Vol. 12

What your vendor won’t tell you.

What your team needs to hear.

One issue a week.

| Here’s what we’re watching, unpacking, and calling out in the world of core banking transformation:

|

| ⏱️ Recycled Strategy ≠ Progress Why slapping a new date on an old plan is stalling real transformation—and what to do instead.

|

| 🌐 News: 5 Big Core Moves in a Single Week Lunar, MSB Vietnam, FirstBank Ghana, Mambu, and Finovifi are rewriting the rules. Are you keeping up?

|

| 📎 Our New Whitepaper Hub Is Live Our brand new Whitepaper Series landing page is now live!

|

| ⚙️ The ROI of Optimization Why refining beats replacing rethinking Core System upgrades

|

| 🧩 The Patchwork Trap When “temporary fixes” become permanent risks. How to spot the danger—and exit with control.

|

| 💼 Cut Costs Without Cutting Corners From cloud to SaaS, five high-impact ways banks are saving millions without compromising capability.

|

| 👔 Careers If you know anyone that is looking for work. We have some recent open positions.

|

| 🔐 Next Week: Vendor Prison What happens when your vendor holds the keys—and how to escape before the next auto-renewal locks you in.

|

| Still sitting on a recycled roadmap? You’re already behind. |

The Overdue Transformation

Why Slapping a New Date on

an Old Plan Isn’t Progress

| Many banks mistake cosmetic updates for progress—until stakeholder trust erodes, momentum dies, and competitors pull ahead. This piece unpacks the risks of “recycled strategy,” how to spot it, and what real transformation actually demands. |

Core Banking News

What’s Happening in Core Banking This Week?

Another week, another wave of core shakeups.

Lunar Migrates to Visa-Owned Cloud-Native Core Platform (Pismo)

FirstBank Ghana Upgrades to Finacle 11.x Core Platform

MSB (Vietnam) Completes Core Banking Transformation with Temenos

Finovifi Acquires MBS to Expand Core Banking Capabilities

Light Frame & Mambu Partner on Core Banking for Wealth Sector

Marginalen Bank Migrates to Mambu Cloud Core System

|

|||||||||||||||

🌐

Our New Whitepaper Hub Is Live!

Ready to upgrade your transformation game with insights that actually move the needle? From checklists to real-world stories, we’ve packed the essentials into one powerful library.

Our brand new Whitepaper Series landing page is now live!

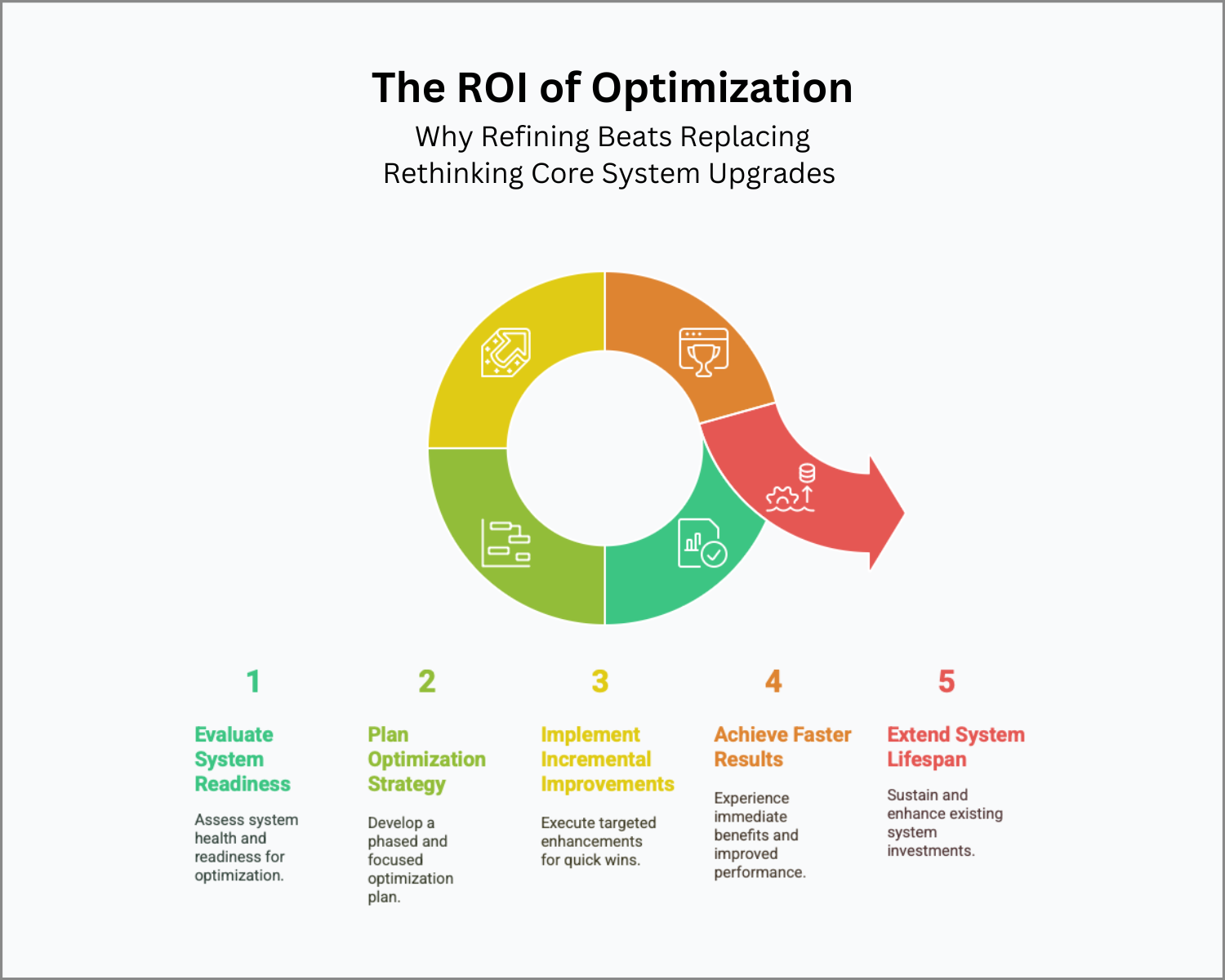

The ROI of Optimization

Why Refining Beats Replacing

Rethinking Core System Upgrades

Many banks mistake cosmetic updates for progress—until stakeholder trust erodes, momentum dies, and competitors pull ahead. This piece unpacks the risks of “recycled strategy,” how to spot it, and what real transformation actually demands.

The Patchwork System

When “Temporary Fixes”

Become Permanent Problems

If your tech stack is a patchwork of legacy systems, quick fixes, and duct-taped integrations, you’re not alone—but you are at risk. This piece breaks down why “just keeping it running” is no longer good enough—and what smart modernization really looks like. Don’t wait for the next outage to take action.

Core banking costs

Smart strategies to cut expenses

(Without Cutting Corners)

Think trimming your tech budget means sacrificing performance? Think again. From cloud moves to SaaS smarts, this article shares 5 proven strategies to reduce core banking costs and boost ROI. Smarter spend, smoother operations—without the rework.

Stay Connected with Core Insider

Thank you for being a part of our Core Insider community! Stay ahead in core banking transformation with our expert insights, actionable strategies, and curated news.

Explore More:

- Visit Our Blog for in-depth articles and thought leadership.

- Follow Us on LinkedIn for daily tips and industry updates.

- Contact Us for collaboration inquiries or to learn more about our services.

Join the Conversation:

Have insights to share or questions about today’s newsletter? Reply to this email or join the discussion on our LinkedInPage.

Looking for Talent or Opportunities?

Check out our Careers Page for exciting opportunities in core banking transformation.

Spread the Word:

Enjoyed this issue of Core Insider? Forward it to a colleague or friend who would benefit from these insights.

Stay Inspired. Stay Informed. Stay Connected.

Let’s transform the future of core banking together.