Vol. 14

What your vendor won’t tell you.

What your team needs to hear.

One issue a week.

Core Under Pressure

Fixing What’s Slowing You Down

Too many tools, too little control—this issue exposes the hidden risks of messy migrations, duct-taped compliance, and vendor lock-in, while spotlighting the bold moves reshaping core banking.

🛠️ The Accidental Frankenstein – What starts as smart integration can spiral into a tangled monster of tools, gaps, and tech debt—here’s how to spot the signs before it turns on you.

🌐 Core Banking News: What’s Shifting Now – Core banking transformation is accelerating fast—with AI, crypto, and cloud-native strategies reshaping the landscape while keeping humans in the loop.

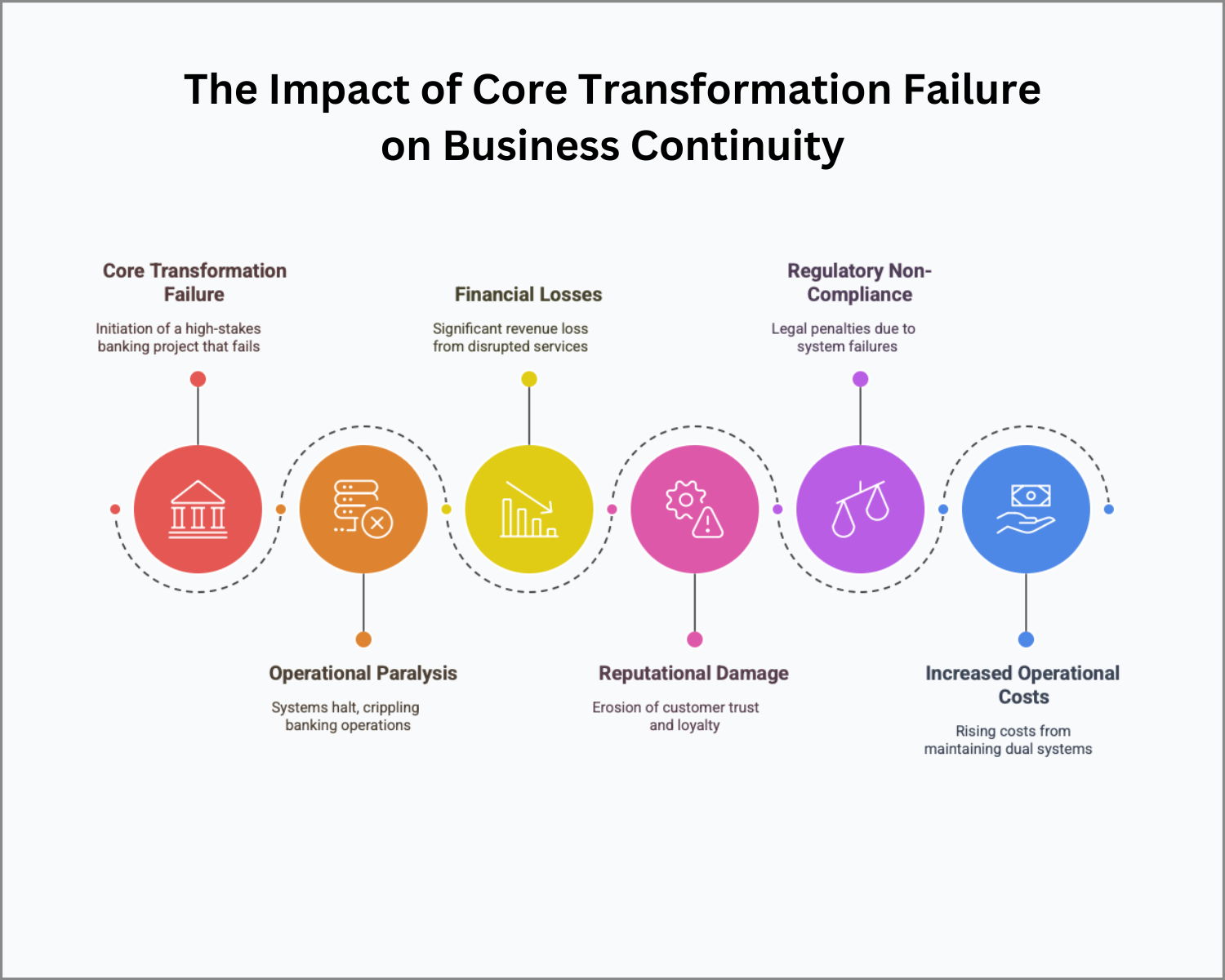

⚠️ The Real Cost of Core Transformation Failure – A failed core transformation can derail operations, damage trust, and hit the bottom line—unless smart planning steps in first.

📘 The Compliance Patch Madness – Quick fixes can satisfy regulators—but over time, they create brittle systems.

⏳ The Migration That Never Ends – Core upgrades dragging on for years cost more than time—they drain trust, momentum, and impact.

📊 Avoiding Vendor Lock-In with Smart Strategy – A strong exit strategy ensures flexibility and future-proof transformation.

📋 Careers in Core Banking – New hybrid and remote roles in core banking are open now—highlighted by an urgent need for a Core Banking Architect in New Jersey.

Ready to sidestep the usual pitfalls and lead with sharper vision? Let’s dive in.

The Accidental Frankenstein

When Integration Creates a Monster

|

What starts as “smart integration” can quietly morph into a patchwork nightmare of clashing tools, hidden dependencies, and security gaps. If your architecture feels more like Frankenstein than forward-thinking, it’s time for a reset. Discover the warning signs—and how to simplify before you electrify. |

What’s Happening in

Core Banking This Week?

|

This Week in Core: 10 Big Shifts You’ll Want on Your Radar Transformation isn’t slowing down—it’s accelerating. From Cathay United’s Avaloq rollout to Abound’s Jack Henry switch, core banking moves are stacking up fast. If you’ve been heads-down, now’s the time to look up. Big Moves This Week: Top 3 Deployment Headlines

Streamlining private banking with Avaloq’s platform.

A modern move with Banno and Data Hub for cloud-native agility.

A mobile-first core transformation powered by Orion Innovation.

Ready to explore? Dive into the highlights to see how leaders in the banking space are tackling innovation, efficiency, and scalability head-on. Let these stories inspire your own transformation journey. |

The Impact of Core Transformation

Failure on Business Continuity

A botched core upgrade isn’t just an IT hiccup—it can bring operations to a halt, drain budgets, trigger regulatory penalties, and drive customers away. Learn the top five failure points—and how smart planning can protect your bank’s continuity, reputation, and bottom line.

The Compliance Patch Madness

When Temporary Fixes Become

Permanent Problems

Quick fixes may keep regulators at bay—but over time, they create brittle systems, hidden risks, and transformation paralysis. If your compliance architecture looks more like duct tape than design, it’s time to rethink. Discover how to break the patch cycle—for good.

Why Banks That Skip Optimization

Often Regret It

Jumping straight into a full core replacement without optimizing what you already have can cost you—big. From soaring risks and bloated budgets to team burnout and missed quick wins, the hidden costs are real. Discover why smart banks optimize first—and how to do it right.

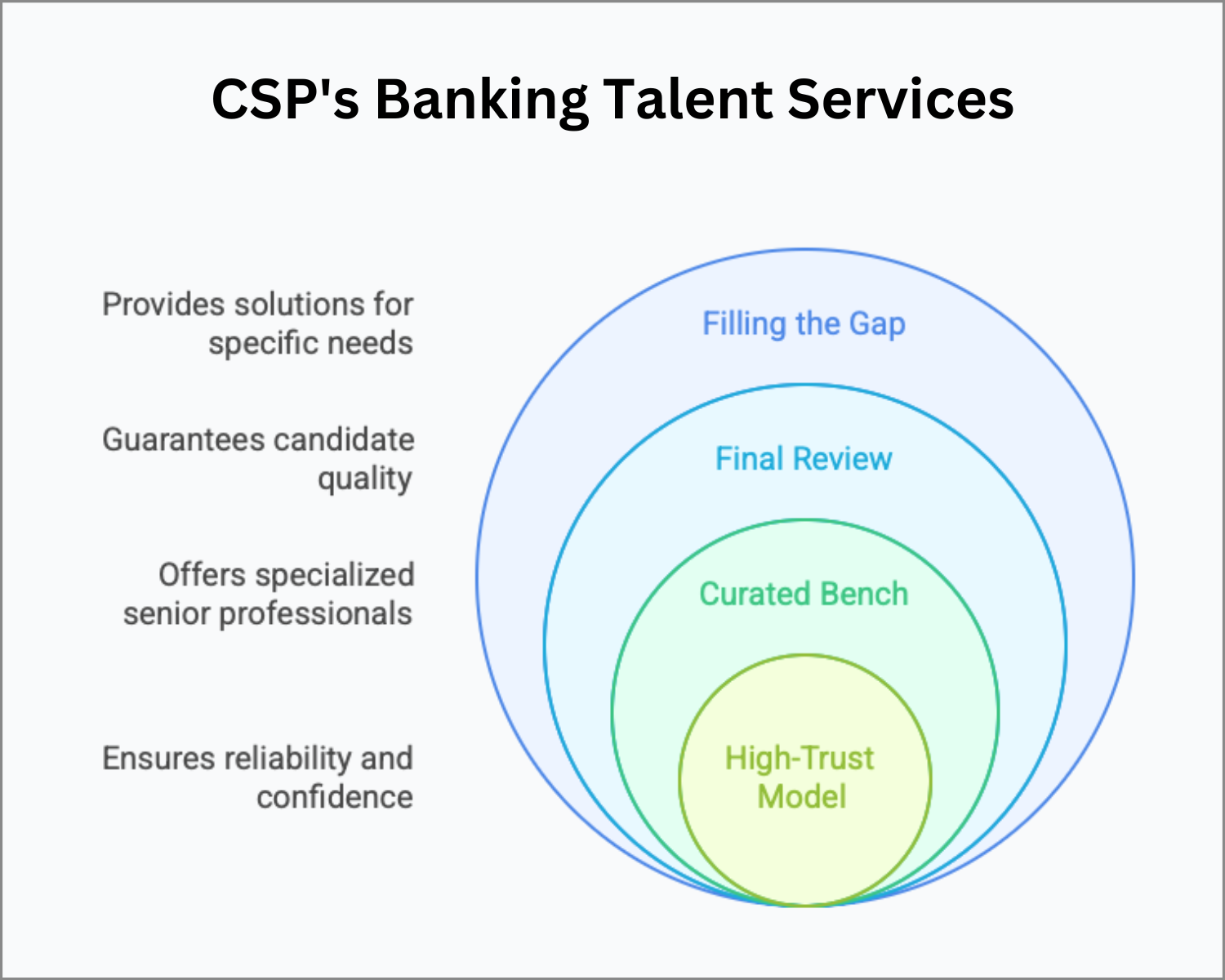

Banking Talent Services

Most banks don’t need more resumes. They need the right person—someone who actually understands how their core systems work and how to navigate transformation without slowing the business down.

That’s what we’re building.

CSP’s Banking Talent Services is a curated bench of senior professionals who’ve been in the trenches. No generalists. No fluff. Every candidate goes through a final review by me before we put them in front of a client.

It’s not a high-volume model. It’s high-trust. If you’ve ever thought, “I just need someone solid I don’t have to explain everything to,” that’s exactly the gap we’re filling.

Stay Connected with Core Insider

Thank you for being a part of our Core Insider community! Stay ahead in core banking transformation with our expert insights, actionable strategies, and curated news.

Explore More:

- Visit Our Blog for in-depth articles and thought leadership.

- Follow Us on LinkedIn for daily tips and industry updates.

- Contact Us for collaboration inquiries or to learn more about our services.

Join the Conversation:

Have insights to share or questions about today’s newsletter? Reply to this email or join the discussion on our LinkedInPage.

Looking for Talent or Opportunities?

Check out our Careers Page for exciting opportunities in core banking transformation.

Spread the Word:

Enjoyed this issue of Core Insider? Forward it to a colleague or friend who would benefit from these insights.

Stay Inspired. Stay Informed. Stay Connected.

Let’s transform the future of core banking together.