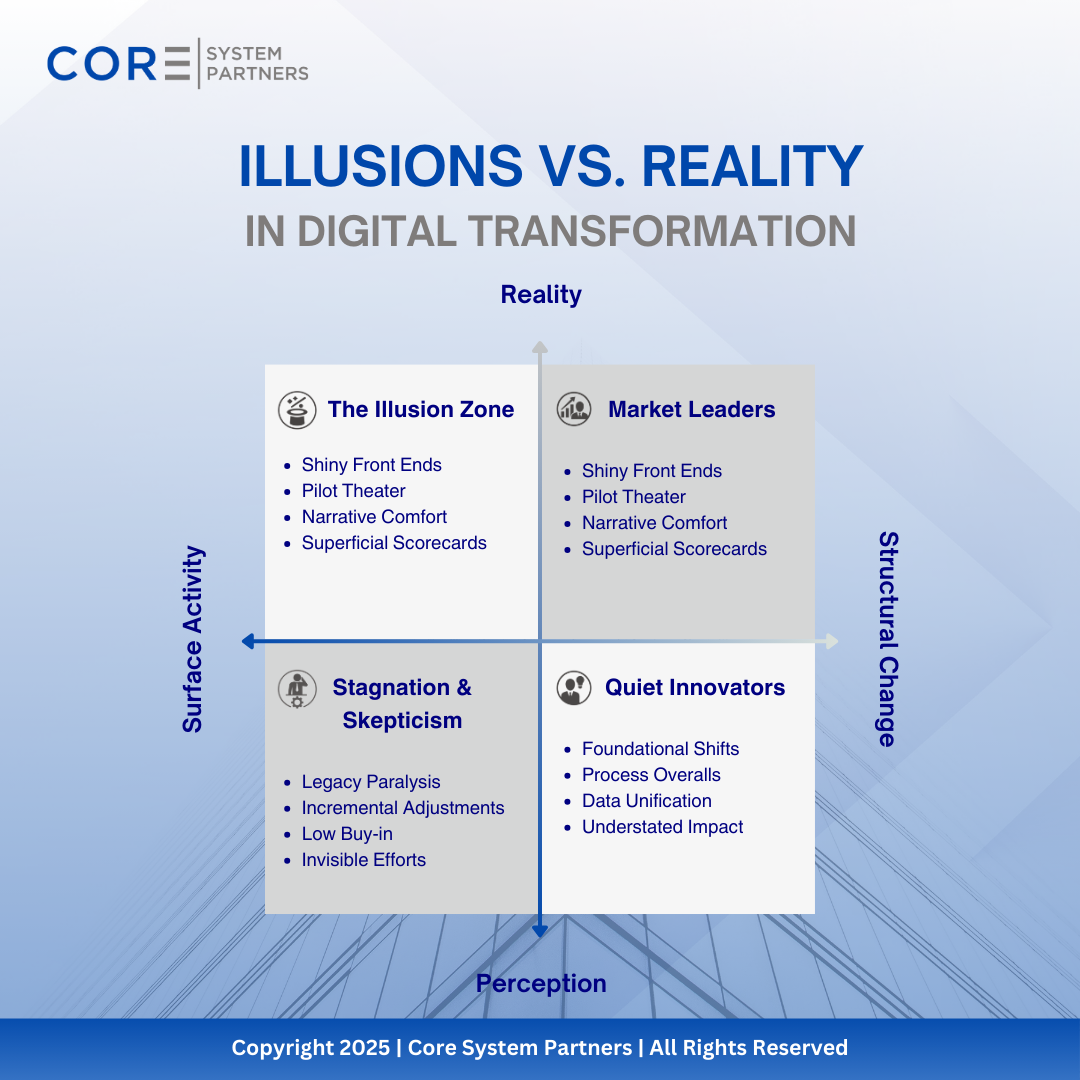

This visual exposes how banks can confuse digital activity with transformation progress—illustrating the difference between illusion, stagnation, and true innovation.

TL;DR – The Real Problem: Misunderstanding What “Digital” Really Means

-

Digital ≠ Technology – Apps and fintech pilots are tools, not transformation. True digital is an operating model shift.

-

Misalignment runs deep – Many banks digitize broken processes without rethinking how the bank actually operates.

-

Success spans four key domains – People, process, technology, and strategy must all align for transformation to stick.

-

Mindset shift is the unlock – Leading banks stop chasing software and start building scalable operating models.

-

Why it matters – Without redefining “digital,” banks waste resources and miss the chance to future-proof their institutions.

When most community bank leaders talk about “going digital,” they point to technology. A new app. Online account opening. Maybe a fintech partnership.

But here’s the problem: digital isn’t technology. Digital is an operating model.

“Digital transformation is not just about technology… It’s about connecting people to use the technology better! – Richard Rotondo”

Until banks understand that distinction, they’ll keep mistaking surface activity for transformation—and they’ll keep falling behind.

What Digital Is Not

Let’s start by clearing the air.

Digital is not a mobile app.

Digital is not online banking.

Digital is not a new website or a digital-only brand.

And digital is definitely not a pilot program with a fintech vendor.

Those might be tactics, but they’re not strategy. They’re tools, not transformation.

What Digital Actually Is

Digital is a fundamentally different way of running your bank. It’s about adaptability, speed, and customer relevance. And it requires discipline across four domains:

- People – Are your teams aligned, trained, and empowered to deliver digital-first experiences? Or are they still working around outdated systems?

- Process – Have you redesigned how work gets done? Or are you digitizing broken processes without fixing them?

- Technology – Is your tech stack enabling innovation, or is legacy middleware still dictating what’s possible?

- Strategy – Do your digital investments serve measurable business outcomes, or are they just boxes checked for the board?

Banks that treat digital as technology alone fail on all four fronts. Banks that treat it as an operating model start to win.

Why the Misunderstanding Persists

This misunderstanding sticks because technology is the most visible part of the change. An app is easy to show. A branch refresh is easy to promote. Process redesign, governance models, vendor discipline—those are invisible to the outside world.

But invisible doesn’t mean unimportant. It means leaders need the courage to work on the things customers don’t see directly, but impacts them so that what they do see actually works.

Breaking the Myth

The banks that get this right shift their mindset:

- From buying software to building operating models.

- From measuring features to measuring outcomes.

- From isolated IT projects to enterprise-wide transformation.

And they don’t guess. They measure their readiness using structured frameworks like the CSP Transformation Scorecard, which forces leaders to look across people, process, technology, and strategy.

For banks still in the early stages, the Core Banking Starter Guide is a practical way to understand what to fix first before chasing shiny tools.

Final Word

Digital is not an app. It’s not a fintech pilot. It’s not a press release.

Digital is an operating model and mindset. Until banks treat it that way, they’ll keep spending money without moving forward.

The ones that do make the shift. They’ll set the pace for the next era of community banking.

Next in the series: What the Best Banks Are Doing Differently

Return to: The Wake-Up Call – Hub Article

Co-Author Credit

Co-authored with Richard Rotondo,

Chief Digital Strategist at Digital Vision Banking.

#CoreBankingTransformation #DigitalBanking