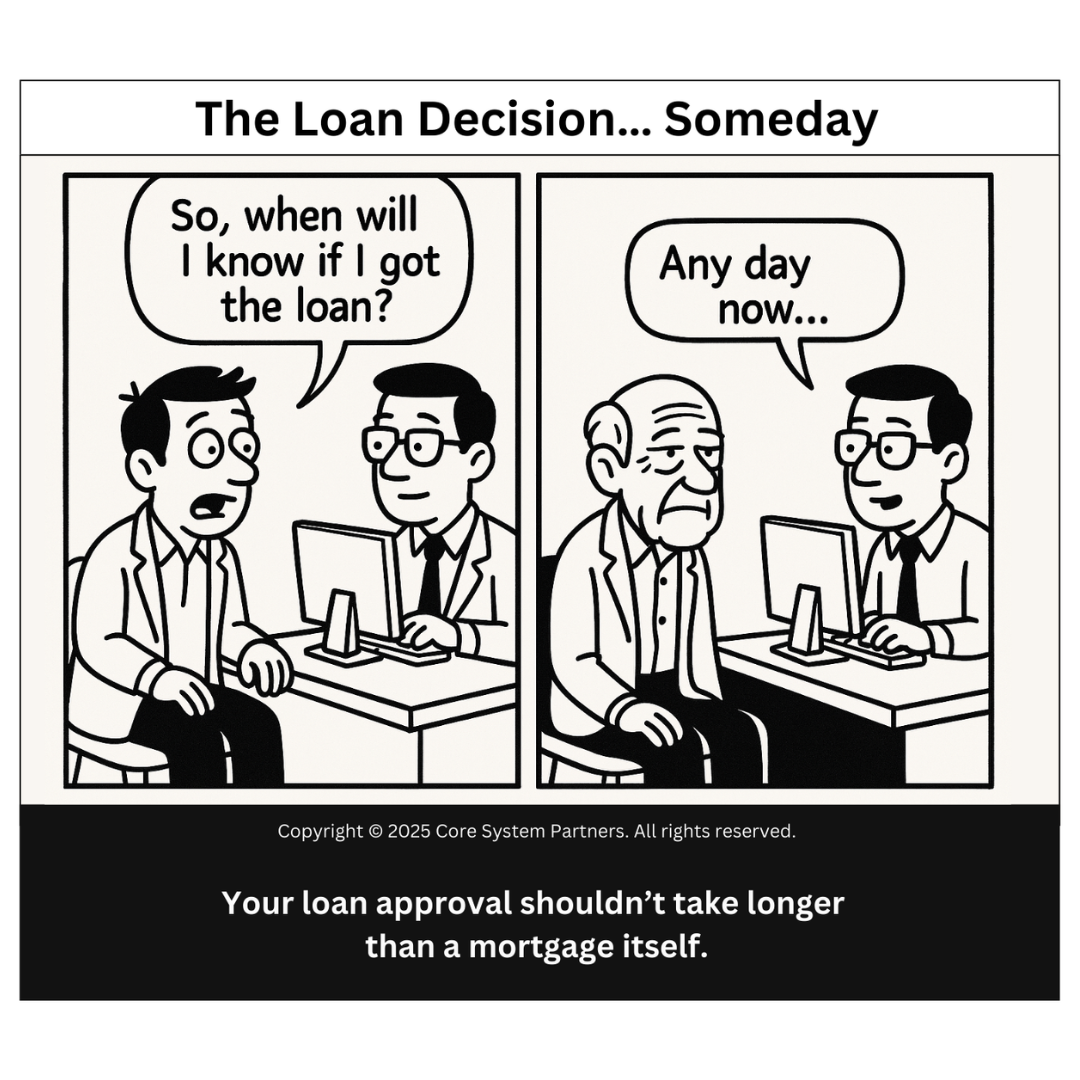

Loan decisions delayed by outdated systems

“So, when will I know if I got the loan?”

“Any day now…”

We’ve all heard the joke about banking timeframes moving slowly. But when your customer applies for a loan and the response time rivals a geological era, it’s not just a punchline—it’s a problem.

In today’s landscape of instant payments, same-day deliveries, and real-time everything, waiting weeks (or longer) for a simple loan decision feels archaic. It’s not just frustrating—it’s business lost. Worse, it signals to customers that we’re either not ready or unwilling to move at the speed of their lives.

The Real Cost of “Any Day Now”

Let’s be clear: slow loan decisions aren’t just a minor inconvenience—they’re a competitive liability.

I once worked with a regional bank where loan officers genuinely cared. But their processes were so fragmented—paper applications, separate credit check systems, manual underwriting steps—that customers were routinely left in limbo. One client even joked, “I got married, bought a house, and changed jobs before I heard back.”

He wasn’t exaggerating.

The damage isn’t just reputational:

- Abandoned applications spike when delays drag on.

- Customer trust erodes with each “we’re still reviewing” follow-up.

- Opportunities vanish when competitors close in faster.

Speed and service aren’t separate anymore. They’re synonymous.

What’s Actually Slowing You Down?

You’re not dragging your feet on purpose. But if we unpack what’s happening behind the scenes, the reasons often include:

- Legacy core systems that can’t support real-time processing

- Manual review steps with no workflow automation

- Disjointed credit, risk, and compliance teams using separate tools

- Siloed customer data that requires multiple logins and manual reconciliation

- Overengineered decision logic that creates bottlenecks instead of safeguards

When even basic personal loan decisions depend on a half-dozen spreadsheets and four approvals, you’re not doing credit review—you’re doing choreography.

Loan Decisions in the Age of Agility

Modern customers don’t care how complex your internal systems are. They care about outcomes.

You don’t need to offer one-click lending tomorrow, but you do need to commit to speed, transparency, and consistency. Here’s where transformation leaders are focusing their efforts:

1. Pre-decision logic embedded at intake

Why collect applications you can’t process? High-performing banks use real-time data checks and eligibility logic at the front end, filtering out unqualified applications before they clog the pipeline.

“Pre-qual in 60 seconds” isn’t a gimmick. It’s the baseline.

2. Integrated credit engines

You’re guaranteed delays if your credit models live in a separate system from your core lending platform. Instead, integrate your decisioning engine with your CRM and core, so approvals can happen in real time, and exceptions are flagged instantly.

3. Automated underwriting

This isn’t about removing humans. It’s about eliminating repetitive tasks that humans shouldn’t be doing. Automate 80% of the cases that follow standard rules. Free up your underwriters to focus on the nuanced 20%.

4. Clear communication during the process

If you can’t decide quickly, at least communicate clearly. Give customers status updates. Set expectations. Let them know what’s happening behind the scenes. Silence is the fastest way to lose them.

5. Time-to-decision as a KPI

Stop treating loan turnaround as an operations stat. Make it a business metric. Tie it to NPS, funding success, and even executive comp if needed. What gets measured gets moved.

From Delay to Delight: One Bank’s Pivot

A mid-sized lender we worked with had an average turnaround time of 14 days for personal loans. After a full-stack transformation—new LOS, credit engine integration, front-end revamp—they brought that down to 2.3 days.

The result?

- 35% increase in loan volume

- 40% drop in abandonment rate

- NPS score up 18 points in six months

Speed wasn’t just a nice-to-have. It unlocked growth.

Transformation Isn’t Just for Tech—It’s for Trust

A promise is at the heart of a loan: We’ll be there when you need us. If it takes weeks to respond, what does that say about our readiness to support?

Transformation isn’t only about digitizing processes—it’s about restoring credibility. If we want to be trusted financial partners, we need to match our words with action. In lending, action looks like a timely, transparent decision.

Final Thoughts: The Wait Is Over

Let’s stop confusing slow for safe. The future of lending isn’t about racing to decisions—it’s about removing the friction that never needed to exist.

If your loan approval process takes longer than the life of the loan, something’s broken. And the good news? You can fix it.

The question isn’t “How fast can we go?”

It’s “What are we willing to change so customers don’t wait forever?”

OptimizeCore® Scorecard Tip

Evaluate your Loan Turnaround Health during transformation:

- Do you measure time to make decisions by product?

- How many handoffs or manual steps exist between intake and approval?

- Are underwriters focused on value-add cases, or just cleaning up inputs?

Because your delivery date should never be someday.

#CoreBankingTransformation #CoreBankingOptimization