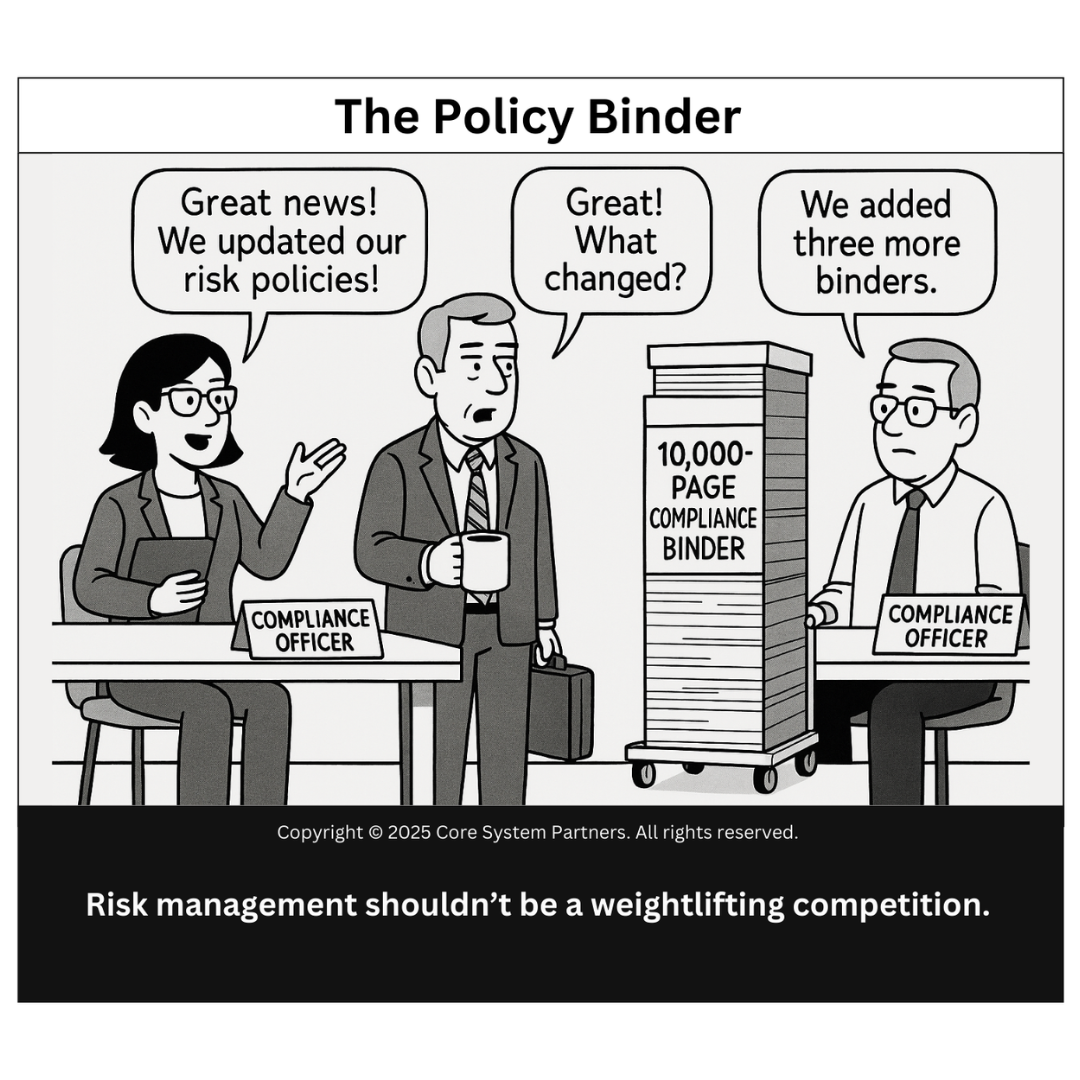

Risk management shouldn’t be a weightlifting competition.

We’ve all been there. Someone excitedly announces a policy update. You lean in, thinking, *“Finally—something useful.”*Instead, a 10,000-page compliance binder lands with a thud. Not a new policy, just more of the same. If risk management feels like Olympic-level weightlifting, something’s gone sideways.

This cartoon hits close to home. It’s funny because it’s true—and frustrating because it’s common. Let’s talk about how we got here, what it’s costing us, and how to shift from bulk to better.

When Risk Management Gets Lost in the Paperwork

In many banks, the compliance function has become synonymous with document creation. More policies. More procedures. More appendices. The assumption is that volume equals rigor.

But here’s the thing: a thicker binder isn’t a better defense.

- It doesn’t help front-line staff understand what actually changed.

- It doesn’t make it easier to comply.

- And it certainly doesn’t make your bank safer—especially if no one reads it.

Instead, it creates what one of our clients once called “a compliance fog”—so much paper, no one can see what matters anymore.

The Risk of Too Much Risk Policy

Excessive documentation isn’t just annoying. It’s operationally dangerous. Here’s why:

1. Clarity Suffers

When key updates are buried under pages of boilerplate, people miss them.

“We technically covered it in the policy update” doesn’t help if no one knew what changed.

2. Frontline Confusion

Your loan officers, tellers, and contact center reps are the real risk control layer. If policies aren’t actionable, they’ll default to habit—or worse, guesswork.

3. Audits Get Slippery

Vague or bloated documentation leads to inconsistent interpretation, which leads to inconsistent application, which leads to findings.

4. Transformation Slows Down

Over-documented processes become harder to change. Every improvement initiative turns into a policy rewrite project, bogging down transformation momentum.

Real Talk: Is Your Risk Policy Helping or Hurting?

If your team groans at the mention of policy updates, that’s a signal. If your risk culture is based on binder size rather than behavioral outcomes, it’s time for a rethink.

Ask yourself:

- Can your staff explain the intent behind the policy?

- Do people know what actions they should take differently tomorrow?

- Is your documentation designed for clarity, or just compliance?

Better Risk Management Starts with Less—But Smarter—Policy

We’re not saying throw out the binder. We’re saying build a smarter one.

Here’s what effective, transformation-ready policy looks like:

1. Purpose-Driven

Start every policy with why it exists and what risk it mitigates. Don’t just list rules—explain the reasoning.

2. Role-Relevant

Tailor content to the reader. The compliance officer needs depth. The branch manager needs application. The front-line worker needs clarity.

3. Bite-Sized Updates

No one reads a 300-page revision. Send concise change summaries. Use redlines. Offer “before and after” comparisons.

4. Embedded in Workflow

Move beyond the binder. Embed guidance in the tools people already use—loan origination systems, CRMs, teller apps. Make compliance part of the workflow, not an extra step.

5. Digital > Physical

Let’s be real: paper binders are symbolic, not functional. Use digital policy libraries with keyword search, version history, and contextual prompts.

From Paper Compliance to Practical Risk Culture

One bank we worked with had 200+ separate policy documents—each owned by a different department, updated in isolation. Employees spent more time figuring out which document applied than following it.

We helped them:

- Consolidate overlapping policies.

- Introduce a digital front-end for staff-facing content.

- Launch a policy update digest in plain English every quarter.

- Tie every policy section to a corresponding risk category and control.

Result? Compliance awareness went up, audit findings went down, and front-line staff actually used the policies.

What This Means for Core Banking Transformation

In any major transformation, whether it’s core modernization, cloud migration, or process automation, your risk posture matters. But not in the “let’s add 300 pages of disclaimers” kind of way.

- If your policies aren’t agile, your system design won’t be either.

- If your controls can’t scale digitally, your transformation will stall.

- If compliance is treated as a binder instead of a behavior, risk will creep in through the cracks.

The point isn’t to deregulate—it’s to reframe risk management as an enabler, not an anchor.

Final Thought: Stop Managing Risk with Weight

Good risk management is clear, contextual, and continuous. It doesn’t hide behind binders or obscure jargon. It empowers people to do the right thing, consistently and confidently.

So let’s retire the binder arms race. Let’s build policy that works the way our banks need to—nimble, smart, and resilient.

Ready to Modernize Risk the Right Way?

If you’re preparing for a transformation, your risk controls should evolve with you. Our OptimizeCore® Scorecard includes a dedicated review of policy clarity and control scalability.

Because risk management shouldn’t be measured in pages—it should be measured in performance.

#CoreBankingTransformation #CoreBankingOptimization