The “Just Sign It” Incident – Understanding risk is better than blindly accepting it.

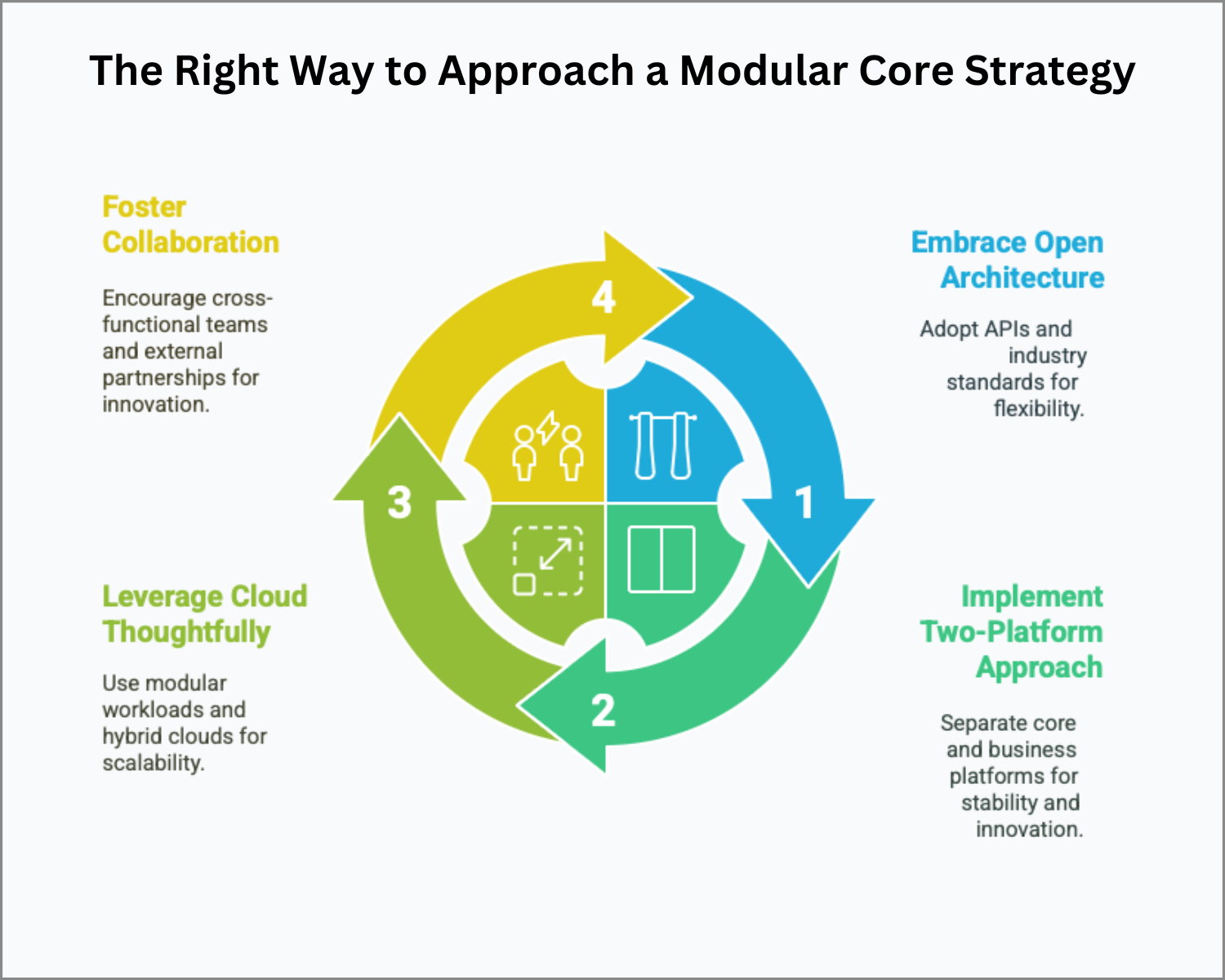

TL;DR – The Right Way to Approach a Modular Core Strategy

-

Start with True Modularity – Break monolithic cores into flexible, interoperable modules that can evolve without disrupting the whole system.

-

Adopt a Two-Platform Approach – Let the core handle transactions while a separate platform drives innovation and customer-facing agility.

-

Leverage Cloud Thoughtfully – Use hybrid or modular workloads to boost scalability and resilience while staying compliant.

-

Prioritize Collaboration – Modular success requires cross-functional teams, external partnerships, and a culture of innovation.

-

Why It Matters – A modular core strategy lowers risk, controls costs, and accelerates digital transformation while keeping customers front and center.

Have you ever tried to renovate your entire house in a single weekend? If so, you’ll know it’s a recipe for chaos (and probably a trip to the hardware store you didn’t plan on). The same goes for core banking systems. In a sector where agility and customer demands are moving at lightning speed, the smart play isn’t a risky rip-and-replace—it’s modular core strategy.

By breaking down the core into manageable, interoperable components, banks can evolve at their own pace. Modular transformation is about staying nimble, reducing risk, and adding functionality without disrupting the entire shop.

Let’s talk through why modular cores are the future—and how to make it work in the real world.

1. Embrace an Open and Modular Core

What Banks Often Get Wrong:

- Building a tech stack that’s more fortress than flexible—closed systems that stifle innovation.

- Thinking “modular” just means adding plug-ins to a legacy system.

- Assuming one vendor’s ecosystem can meet all future needs.

The Reality:

A true modular core breaks down monolithic systems into bite-sized, functional components. You gain flexibility to add, upgrade, or replace modules as the business evolves—without putting the entire operation at risk.

(Source: Modular Management + Epic Nine)

How We Make It Work:

- Adopt open architecture. That means APIs, industry standards, and modules that play nicely with third-party tools.

- Standardize interfaces to shorten development times and reduce costs.

- Focus on scalability and agility—whether that’s customer onboarding today or launching crypto wallets tomorrow.

Pro tip: One bank we worked with modularized their payments engine first—then layered on BNPL and digital wallets six months later. Smooth, controlled, no fire drills.

2. Use a Two-Platform Approach to Stay Nimble

What Banks Often Get Wrong:

- Relying solely on the core for both transactional operations and customer-facing innovation.

- Assuming one platform can do it all—and do it well.

- Not separating “run the bank” from “change the bank” initiatives.

The Reality:

A two-platform strategy keeps your core focused on what it does best—processing transactions, maintaining accounts—while a separate business platform accelerates customer innovation and new products.

How We Make It Work:

- Run your core platform for stability, regulatory compliance, and transactions.

- Deploy a business platform for agility—experiments, fintech partnerships, and customer-facing services.

- This separation lets you move fast on customer demands without risking core stability.

Lesson learned: A mid-sized bank used this two-speed model to roll out SME lending products on their business platform—without changing their core. Time-to-market? 90 days, not 18 months.

3. Leverage Cloud Enablement (But Do It Thoughtfully)

What Banks Often Get Wrong:

- Thinking “lift and shift” equals cloud transformation.

- Assuming the cloud is one-size-fits-all for core banking.

- Underestimating regulatory hurdles and security requirements.

The Reality:

Cloud isn’t about parking your systems on someone else’s server farm. Done right, it’s about scalability, resilience, and faster innovation cycles. And yes—it can lower your costs if you’re strategic.

How We Make It Work:

- Start with modular workloads—think customer onboarding, CRM, or fraud detection.

- Choose hybrid or multi-cloud strategies if regulators or risk teams raise concerns.

- Build in security and compliance from the start. This isn’t the place to cut corners.

Cautionary tale: We’ve seen banks rush into cloud migration without adjusting their data governance policies. Guess who spent six months backtracking?

4. Foster Collaboration and Innovation—Internally and Externally

What Banks Often Get Wrong:

- Assuming modular strategies are just about tech.

- Neglecting the cultural shift required to embrace modular thinking.

- Working in silos instead of bringing cross-functional teams to the table.

The Reality:

Modular transformation is as much about people and process as it is about platforms. To succeed, you need cross-functional collaboration, not just a brilliant IT team working in isolation.

How We Make It Work:

- Build multi-disciplinary teams—business, IT, ops, compliance.

- Encourage experimentation and rapid prototyping—it’s okay to fail fast and learn.

- Bring external partners into the fold—fintechs, third-party developers, you name it.

One client story: A bank’s fraud detection module became way more effective after they invited external partners to co-develop machine learning models. Turns out, outside perspectives bring serious value.

Final Thoughts: Why Modular Core is the Smarter Play

A modular core strategy isn’t about patching holes in a leaky ship. It’s about building a faster, more adaptable fleet—ready to handle shifting tides, customer expectations, and regulatory waves without capsizing.

Banks that embrace modular transformation modernize incrementally, lowering risk, controlling costs, and keeping customers happy along the way.

Want to find out where modularization makes the most sense in your bank?

Take the OptimizeCore® Scorecard to assess your current systems and uncover opportunities for a smarter, modular approach.

#CoreBankingTransformation #CoreBankingOptimization