Outdated approval workflows cost more than time—they drive away customers, stall revenue, and burn out teams. Streamlining approvals is key to unlocking transformation.

During a recent visit with a mid-tier bank, I watched a loan officer print out an application, walk it over for a wet signature, then fax it—yes, fax it—to another department for approval. The process took three days for something that should’ve taken 30 minutes. When I asked why, the answer was predictable: “That’s just the way we’ve always done it.”

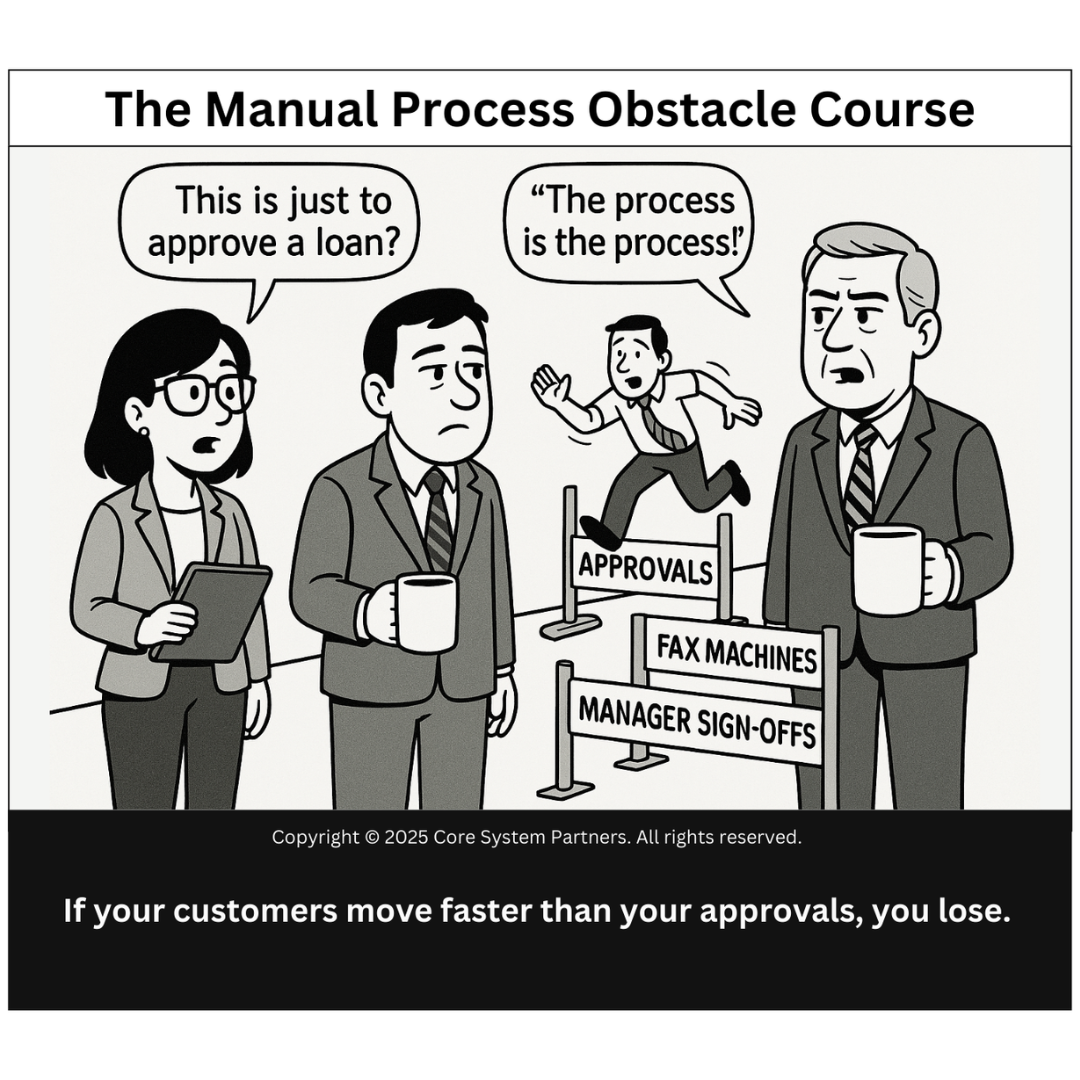

That moment stuck with me, and it’s perfectly captured in this cartoon. Because while banks talk about digital transformation, many are still trapped in an endless obstacle course of manual steps, legacy approvals, and process bloat. And in a world where your competitors are approving loans in minutes, that’s a race you can’t afford to lose.

Let’s talk about why outdated approval workflows are still around, how they hurt your bottom line, and how to build smarter, faster systems that serve both customers and staff.

The Real Cost of Slow Approvals

The problem isn’t just inefficiency. It’s customer attrition, regulatory risk, and employee burnout—all baked into your operations.

When approvals crawl instead of click:

- Customers walk away. They expect Amazon-speed and fintech simplicity. Waiting days for decisions feels prehistoric.

- Revenue is delayed or lost. Every slow approval equals opportunity cost—especially for time-sensitive services like mortgages or small business loans.

- Risk increases. Manual steps create audit gaps, missed SLAs, and inconsistent documentation.

- Employees disengage. No one enjoys jumping through unnecessary hoops to get basic work done.

And let’s be honest—most of the delay isn’t about thoughtful decision-making. It’s about bottlenecks. Siloed systems. And signatures sitting in inboxes or literal file trays.

Why Manual Processes Stick Around

If you’ve ever tried modernizing a legacy workflow, you know it’s not just about tech—it’s about behavior. Some of the most common reasons approvals stay manual:

1. “We’ve Always Done It This Way”

Institutional muscle memory is strong. People trust what they know, even if it’s inefficient.

2. Compliance Paralysis

Fear of messing with controls means approvals stay locked behind outdated processes—often without reevaluating whether they’re still necessary.

3. Fragmented Systems

When your core banking platform doesn’t integrate well with credit, risk, or document systems, approvals default to email chains and file handoffs.

4. Decision-by-Committee Culture

Some institutions over-rotate on consensus, requiring too many touchpoints for even low-risk decisions.

Breaking Down the Obstacle Course

If this sounds familiar, you’re not alone. But the good news? You don’t need a complete overhaul to make meaningful change.

Here’s where to start:

1. Map the Approval Journey

Document every step, approver, and tool involved. You’ll likely uncover redundant loops, unclear accountability, and steps no longer needed.

2. Differentiate Risk Tiers

Not every transaction deserves the same scrutiny. Build a framework that routes high-volume, low-risk approvals through faster, rules-based channels—and reserve manual review for exceptions.

3. Automate the Handshakes

Use workflow automation tools to:

- Route requests to the right person automatically

- Trigger reminders and SLAs

- Integrate digital signatures

- Archive approvals for audit-readiness

4. Consolidate Approval Interfaces

If teams are toggling between five apps just to sign off on a request, find ways to centralize or layer interfaces using portals, APIs, or process hubs.

5. Reevaluate the “Why”

Ask every approver: Why is your step necessary? What value does it add? You might be surprised how many approvals exist out of habit, not need.

A Real-World Win

We helped a client overhaul their commercial lending approval flow. Originally, it required nine separate approvals, a shared drive, a PDF stamp, and—yes—a fax machine.

We worked with them to:

- Reduce the approval chain from nine to four by clarifying risk thresholds

- Digitize the entire workflow using a low-code platform

- Connect approval status directly into their CRM

- Set time-based SLAs and escalation triggers

Turnaround time dropped from 5 days to under 24 hours. Customer satisfaction shot up. And employees? They actually had time to work on pipeline building instead of chasing down signatures.

What to Watch Out For

As you modernize your workflows, avoid these common traps:

- Replacing analog bottlenecks with digital ones. Just because it’s in a system doesn’t mean it’s efficient. Design with the user in mind.

- Skipping change management. Tools are only as effective as the people using them. Train and support teams to adapt.

- Forgetting the customer. Every internal delay creates external frustration. Tie your workflows to the customer journey.

Final Thought: The Process Is Not the Goal

The phrase “The process is the process” is a red flag. If your processes aren’t serving your people or your customers, it’s time to rethink them. And in core banking transformation, approvals are often where friction lives longest.

You don’t need to accept legacy lag as your reality. You can design for speed and control. Simplicity and compliance. Customer experience and operational clarity.

But only if you stop treating the obstacle course as a given—and start redesigning the track.

Ready to Benchmark Your Approval Workflows?

Take our free OptimizeCore® Assessment to identify bottlenecks, risks, and areas for speed gains.

Because in today’s market, if your customers move faster than your approvals—you lose.

#CoreBankingTransformation #CoreBankingOptimization