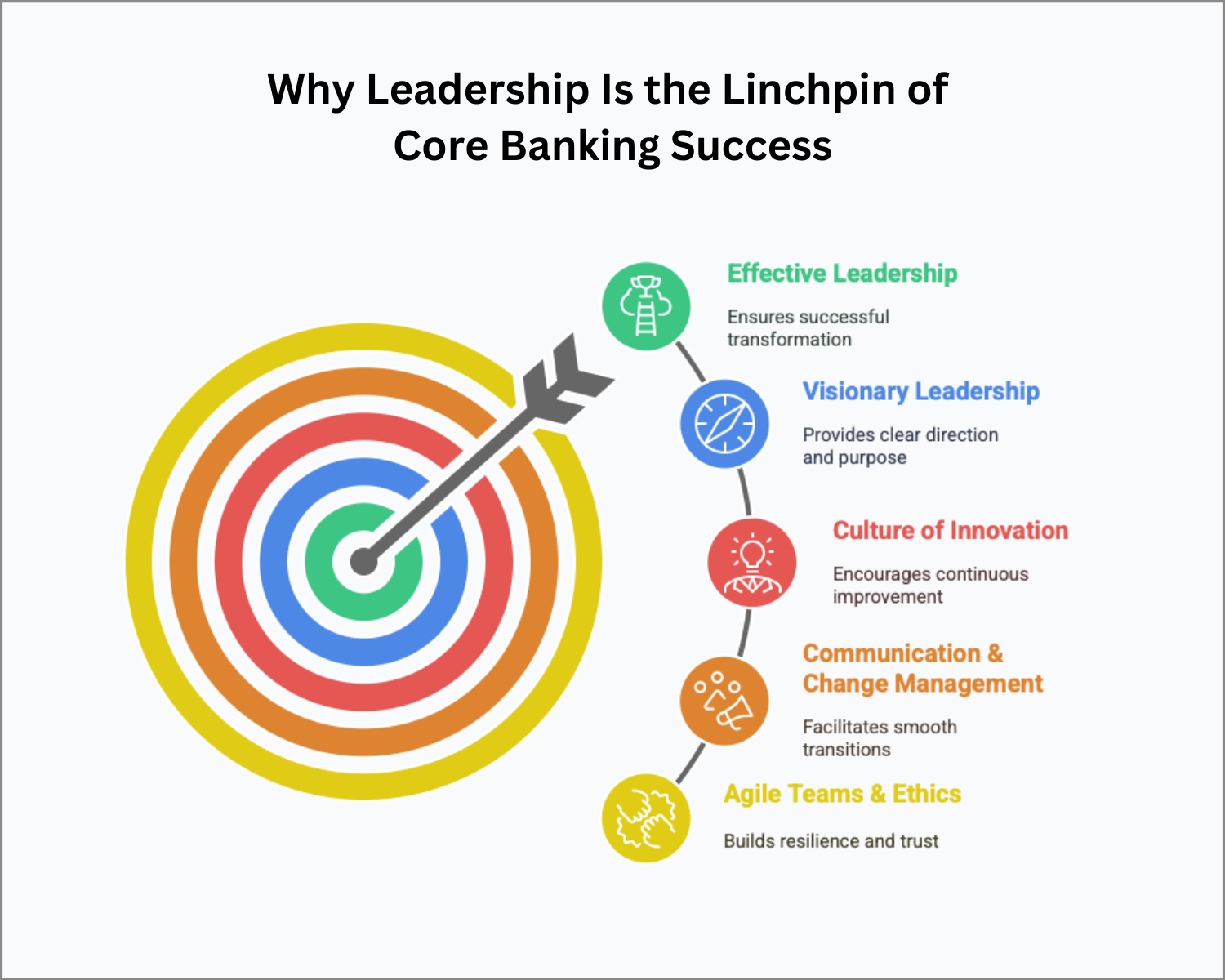

Strong leadership is the blueprint for core banking transformation success—uniting vision, innovation, and change management to guide people and technology toward lasting results.

TL;DR – The role of leadership in core banking success

-

Vision-Driven Execution – Strong leaders tie transformation to clear business goals, not just tech trends.

-

Innovation as a Leadership Habit – Create a culture where experimentation is encouraged and rewarded across the organization.

-

Communication That Lands – Lead change with clear, consistent messaging that connects strategy to everyday roles.

-

Teams Built for Agility – Invest in skills, collaboration, and resilience to adapt quickly without burnout.

-

Why It Matters – Leadership is the catalyst that turns core banking transformation from a technical upgrade into lasting competitive advantage.

Strong Leadership Isn’t a Bonus—It’s the Blueprint

Let’s level with each other: core banking transformations aren’t just about technology. If they were, every big-budget system overhaul would be a smashing success. But we both know that’s not how it plays out. What separates the success stories from the cautionary tales? Leadership. And not just leadership in title, but leadership that’s hands-on, clear-eyed, and relentlessly focused on both people and purpose.

Technology gives you the tools. Leaders show everyone how (and why) to use them. When leadership falters, transformations stall. Employees disengage. Budgets balloon. And before you know it, you’re halfway through a core replacement wondering where it all went sideways.

So let’s talk about what great leadership looks like in core banking transformations—and why it’s the difference between thriving and just surviving.

1. Visionary Leadership: Where Are We Going, and Why?

What We Often See:

- Leaders greenlighting a transformation project because “everyone else is doing it.”

- Jumping into tech decisions without tying them back to real business goals.

- Banking on a flashy new system to fix deep-rooted process inefficiencies.

The Reality:

If your leadership doesn’t have a clear, compelling vision, no one else will either. Visionary leaders don’t just chase digital buzzwords—they connect the dots between technology investments and tangible business outcomes. More customer value. Greater efficiency. Faster compliance.

How to Lead Here:

- Articulate a bold, but grounded vision for how modernization will move the bank forward.

- Align leadership at every level—the board, C-suite, operations. If they’re not on the same page, expect friction.

- Define success in measurable terms. Customer NPS. Time to market. Risk reduction. Whatever it is, make it clear and trackable.

(Source: International Banker)

2. Fostering a Culture of Innovation: It Starts at the Top

What Trips Banks Up:

- Treating transformation as a one-and-done project. Flip the switch and move on.

- Innovation stuck in the IT department, rather than woven into the entire business.

- Leaders who fear failure—so no one dares to take risks.

The Reality:

Banks with strong leadership create cultures where experimentation is rewarded, not punished. They know innovation isn’t a destination—it’s an operating principle.

When leadership empowers teams to think differently, small wins stack into big competitive advantages.

How to Lead Here:

- Encourage cross-functional brainstorming. Ops, tech, customer service—everyone brings something to the table.

- Adopt agile practices, but make sure leadership walks the walk. It’s not just for your dev team.

- Celebrate lessons learned, not just successes. Some of the best ideas emerge from “what didn’t work.”

3. Mastering Communication & Change Management: No More Mushy Messaging

Common Pitfalls:

- Assuming people will “get it” because you had one kickoff meeting.

- Announcing big changes without explaining why they matter to the person on the front line.

- Treating change management as “HR’s job” instead of a leadership responsibility.

The Reality:

Change management isn’t a sideshow—it’s the main event. People don’t resist change; they resist unclear or inconsistent leadership.

A leader’s job is to be visible, consistent, and accessible, especially when things get messy. (And they will.)

How to Lead Here:

- Create a structured change management plan, with clear messaging, milestones, and a feedback loop.

- Be honest about challenges, not just the upside. Credibility is built through transparency.

- Empower internal champions—people trust their peers more than corporate memos.

4. Building Agile and Resilient Teams: Adapt or Fall Behind

The Blind Spots:

- Assuming current teams have the right skills for tomorrow’s technology.

- Rolling out new systems and expecting overnight adoption.

- Overlooking burnout—asking teams to “do more with less” without a plan for relief.

The Reality:

You can have the best tech in the world, but if your people aren’t equipped to use it—or worse, if they’re exhausted and checked out—it won’t matter.

Resilient, agile teams aren’t born. They’re built, intentionally, by leaders who invest in continuous learning and foster a safe environment for change.

How to Lead Here:

- Upskill early and often. Don’t wait until you’re knee-deep in rollout.

- Encourage collaboration between business and tech teams. No more “us vs. them.”

- Create flexible teams that can pivot quickly—whether it’s responding to customer needs or regulatory shifts.

5. Leading with Ethics and Sustainability: Because It’s Not Optional Anymore

Where Banks Slip:

- Tacking on ESG goals as an afterthought.

- Focusing only on compliance without thinking about long-term trust.

- Prioritizing quarterly targets over sustainable business practices.

The Reality:

Ethical leadership isn’t just a moral stance—it’s a business imperative. Customers (and regulators) expect banks to walk the talk on data privacy, sustainable finance, and social responsibility. Leaders who get this right build trust that drives long-term growth.

How to Lead Here:

- Integrate ESG into your transformation strategy, not just your annual report.

- Ensure transparency—in data handling, lending practices, and customer relationships.

- Model ethical leadership from the top down. What leaders tolerate becomes the culture.

Final Thoughts: Leadership Is What Makes or Breaks Core Transformation

A successful core banking transformation isn’t about buying the latest platform—it’s about leading people through complex change. Technology enables transformation, but leadership ensures it sticks.

Leaders who drive vision, foster innovation, manage change with empathy, build resilient teams, and operate with integrity will deliver more than a new system. They’ll deliver a bank that’s future-ready, customer-centric, and built to last.

Ready to evaluate how your leadership measures up?

Take the OptimizeCore® Scorecard to assess your leadership team’s alignment, change-readiness, and ability to drive successful core banking transformation.

#CoreBankingTransformation #CoreBankingOptimization