Many community banks confuse being digital with being transformed. True transformation goes beyond apps and websites—it requires a clear roadmap, integrated core strategy, and reengineered customer journeys.

TL;DR – The Wake-Up Call: What Community Banks Still Get Wrong About Digital

-

Surface-level “digital” isn’t transformation – White-labeled apps and refreshed websites aren’t enough to stay competitive.

-

Most banks are flying blind – 78% of community banks lack a digital roadmap tied to business outcomes, leading to stalled progress.

-

Digital is an operating model, not a product – True transformation touches people, process, tech, and strategy—not just tech upgrades.

-

The cost of getting it wrong is real – Delays, attrition, outdated systems, and lost relevance compound quickly.

-

Leaders winning at digital ask better questions – They measure readiness, align on outcomes, and treat vendors as strategic partners.

Picture this…

A small community bank, let’s call it MidState Financial, is facing declining deposits, aging customers and mounting pressure from both fintechs and the megabanks. The CEO knows something has to change. They greenlight a digital project, slap their logo on a white-labeled mobile app, make a few cosmetic updates to their website and start talking about innovation in board meetings.

They believe they’ve transformed. They haven’t.

They’ve digitized the surface and nothing more.

That’s the fictional scenario I laid out in “The Wake-Up Call – A Community Bank at a Crossroads” [HYPER]. But here’s the uncomfortable truth: that story isn’t fiction. It’s a mirror. We’ve seen versions of it play out again and again in boardrooms and project plans across the country.

This article is a call to the people who are still hitting the snooze button.

The Illusion of Progress

Every week we speak with banking leaders who believe they’re further along in their digital transformation than they actually are. They’ll point to a mobile app refresh, maybe a digital account opening tool or a few partnerships with fintechs.

They’ll say things like:

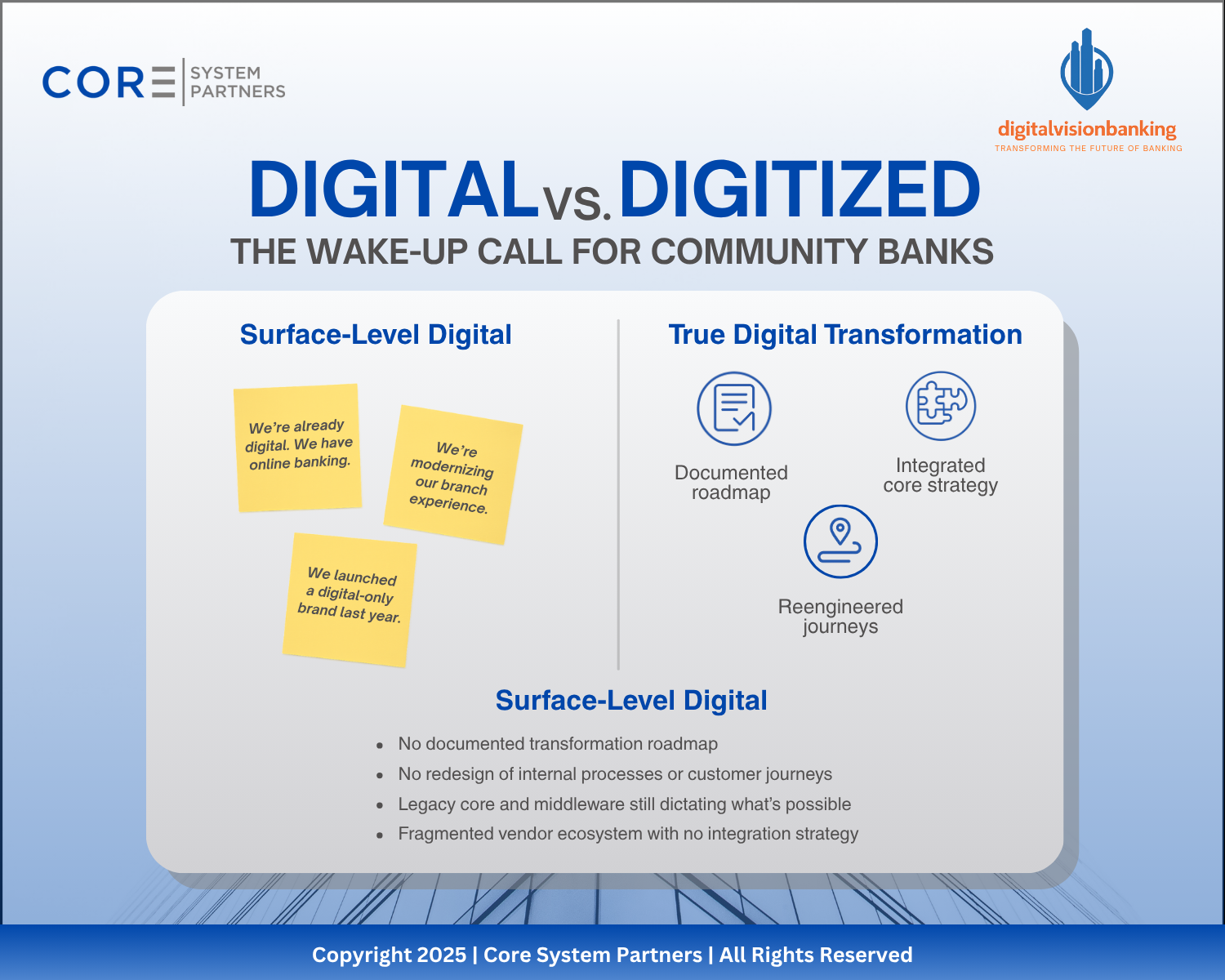

“We’re already digital. We have online banking.”

“We’re modernizing our branch experience.”

“We launched a digital-only brand last year.”

But when we look under the hood, the same issues show up:

No documented transformation roadmap

No redesign of internal processes or customer journeys

Legacy core and middleware still dictating what’s possible

Fragmented vendor ecosystem with no integration strategy

Lack of a true “digital forward mindset” from leadership

According to CSP’s latest CB RADAR™- Core Banking Market Intelligence

Report — which surveyed over 113 banks worldwide—only 22% of community banks reported having a digital roadmap tied to strategic business outcomes.

Most are flying blind, confusing incremental upgrades with real transformation.

The Real Problem: Misunderstanding What Digital Means

Digital isn’t a feature. It’s not a platform. And it’s definitely not an app.

Digital is an operating model, a fundamentally different way of organizing your bank around speed, adaptability and customer relevance. It requires thinking across four domains (a core part of our CSP Readiness Scorecard):

People: Are your teams aligned, trained and empowered?

Process: Have you reengineered how work gets done?

Technology: Is your tech stack enabling or constraining innovation?

Strategy: Do your digital efforts serve a clear, measurable goal?

Too many banks skip steps. They rush into vendor demos and pilot programs without ever asking the foundational questions. In fact, one of the most common transformation myths we see is the belief that buying software is the strategy. The fact is that technology may have been neglected for some time, and by upgrading or adding a new piece they think it solves their problems.

It’s not and it dosen’t.

The Cost of Getting It Wrong

Let’s be blunt. Banks that confuse digital window dressing with digital transformation are going to lose.

They’ll lose relevance with younger generations who expect seamless onboarding, instant service and personalized experiences.

They’ll lose efficiency as manual processes clog growth.

They’ll lose deposits as rate-chasers flock to platforms that combine convenience with competitive value.

They’ll lose talent as their own teams get frustrated with outdated systems and slow decision cycles.

They’ll lose opportunities for new customer acquisition outside of their normal operating footprints.

Our data shows that banks with no formal transformation strategy are 5x more likely to cite customer attrition and 3x more likely to delay key initiatives due to internal confusion or vendor misalignment.

And those delays? They compound.

And here’s the bigger risk: in the next 3–5 years, AI, fintech partnerships, cloud- native cores, automation and even blockchain will converge into a new banking model. Banks that settle for cosmetic fixes today will find themselves even further behind once that convergence becomes the norm.

What the Best Are Doing Differently

We’ve worked with banks that are getting this right, and the difference is obvious. They start by asking better questions:

What business outcomes are we trying to drive?

What customer experiences do we want to deliver?

What does the future of our operating model look like?

They take a readiness-first approach using tools like our CSP Transformation Scorecard to assess their maturity across strategy, execution, vendor alignment and customer centricity. They don’t guess where they stand…they measure it.

They also focus relentlessly on execution discipline. A great plan without the muscle to deliver means nothing. That’s why we developed the Core Banking Starter Guide, to help banks cut through vendor noise, get their data and processes in order and build the foundation for a real transformation journey.

And finally, they treat vendors like strategic collaborators, not just product providers. They know that selecting the right core, middleware or fintech partner isn’t just about features…it’s about long-term fit, alignment and support. (We’ll be covering this in more detail in upcoming articles.)

So Here’s Your Wake-Up Call

If you’re still defining digital by what your competitors are doing or by what your IT team can implement without shaking things up, you’re already behind.

This isn’t about chasing trends. It’s about redefining your bank for the next era; where AI, fintech ecosystems and customer expectations converge.

Build the bank your future customers and your future team will actually want to be part of.

Don’t start with a product demo. Start with a hard look at your bank’s digital maturity. Start with questions that challenge your assumptions.

This article kicks off a series where we’ll unpack:

- The most common mistakes banks make when “going digital”

- How to assess your true readiness to transform

- What successful digital execution looks like (with real examples)

And if you want to jump ahead, read our CB RADAR™- Core Banking Market Intelligence Report . It’s built from dozens of interviews and surveys, and it lays bare where the gaps are and where the opportunities lie.

No more sleepwalking. Time to get moving.

Next in the series: From Digital Illusions to Real Transformation: Spotting the Red Flags

Co-Author Credit

Co-authored with Richard Rotondo,

Chief Digital Strategist at Digital Vision Banking.

#CoreBankingTransformation #DigitalBanking