What your vendor won’t tell you.

What your team needs to hear.

One issue a week.

🌐 Spotlight: Core systems aren’t just tech, they’re the heartbeat of banking.

🌐 This Week’s Sketch: The Just Sign It Incident warns against blind risk approvals.

🌐 News: Core launches, migrations, neobank growth

🌐 Strategy: Modular cores cut risk, cost, and time with step-by-step modernization.

🌐 Workflow Fix: When Risk Governance Becomes a Riddle shows how approval loops stall progress.

🌐 Ops Insight: OptimizeCore journey recap highlights next steps in modernization.

🌐 Careers: Now Hiring Remote Hybrid Specialists.

🌐 Next Week: Next week uncovers digital pain points before they trip you up.

Strategy meets execution here. Don’t miss what could spark your next big move.

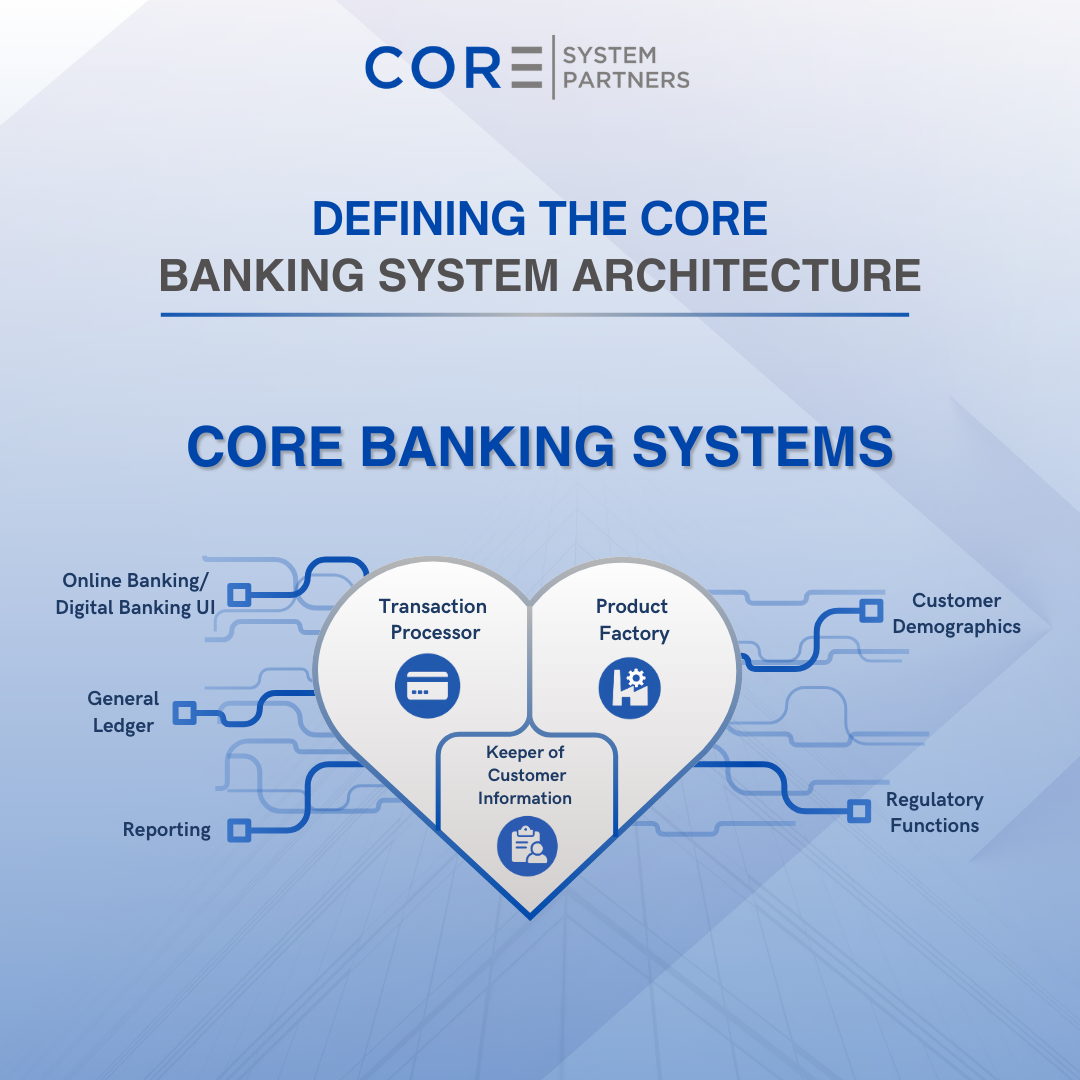

Exploring the true essence of

core banking systems

Is your “core” banking system actually the core?

We asked readers how they define a core system and the answers revealed just how fuzzy the term has become. In this deep dive, we cut through vendor marketing and internal confusion using a surprisingly useful analogy: the cardiovascular system.

Discover the true heartbeat of your banking operations.

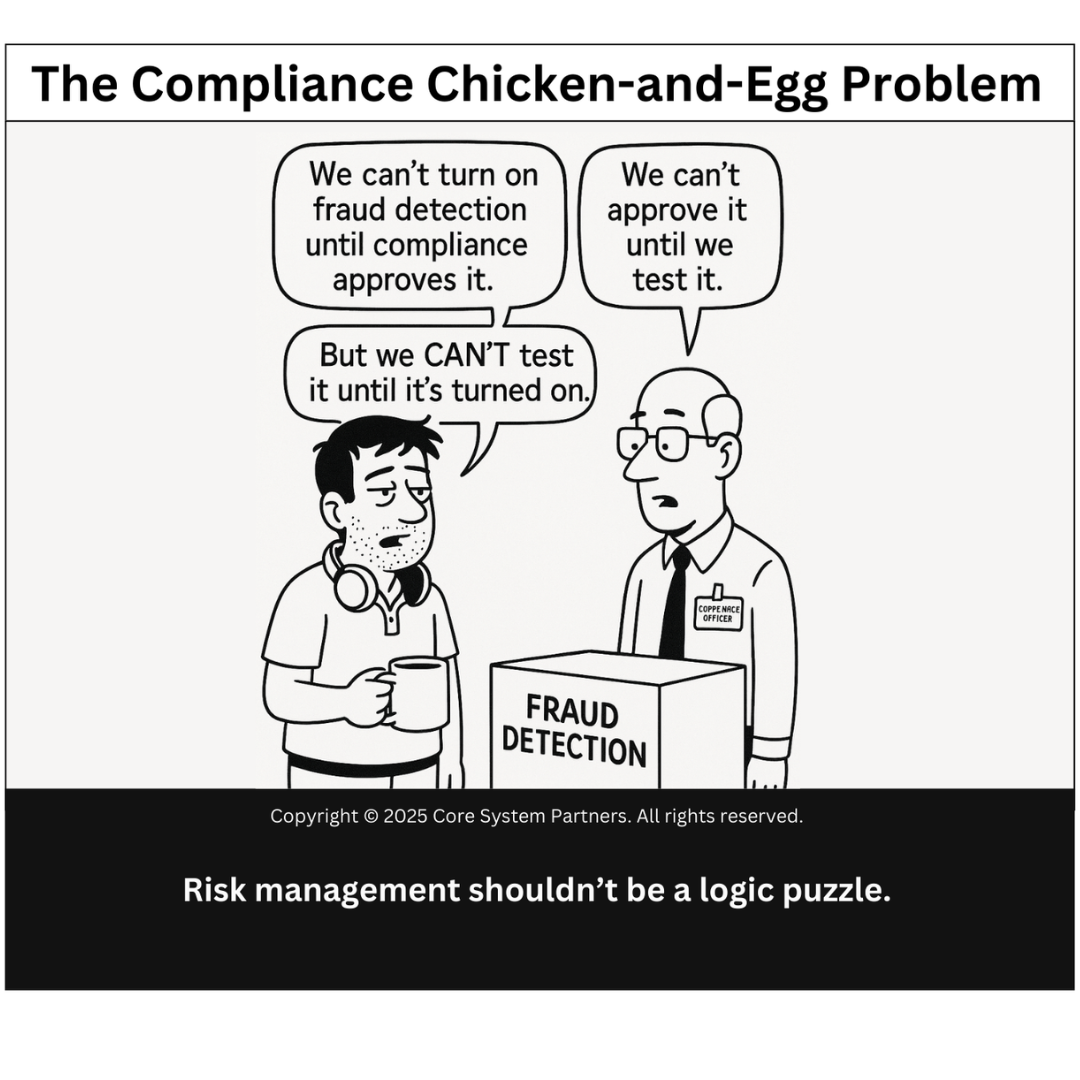

The “Just Sign It” Incident

Banks that treat risk signoffs as routine paperwork risk signing away more than they realize. Learn how to spot red flags and turn approvals into strategic tools.

Asia Pacific Technology Systems launches a cloud-ready core banking platform tailored for regional banks’ digital transformation..

Bank of Commerce (Philippines) pulls off a weekend-wide core system upgrade across 140+ branches and ATMs with Infosys and IBM.

Greek neobank Snappi hits 10,000+ users powered by Natech’s modular core—delivering agile, digital-native banking from day one.Ready to explore? Dive into the highlights to see how leaders in the banking space are tackling innovation, efficiency, and scalability head-on. Let these stories inspire your own transformation journey. |

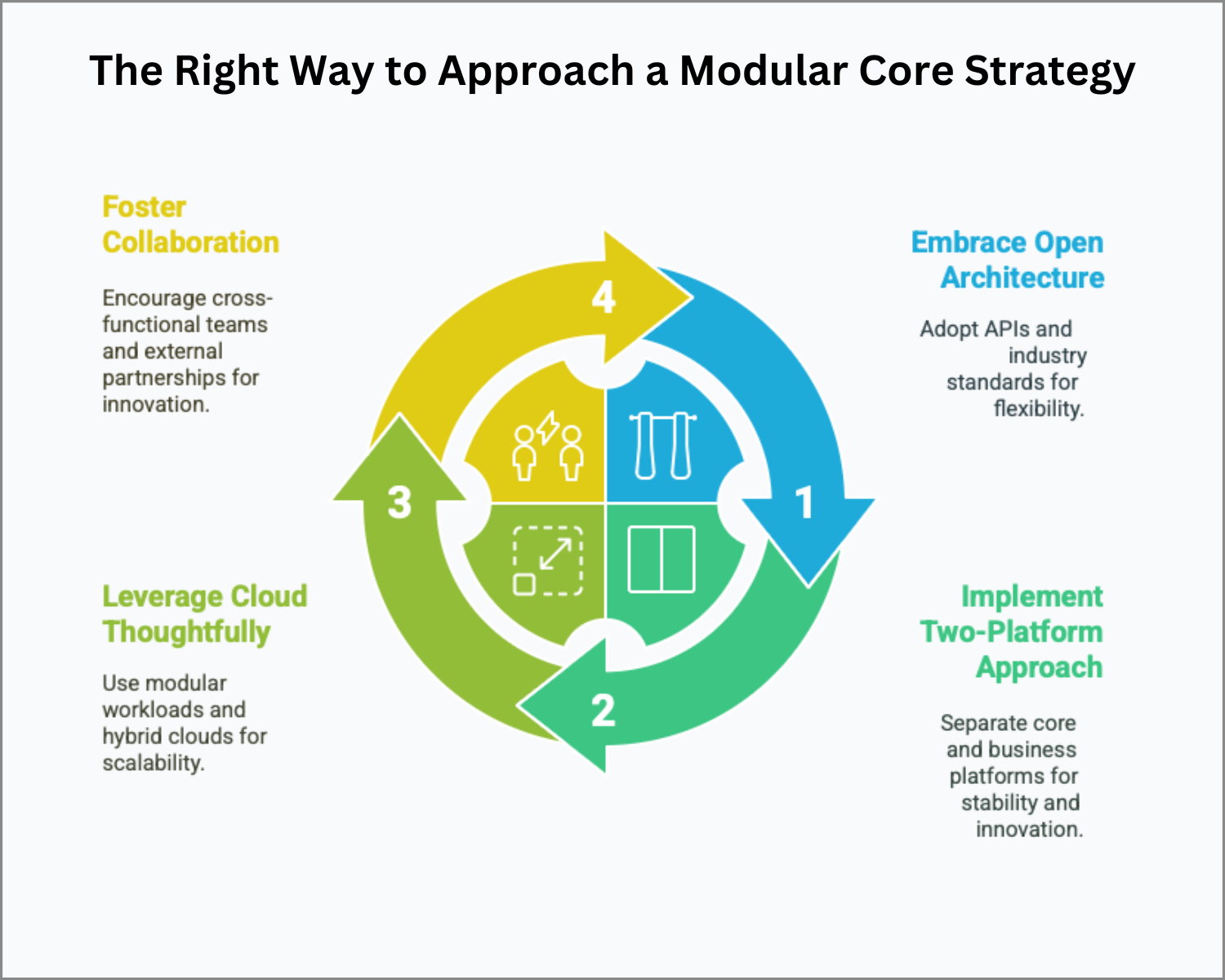

The Right Way to Approach

a Modular Core Strategy

Forget one-and-done overhauls. Learn how a modular core strategy lets banks modernize faster, cheaper, and with less risk, one component at a time.

When Risk Governance Becomes a Riddle

Compliance shouldn’t block progress. Learn how banks can break the approval loop and design governance that supports safe, smart innovation.

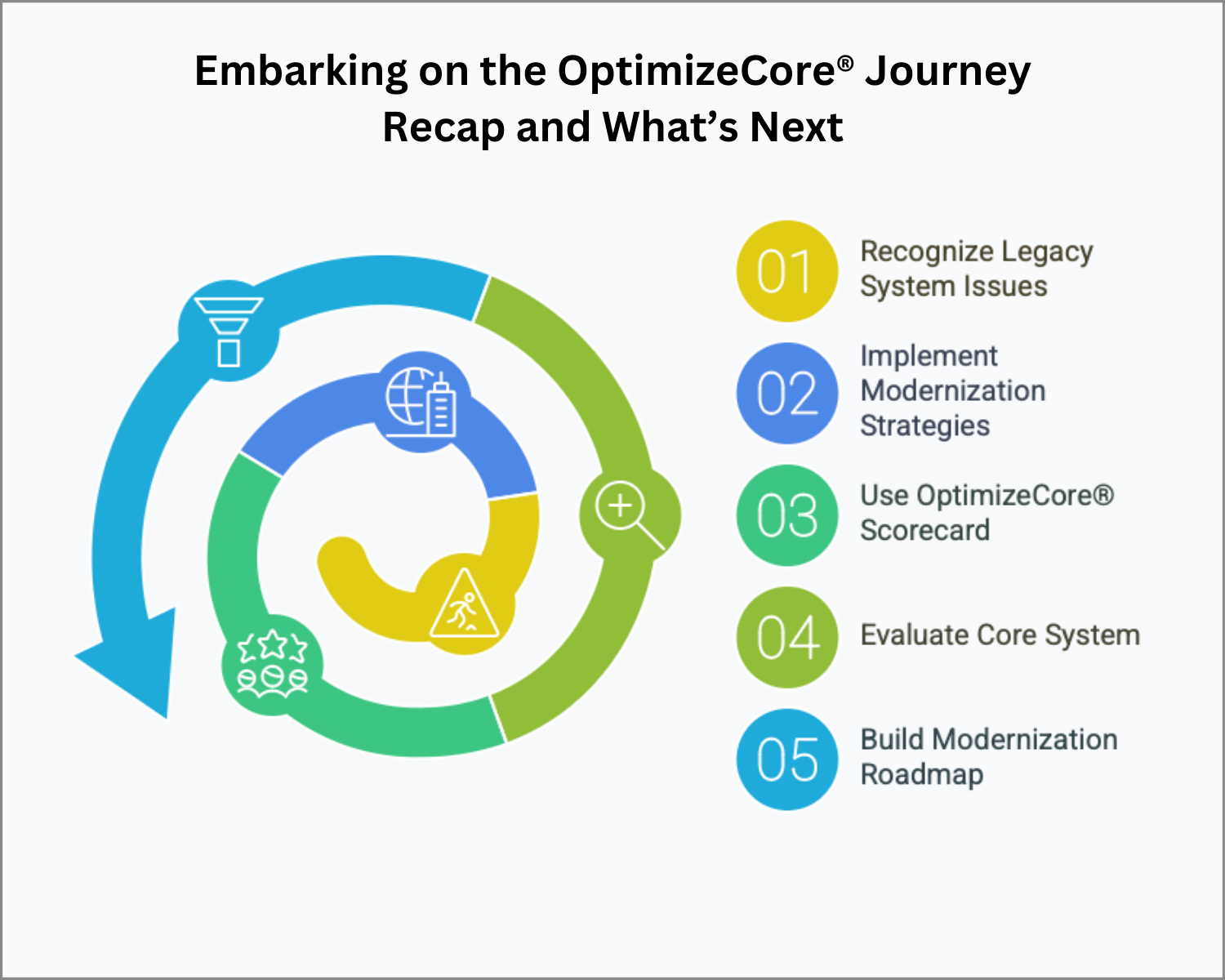

Embarking on the OptimizeCore® Journey:

Recap and What’s Next

Compliance shouldn’t block progress. Learn how banks can break the approval loop and design governance that supports safe, smart innovation.

Stay Connected with Core Insider

Thank you for being a part of our Core Insider community! Stay ahead in core banking transformation with our expert insights, actionable strategies, and curated news.

Explore More:

- Visit Our Blog for in-depth articles and thought leadership.

- Follow Us on LinkedIn for daily tips and industry updates.

- Contact Us for collaboration inquiries or to learn more about our services.

Join the Conversation:

Have insights to share or questions about today’s newsletter? Reply to this email or join the discussion on our LinkedInPage.

Looking for Talent or Opportunities?

Check out our Careers Page for exciting opportunities in core banking transformation.

Spread the Word:

Enjoyed this issue of Core Insider? Forward it to a colleague or friend who would benefit from these insights.

Transformation starts with insight. Stay sharp. Stay Core.