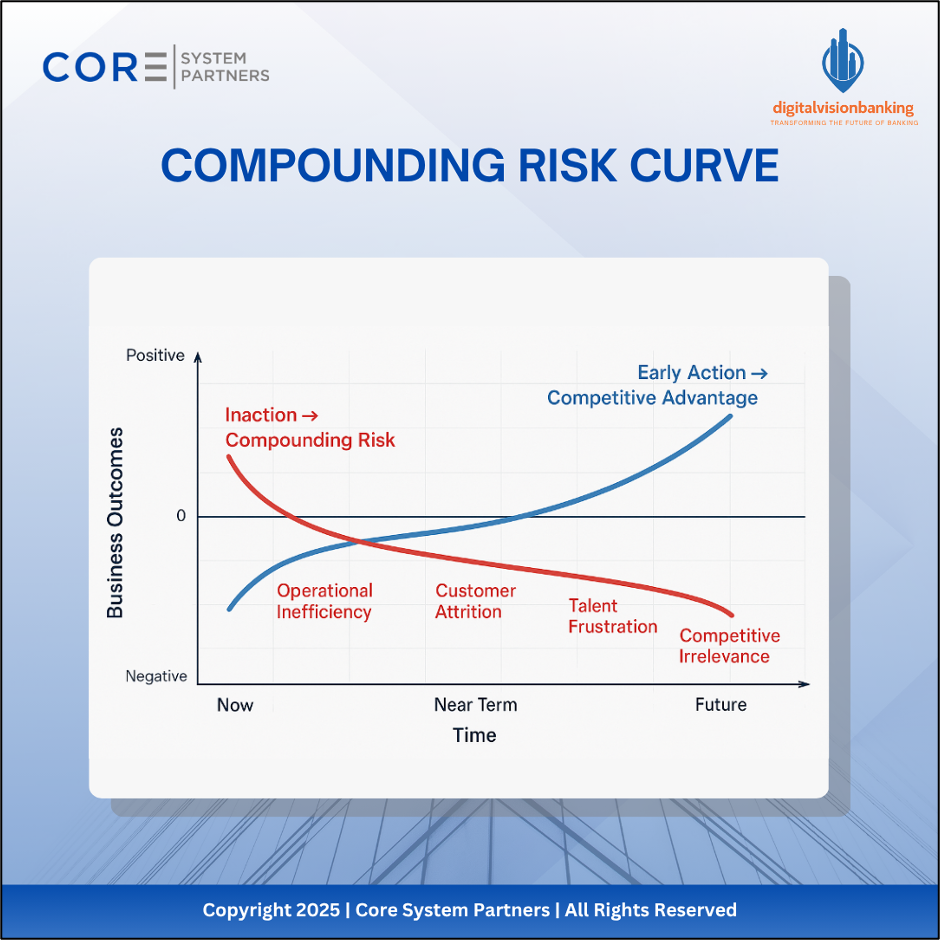

Delaying transformation isn’t neutral, it compounds risk. Acting early creates long-term competitive advantage, while inaction drives inefficiency, attrition, and irrelevance.

TL;DR – What the Best Banks Are Doing Differently

-

Mindset shift sparks momentum – Leading banks stop reacting to legacy limitations and start designing for future customer needs.

-

Readiness drives smarter decisions – Winners measure digital maturity across people, process, tech, and strategy before acting.

-

Execution is a discipline, not a checkbox – Governance, alignment, and rhythm separate digital talkers from digital doers.

-

Vendors become partners – The best institutions build ecosystems, not tech stacks, by aligning vendors with long-term goals.

-

Why it matters – Early movers build compounding advantage. Waiting too long creates gaps that may soon be impossible to close.

The Compounding Risk Curve shows why delaying digital transformation is not neutral, it’s actively harmful. Inaction compounds risks like inefficiency, attrition and eroded market share, while early action may carry short-term costs but creates long-term advantages such as employee empowerment, market leadership and sustained growth. The crossover point, the cost of waiting, marks where the gap between leaders and laggards becomes too steep to close.

Not every bank is stuck in digital illusions or trapped by legacy thinking. A small but growing group of community and mid-sized institutions are breaking the pattern and it shows.

These banks aren’t just patching the surface. They’re building for the future. And the difference comes down to four things: mindset, readiness, execution and collaboration.

A Different Mindset

The banks that win don’t define digital as “keeping up.” They define it as leading change.

They stop asking: What can our current systems handle?

And start asking: What will our future customers demand?

That shift in mindset, from defensive to proactive, is the first domino. Once it falls, everything else becomes possible.

Readiness First

The best banks don’t guess where they stand. They measure it.

They use structured diagnostics like the CSP Transformation Scorecard to assess maturity across strategy, people, process and technology. They don’t confuse activity with progress. They know exactly which gaps they need to close before signing a contract or kicking off a project.

For banks earlier in the journey, the Core Banking Starter Guide is the first step. It’s not theory, it’s a practical orientation that helps leaders cut through vendor noise and get their house in order.

Disciplined Execution

Mindset and readiness mean nothing if execution falls apart.

The best banks treat execution like a core competency. They establish governance. They track risks and decisions. They keep workstreams aligned and interdependent.

Instead of lurching from one initiative to the next, they operate with rhythm and discipline. And that rhythm compounds into credibility, internally with staff, externally with customers and especially with vendors.

Vendor Collaboration, Not Just Selection

The average bank still treats vendors like product providers. The best banks treat

them as long-term collaborators.

They don’t just look at features and demos. They ask: Does this partner align with our roadmap? Will they help us scale? Do they understand our operating model?

The difference is night and day. One bank gets a vendor relationship that locks them into constraints. The other builds an ecosystem that accelerates innovation.

Final Word

The banks that are pulling ahead aren’t the ones with the flashiest apps or the most aggressive PR. They’re the ones with the courage to think differently, the discipline to measure reality, the muscle to execute and the wisdom to build the right partnerships.

The tools are there. The frameworks are there. The question is whether you’re ready to use them.

Return to: The Wake-Up Call – Hub Article

Co-Author Credit

Co-authored with Richard Rotondo,

Chief Digital Strategist at Digital Vision Banking.

#CoreBankingTransformation #DigitalBanking