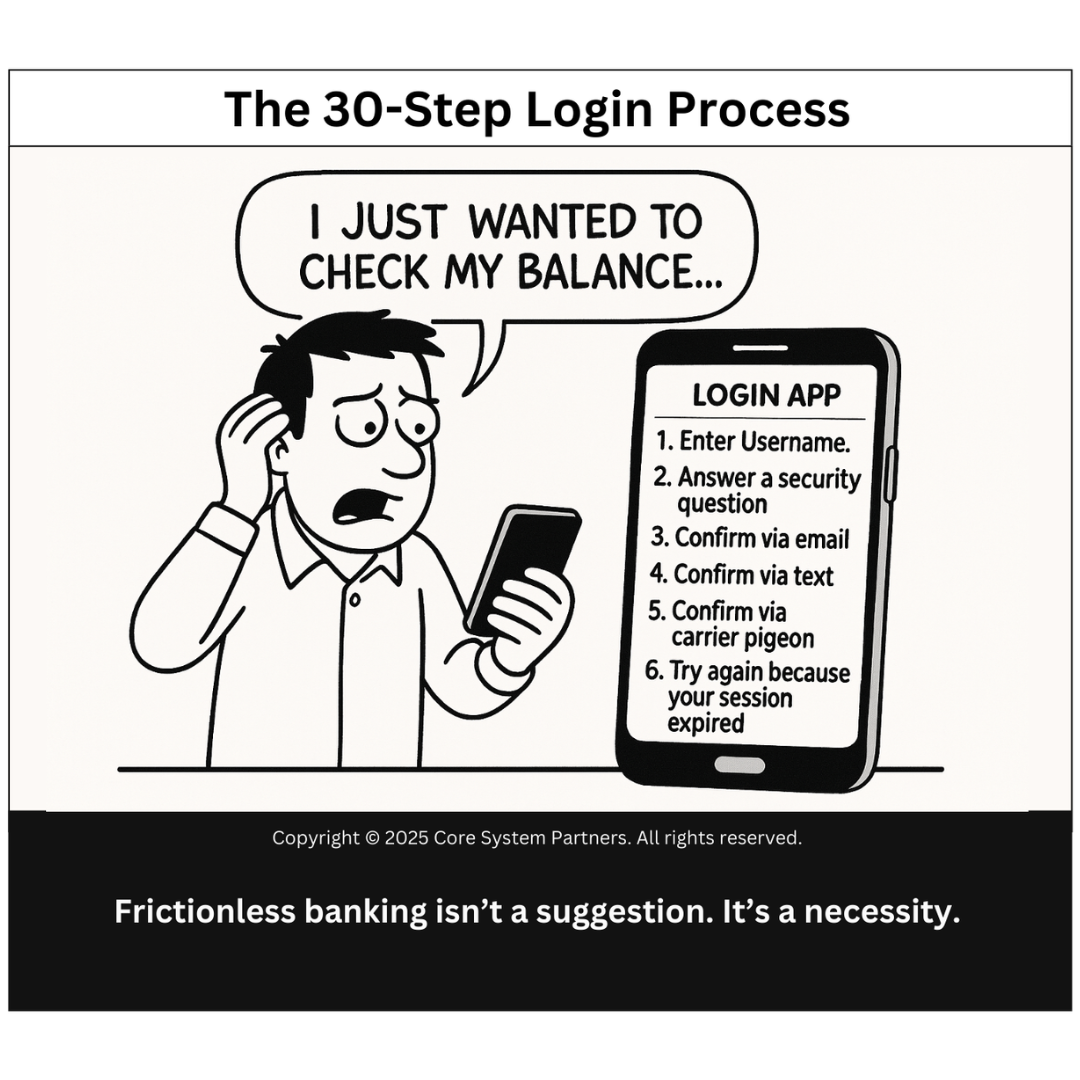

Frictionless banking isn’t a suggestion—it’s a necessity.

“I just wanted to check my balance…”

We’ve all been there. What should’ve taken five seconds turns into a biometric scavenger hunt:

- Username

- Password

- Security question

- Email confirmation

- Text message code

- (Optional) Morse code from your childhood best friend

By the time you finally log in, you’ve forgotten why you even opened the app.

This cartoon hits a nerve not because it’s exaggerated—but because it’s real. And if you’re in banking, it’s worth asking: have we made security more painful than a breach?

The Security vs. Simplicity Dilemma (That Isn’t Actually a Dilemma)

Let’s be clear: security matters. Financial institutions carry more than just capital—they carry trust. But that trust isn’t built through digital hazing rituals.

Here’s the trap we fall into:

- Add one security layer = good

- Add ten more = safer?

- Add thirty = secure… but unusable

In reality, customers don’t see friction as safety—they see it as incompetence.

Case in point? A mid-size bank we worked with had a mobile login process so clunky, their NPS (Net Promoter Score) for digital banking dropped below 20. When they streamlined the experience with biometric and contextual authentication, that score jumped 30 points in a quarter.

It wasn’t a tech miracle. It was customer respect.

Why It Happens: A Look Under the Hood

These bloated login processes usually aren’t intentional. They’re an accumulation:

- A regulator asked for stronger two-factor authentication… so we added email

- An audit suggested backup recovery… so we added secret questions

- Legal flagged a risk… so we made sessions expire every 90 seconds

Each step makes sense in isolation. Together? They’re death by a thousand compliance cuts.

The Hidden Costs of Digital Friction

We often hear, “Well, it’s annoying, but at least it’s secure.”

Let’s reframe that.

Digital friction isn’t just annoying—it’s expensive. Here’s how:

- Abandoned sessions = lost engagement = fewer upsell opportunities

- Increased support calls = higher cost per customer

- App fatigue = brand erosion over time

- Reputational damage = “My bank is the worst” going viral in app store reviews

Security that drives customers away isn’t security—it’s self-sabotage.

What “Frictionless” Really Means (Hint: Not Reckless)

Let’s not confuse frictionless with careless. We’re not suggesting you throw out controls. We’re saying build them better.

Smart banks are rethinking the authentication experience around contextual risk, not uniform burden.

Here’s how they do it:

1. Use Risk-Based Authentication

Not all login attempts are equal.

Known device, known location? Minimal friction.

New device, foreign IP, high-value transaction? Pull out the extra checks.

Let the system do the thinking—not the user.

2. Go Passwordless Where Possible

Use:

- Biometrics

- Device tokens

- Magic links

Your phone already knows you. Why pretend otherwise?

3. Design for Human Memory, Not Policy

Example: a user forgot their password. Instead of a 6-step reset, allow:

- In-app reset with fingerprint

- Text-to-reset with time-bound link

- One-time password (OTP) valid for X minutes

Security policies should support the customer—not trap them.

A Real-World Example: How One Bank Cut Login Time by 80%

A regional bank we worked with ran a diagnostic on their mobile login drop-off rate. Nearly 40% of users failed to complete authentication on first try.

They streamlined:

- Removed the security question layer (wasn’t stopping fraud anyway)

- Used device fingerprinting to pre-approve logins

- Added FaceID and TouchID support

- Login success on first attempt jumped to 91%. Mobile usage spiked. Fraud rates? Flat.

Turns out, security and convenience aren’t enemies. They’re partners when designed right.

Why This Matters for Core Banking Transformations

Let’s zoom out.

Core transformation isn’t just about moving off COBOL. It’s about rethinking everything—including how customers experience your bank.

If your digital experience is wrapped in red tape, no amount of backend modernization will save you.

Modern banking means:

- Fast logins

- Context-aware workflows

- Real-time account visibility

- Embedded security that works silently, not intrusively

You’re not just replacing systems. You’re re-earning trust—click by click, tap by tap.

Security Is a Feature. But So Is Sanity.

Frictionless banking isn’t a “nice-to-have.” It’s table stakes.

Your customers are comparing you to Amazon, not just other banks. They expect speed and safety—and rightly so.

So if your login process feels like solving a Rubik’s Cube blindfolded, maybe it’s time to ask:

Are we building trust, or just testing patience?

Unlock Your Digital Readiness with the OptimizeCore® Scorecard

Not sure where your login experience stands? Our OptimizeCore® Scorecard benchmarks your institution’s:

- Digital friction

- Authentication strategy

- Risk-weighted UX

- Core transformation alignment

Don’t let security policy be the reason your customers give up on their bank.

Because frictionless isn’t a suggestion. It’s survival.

#CoreBankingTransformation #CoreBankingOptimization