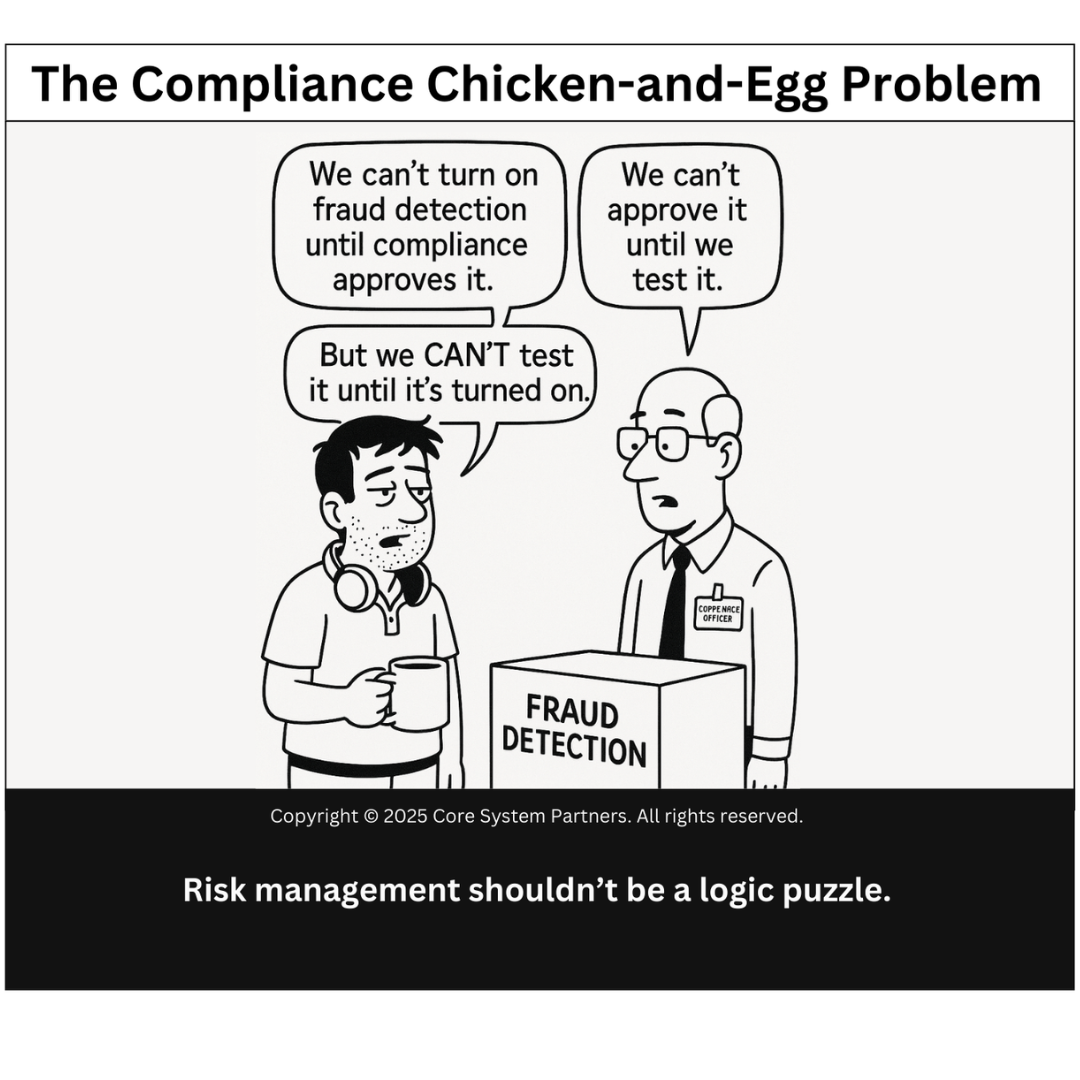

The compliance chicken-and-egg problem: When testing depends on approval, and approval depends on testing, transformation stalls.

“We can’t turn it on until compliance approves it.”

“We can’t approve it until we test it.”

“But we can’t test it until it’s on…”

Sound familiar?

This isn’t just a one-off joke. It’s a frustrating reality across many banks—especially during core banking transformations. What should be a straightforward go/no-go decision gets wrapped in circular logic. Compliance wants certainty. IT needs flexibility. And the fraud detection system? Still sitting in the box, blinking patiently.

Let’s talk about the real issue: risk management that becomes a logic puzzle instead of a business enabler.

The Root of the Paradox

Banks operate in a world of layered accountability. That’s good. You don’t want your fraud tools—or your digital core system—going live without checks and balances.

But sometimes, the way we apply these controls backfires:

- Compliance wants a signed-off test plan before approval.

- Tech can’t generate test results until the tool is enabled.

- Legal says it’s contingent on the compliance sign-off.

So everyone waits. And the business bleeds time.

We’ve seen this delay roll into weeks—sometimes months—because no one wanted to be the one to blink first. That’s not governance. That’s gridlock.

A Real Story: The Time Fraud Stayed Offline… For Safety

One client was rolling out a new fraud detection engine tied to their mobile platform. The engine could spot session hijacking and credential stuffing in real time. Powerful stuff.

But compliance said: “Not until we review every detection rule.”

So the tech team paused deployment.

Then came the irony: during the freeze, a minor fraud incident slipped through—one the system would’ve flagged. The engine that could’ve protected the bank was kept offline by the very governance meant to reduce risk.

No malice. Just misalignment.

Governance Without Pragmatism Is Its Own Risk

When compliance becomes binary—approve or block—it loses nuance.

Transformation isn’t neat. Sometimes you need:

- Sandboxes with pre-approval rules

- Tiered deployment gates (e.g., pilot, limited user exposure, production shadowing)

- Risk-tiered signoffs (high-risk rules get deeper review, low-risk get provisional clearance)

You need to ask:

- Is our current process managing risk, or creating it?

- Are we trying to guarantee certainty where a controlled rollout would be smarter?

- Are departments holding onto authority—or working together to move forward responsibly?

Shifting from Chicken-and-Egg to Yes-And

Here’s how smart banks are redesigning their risk governance:

1. Build Parallel Tracks

Don’t wait for perfect paperwork to begin technical prep. Start early with:

- Pre-configuration work under “non-production” clauses

- Legal & compliance alignment meetings before final development

Parallel progress beats serial handoffs.

2. Deploy with Guardrails

Instead of an all-or-nothing launch, do:

- Feature flags: Let compliance toggle specific detection rules on/off without full tool disablement

- Soft alerts: Run the tool silently and generate reports before enforcing any blocks

- Shadow mode: Let the system learn in parallel to production

You don’t test airbags by crashing the car on launch day.

3. Assign a Risk Translator

This is crucial. Have someone who can:

- Translate compliance concerns into testable hypotheses

- Interpret system logs into operational implications

- Mediate between “We need a policy” and “We need to ship this thing”

We often see this person embedded in transformation PMOs or enterprise architecture teams. The title varies. The impact doesn’t.

The Broader Lesson for Core Transformations

Fraud systems are just one example. This paradox shows up across:

- AI-based credit underwriting – Can’t test the model until it’s trained; can’t train without live data

- Data platform migrations – Can’t validate access controls until you move data; can’t move data until you validate access controls

- Real-time payments – Can’t simulate scale without traffic; can’t go live without passing performance tests

If your governance can’t handle these realities, it’s not transformation-ready. It’s paper-ready.

A Better Way to Govern Innovation

Let’s flip the question:

Instead of “Is this compliant enough to test?” ask, “What testing conditions make it safe to proceed?”

That subtle shift changes everything.

Suddenly:

- Compliance becomes a partner in defining boundaries

- Tech teams gain clarity on what’s permissible

- Risk decisions become transparent and traceable

And progress… actually happens.

Conclusion: Stop Letting Risk Oversight Become the Risk Itself

Governance doesn’t have to be a roadblock. But it does have to evolve.

You can’t manage risk by pretending you’ll never encounter any. Especially in transformation.

So next time someone says, “We can’t test it until it’s approved,” push back—constructively. Say:

“Let’s design a way to test safely, instead of waiting endlessly.”

And if you’re not sure where to start?

Use the OptimizeCore® Readiness Scorecard

We help banks benchmark their readiness across:

- Compliance agility

- Risk-tiered governance models

- Technology rollout maturity

- Decision bottleneck visibility

Don’t let logic loops delay transformation. Solve them before they start.

Because risk management should empower progress—not paralyze it.

#CoreBankingTransformation #CoreBankingOptimization