The core banking market has fragmented—more vendor choice, more complexity, and higher stakes in choosing the right fit.

For years, the core banking market has been dominated by a handful of legacy vendors. But CB RADAR™ 2025 tells a different story.

The market has fractured — fast.

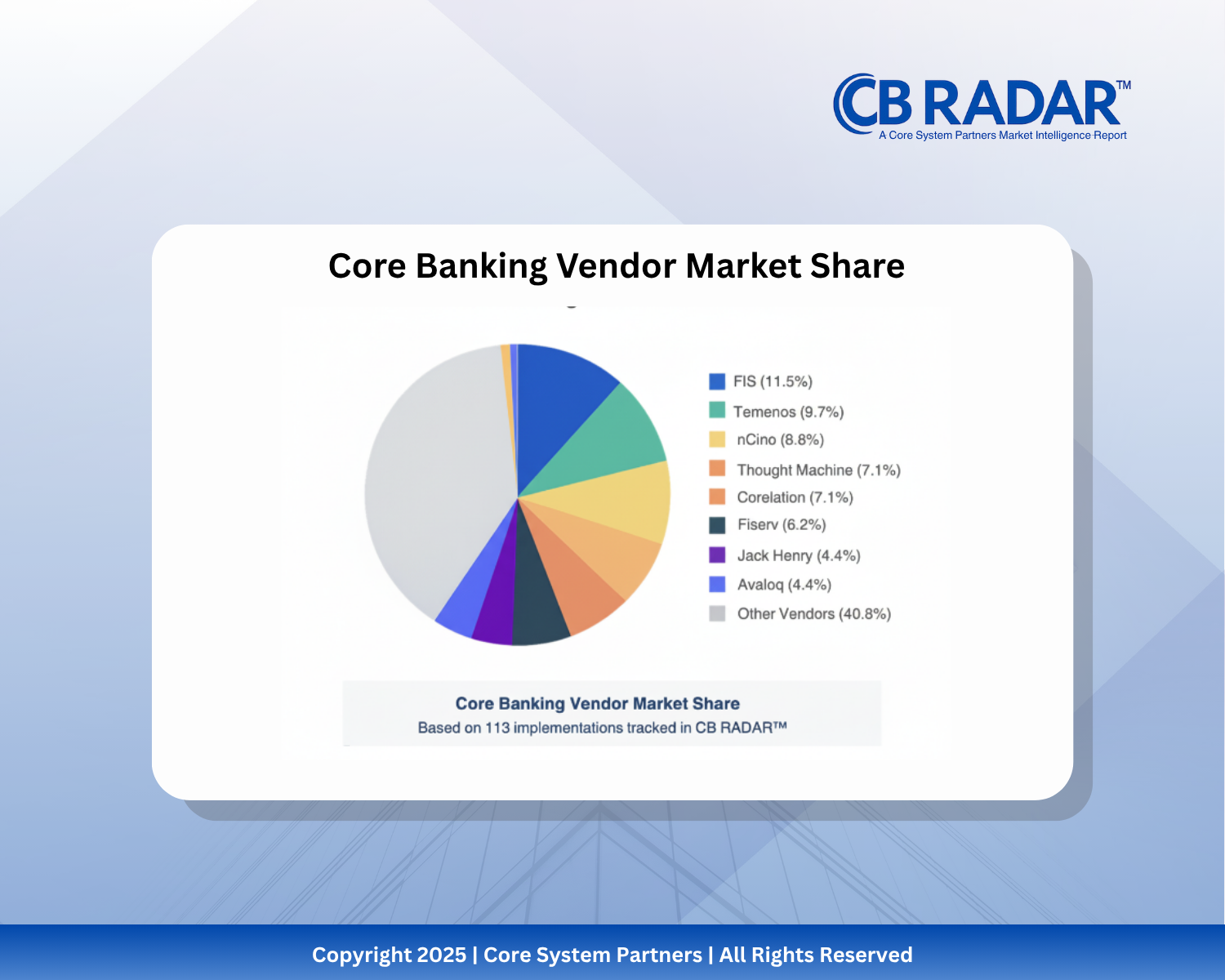

In our analysis of 113 global core banking transformations, the top three providers captured only 30.1% of all projects. The rest were spread across more than twenty vendors, from established names to new digital entrants.

“More vendors mean more choice — but also more complexity.”

The Age of Abundance

Choice, at first glance, feels like progress. A decade ago, banks complained of having too few viable options. Today, the opposite is true — the marketplace is crowded with cloud-native challengers, regional specialists, and modular platforms promising flexibility and speed.

But abundance comes with trade-offs.

Each vendor has its own architecture, licensing model, and delivery ecosystem. For banks, that means a longer evaluation cycle, higher integration risk, and greater dependency on third-party expertise.

“Vendor fragmentation has replaced vendor dominance — and that changes everything.”

What’s Driving Fragmentation

Several forces are pushing the market toward diversity rather than consolidation:

- Cloud enablement: The rise of open APIs and containerization has lowered barriers to entry.

- Regulatory pressure: Local data residency laws are driving regional vendor adoption.

- Specialization: Vendors are carving out niches — payments, lending, retail, or digital-only.

- Investment cycles: M&A activity continues, but integration often lags behind marketing claims.

The result: a vibrant, but chaotic landscape.

The Risk Hidden in Choice

With more than 20 viable vendors, evaluation has become both strategic and political.

CIOs must balance innovation potential with ecosystem maturity.

Boards must decide whether to bet on a known brand or a promising disruptor.

Too often, banks chase modernity only to find themselves in delivery gridlock — a promising platform paired with an underpowered delivery partner.

“In a fragmented market, selection risk has become the new transformation risk.”

What Smart Banks Are Doing Differently

Leaders are shifting from vendor-first to bank-first selection methods. Instead of asking “Who’s best?” they’re asking “Who’s best for us?”

The most successful banks in the CB RADAR™ dataset share three evaluation traits:

- Capability alignment: The chosen core fits the bank’s operating model, not the other way around.

- Delivery maturity: The ecosystem — integrators, accelerators, trained staff — is as strong as the product itself.

- Commercial flexibility: Contracts balance scalability with control.

This pragmatic approach turns fragmentation into advantage.

The Strategic Outlook

Market diversity isn’t going away. If anything, it will increase as new players emerge and traditional cores reinvent themselves.

The opportunity lies in discipline — understanding where the vendor ecosystem adds value and where it introduces risk.

“The best core system isn’t the most modern — it’s the one that fits your bank’s DNA.”

What CB RADAR™ Reveals

CB RADAR™ 2025 reframes vendor evaluation as a strategic discipline, not a procurement exercise.

As the market splinters, success will depend less on choosing the “right” vendor and more on managing the right relationship.

Read the full CB RADAR™ 2025 report to explore how 113 banks selected, implemented, and governed their core vendors — and what patterns are emerging across markets.

And if you want to benchmark your own institution’s readiness against the market, you can also try our Core Banking Transformation Readiness Scorecard, which helps you see how your bank stacks up against the themes revealed in CB RADAR™.

CB RADAR™ is not a vendor pitch. It’s a reality check. And in a market where every decision carries long-term consequences, clarity is your strongest advantage.

#CoreBankingTransformation #CoreBankingBenchmarks