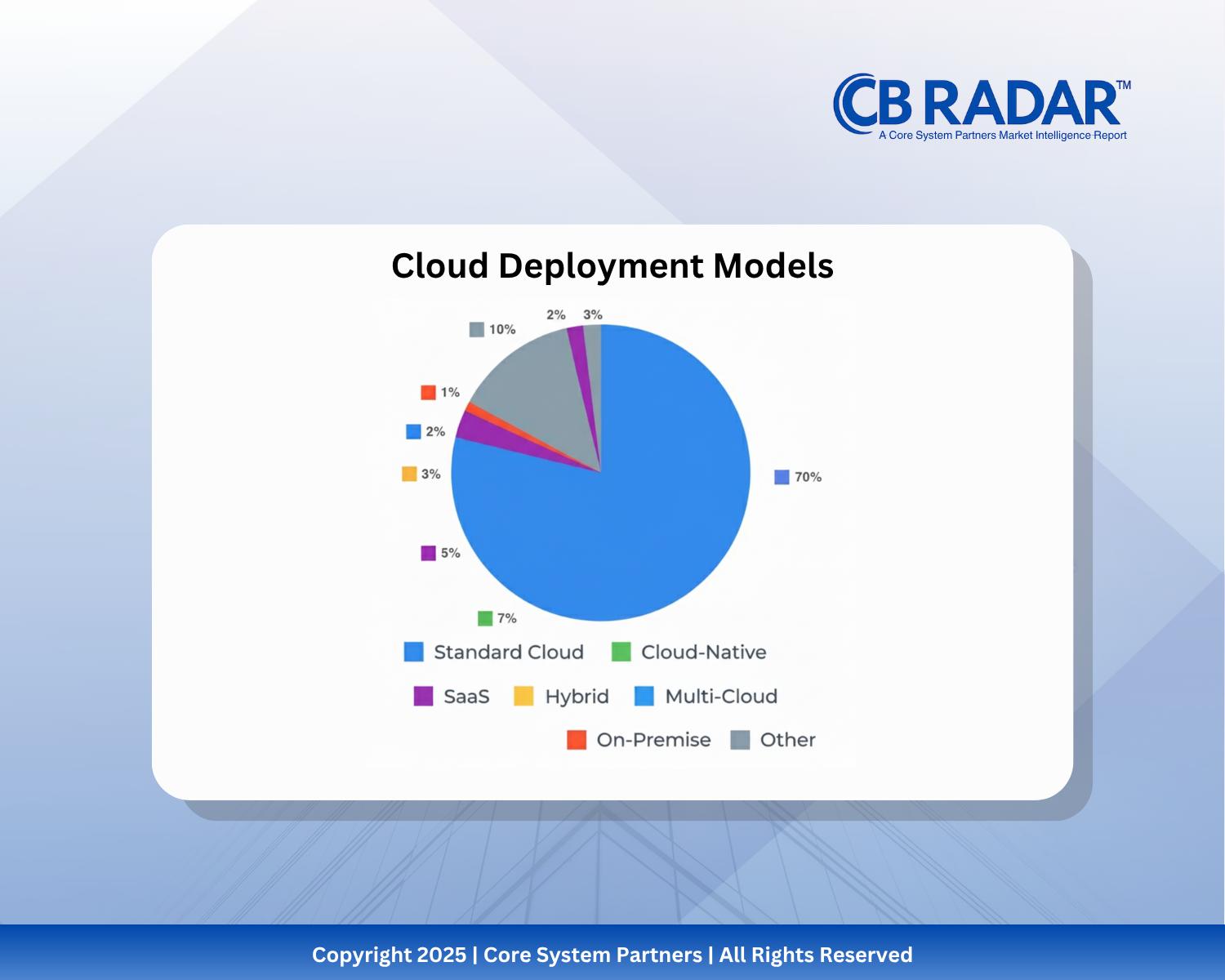

Behind that single term sits a spectrum of interpretations: public, private, hybrid, hosted, or SaaS-lite. Each one carries a different level of modernization risk, and most are a long way from true elasticity or automation.

“Cloud-first is now the baseline, not the differentiator.”

The Hype Meets Reality

Cloud adoption has become a badge of progress. In RFPs and board decks, “cloud-first” often signals innovation — even when the migration is partial or cosmetic.

- Cloud-native: A handful of banks have fully rebuilt around microservices and API-driven cores.

- Hybrid models: Many are still hosting legacy workloads in private environments while wrapping them with cloud-based digital channels.

- SaaS-lite: Others have re-platformed pieces of the core — but the heavy lifting remains on-premise.

Each approach moves the bank forward, but they are not equal in outcome or ambition.

Why Definitions Matter

When cloud strategies are vague, transformation goals blur with them. Projects labeled “complete” may have only shifted infrastructure, not operating models. That’s how banks end up with hybrid complexity — two worlds to support, one budget to stretch.

In CB RADAR™, the gap between stated and actual cloud adoption was clear. The deeper we looked, the more we saw that cloud is less about technology choice and more about execution maturity:

- How automated are your deployments?

- How portable is your data?

- How quickly can you adapt to regulation or scale demand?

“Hybrid cores often mask latency, integration cost, and vendor lock-in.”

The Risk of False Confidence

Declaring victory too early is dangerous. Hybrid cores can create the illusion of progress while hiding legacy dependencies behind a new digital façade.

Executives who believe they’ve “moved to the cloud” may stop investing just when the hardest work begins — operational redesign, process automation, and cultural change.

The Strategic Shift Ahead

Cloud isn’t an endpoint; it’s an operating model.

The banks that will pull ahead over the next 24 months are those that:

Define cloud-first with measurable outcomes.

Align infrastructure, data, and delivery teams around a single playbook.

Treat the journey as continuous modernization, not a one-time migration.

“Cloud isn’t an endpoint; it’s an operating model.”

What CB RADAR™ Reveals

CB RADAR™ 2025 doesn’t challenge the value of the cloud — it clarifies it. Cloud-first is no longer a strategy to brag about; it’s the starting line.

Execution quality is what separates leaders from laggards.

Read the full CB RADAR™ 2025 report to see how 113 banks defined their cloud strategies and how those definitions shaped success.

And if you want to benchmark your own institution’s readiness against the market, you can also try our Core Banking Transformation Readiness Scorecard, which helps you see how your bank stacks up against the themes revealed in CB RADAR™.

CB RADAR™ is not a vendor pitch. It’s a reality check. And in a market where every decision carries long-term consequences, clarity is your strongest advantage.

#CoreBankingTransformation #CoreBankingBenchmarks