Core transformation failures don’t just delay projects—they disrupt operations, erode trust, and invite financial and regulatory fallout. Learn how to protect your bank before it’s too late.

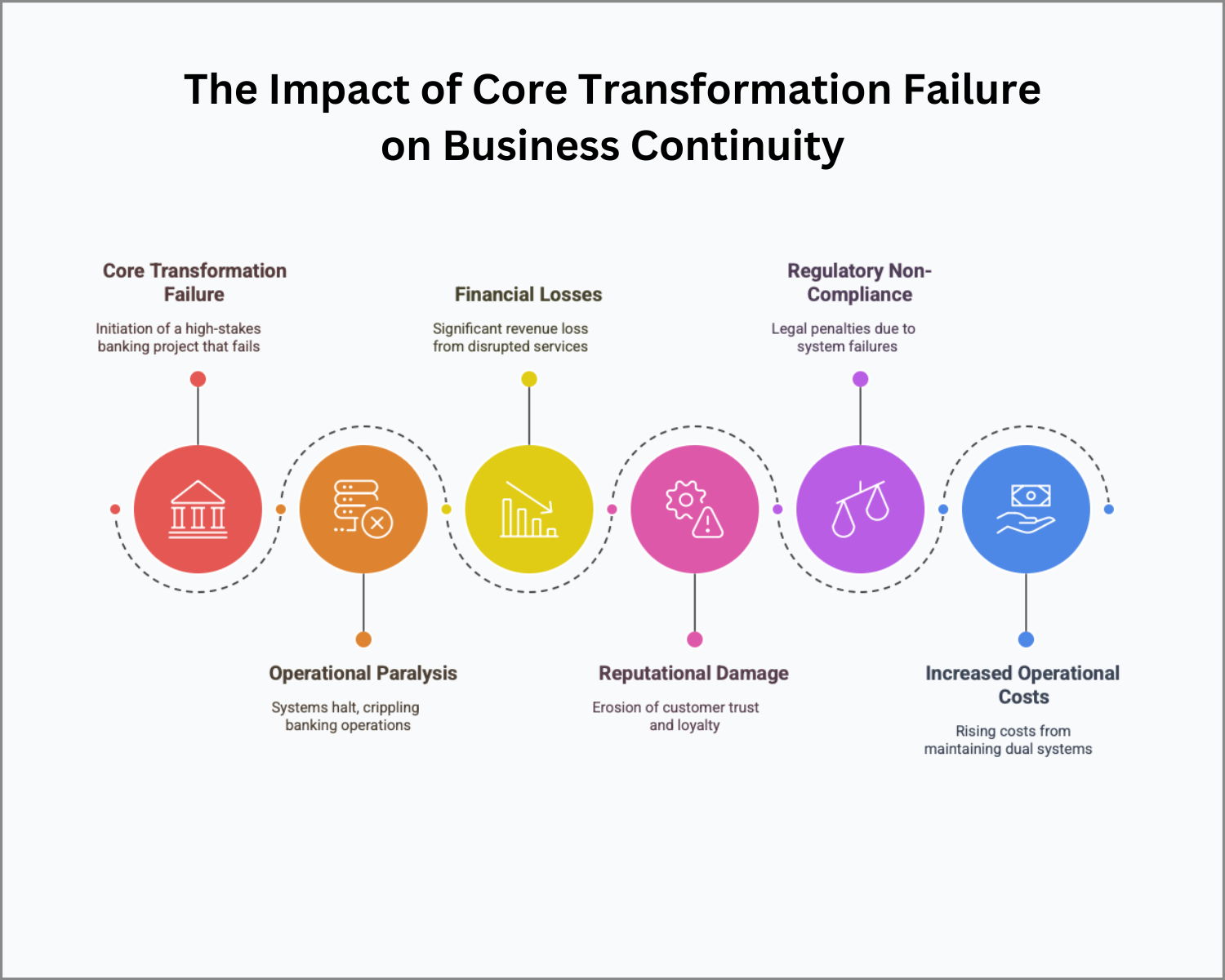

TL;DR – The Impact of Core Transformation Failure on Business Continuity

-

System Downtime Derails Operations – Poorly executed transformations can freeze core services like payments, loans, and account access.

-

Financial Losses Add Up Fast – Missed transactions, emergency fixes, and churned customers cut deep into the bottom line.

-

Reputation Takes a Hit – Customers don’t care about your upgrade—they care when their banking doesn’t work.

-

Regulatory Risks Skyrocket – Compliance gaps during transformation can trigger fines, scrutiny, and legal fallout.

-

Why It Matters – Failing to plan for failure is planning to fail. Safeguard your transformation with strong risk, testing, and communication strategies.

Why a Failed Core Transformation Can Disrupt Everything

Core banking transformation is a high-stakes initiative that, if mismanaged, can wreak havoc on business continuity. A failed transformation isn’t just a technical setback; it can cripple operations, erode customer trust, and result in financial and regulatory consequences.

The challenge? Many banks underestimate the risks until it’s too late. Let’s examine the hidden dangers of core transformation failures and how to safeguard your bank against costly disruptions.

1. Operational Paralysis: When the Bank Comes to a Halt

What Banks Often Get Wrong:

- Assuming that system downtime will be minimal—until it’s not.

- Failing to plan for unforeseen technical failures during migration.

- Underestimating the impact of outages on customer experience.

The Reality: Core transformation failures can cause extended system outages, bringing banking services to a standstill. Account access, payments, loan processing—everything can grind to a halt, crippling daily operations. (Source: Deloitte)

How to Avoid It:

- Implement a robust disaster recovery plan that ensures rapid service restoration.

- Run full-scale testing in a controlled environment before migration.

- Adopt a phased implementation strategy rather than a high-risk “big bang” go-live.

2. Financial Losses: The Cost of Disruption

What Banks Often Get Wrong:

- Overlooking the financial impact of downtime on transaction fees and lost revenue.

- Failing to budget for costly emergency fixes post-failure.

- Ignoring the hidden costs of customer attrition after service failures.

The Reality: Banks that experience core transformation failures lose money in multiple ways—from direct losses due to stalled transactions to indirect financial damage from lost customers and regulatory fines. (Source: TechMagic)

How to Avoid It:

- Conduct risk modeling to quantify potential financial exposure.

- Develop backup transaction channels to maintain essential banking services.

- Invest in a strong risk management framework that proactively mitigates financial threats.

3. Reputational Damage: When Customers Lose Trust

What Banks Often Get Wrong:

- Underestimating how quickly service disruptions erode customer loyalty.

- Failing to communicate clearly during system failures.

- Assuming customers will be patient when banking services are unreliable.

The Reality: A poorly executed core transformation can trigger a PR nightmare. Customers don’t care about back-end upgrades—they want their accounts to work. Service outages, data loss, or security breaches can cause lasting reputational harm. (Source: N-IX)

How to Avoid It:

- Be proactive in customer communication—transparency builds trust.

- Ensure 24/7 support during and after transformation to address customer concerns.

- Have contingency plans for public relations crises—be ready to respond fast.

4. Regulatory Non-Compliance: Legal & Compliance Pitfalls

What Banks Often Get Wrong:

- Assuming compliance is a secondary concern—until penalties hit.

- Underestimating the regulatory impact of system failures.

- Failing to align transformation efforts with evolving compliance requirements.

The Reality: Regulatory bodies don’t tolerate system failures—significantly when they impact consumer protection, financial reporting, or anti-money laundering (AML) compliance. A failed transformation can result in hefty fines and increased scrutiny. (Source: Sopra Banking)

How to Avoid It:

- Engage compliance teams from day one—not as an afterthought.

- Ensure new systems meet all reporting and audit requirements.

- Develop a compliance continuity plan to handle regulatory expectations during the transition.

5. Increased Operational Costs: The Price of a Poorly Planned Transformation

What Banks Often Get Wrong:

- Assuming transformation costs end after implementation.

- Underestimating the need to maintain both old and new systems during transition.

- Failing to account for post-implementation performance tuning and troubleshooting.

The Reality: A failed transformation often means running two systems simultaneously—the old one as a backup and the new one as a work-in-progress. This dramatically drives up IT and operational costs while increasing complexity. (Source: Finextra)

How to Avoid It:

- Plan for a gradual transition—allow legacy and new systems to co-exist.

- Budget for post-launch troubleshooting—unexpected costs are inevitable.

- Optimize existing systems where possible to avoid unnecessary replacement expenses.

Final Thoughts: Proactive Measures to Safeguard Business Continuity

Core transformation isn’t just about getting a new system live—it’s about ensuring the bank continues to operate without disruption, financial loss, or customer churn.

Banks that plan for failure scenarios invest in risk management and communicate proactively stand the best chance of executing a seamless transformation.

Want to evaluate your core system’s resilience before leaping?

Take the OptimizeCore® Scorecard to assess your current system’s strengths, risks, and transformation readiness.

#CoreBankingTransformation #CoreBankingOptimization