What your vendor won’t tell you.

What your team needs to hear.

One issue a week.

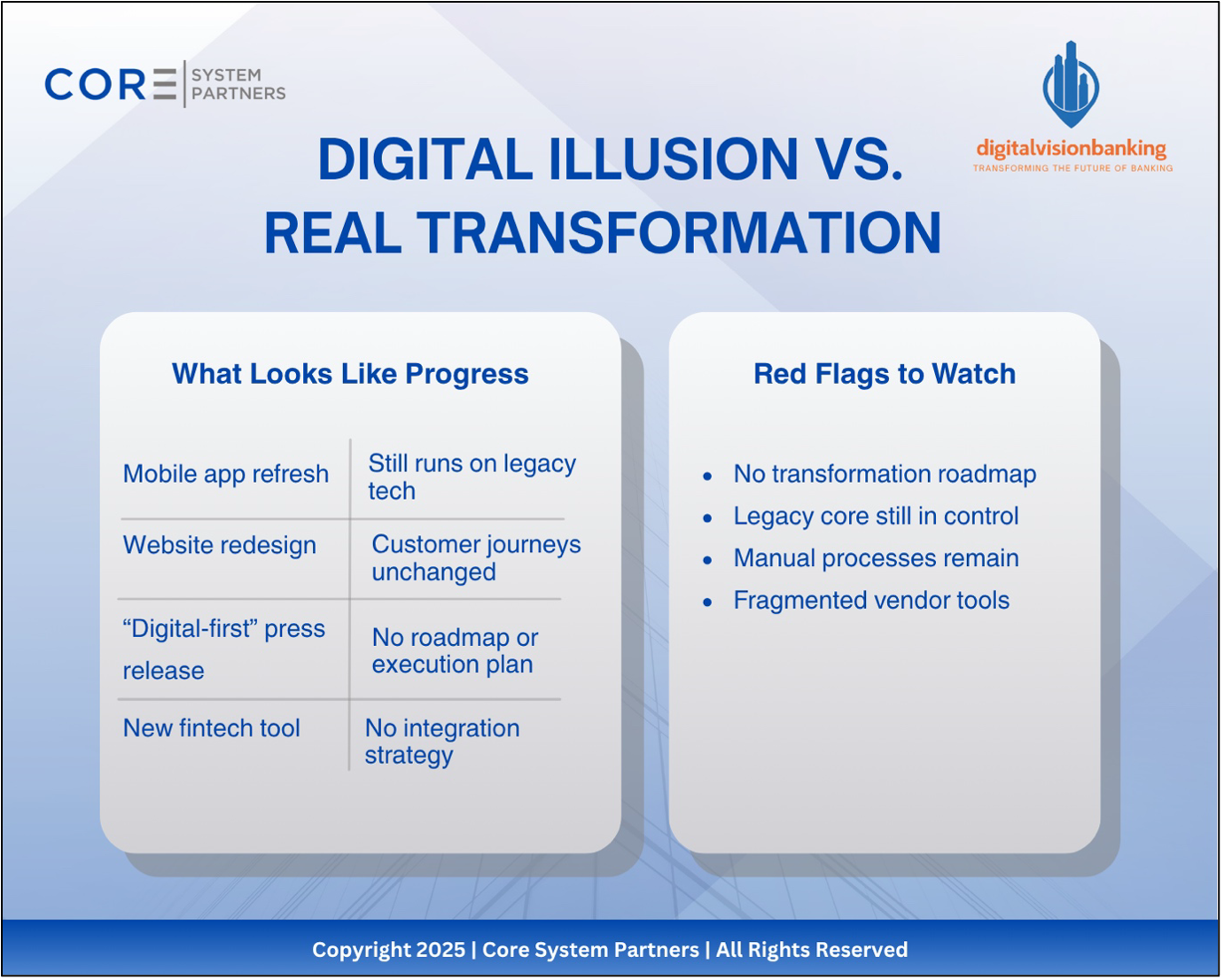

🌐 Spotlight: The Wake-Up Call exposes digital illusions in banking.

🌐 This Week’s Sketch: The Customer Call That Never Ends shows how poor service design erodes trust.

🌐 News: Core Banking News covers BNPL and modernization.

🌐 Strategy: Reveals real change beyond tech upgrades.

🌐 Workflow Fix: The Loan Decision Someday highlights how slow approvals hurt trust.

🌐 Careers: CSP Talent Spotlight highlights hybrid M&A roles in NY.

🌐 Next Week: Breaking the Illusion of Progress exposes fake digital transformation.

Strategy meets execution here. Don’t miss what could spark your next big move.

The Wake Up Call

For Community Banks

|

|

|

The Customer Call That Never Ends

Endless hold times aren’t a tech glitch, they’re a strategy failure. This piece unpacks how outdated service systems quietly erode trust, frustrate customers, and undermine even the best transformation efforts. Discover how forward-thinking banks are redesigning service around empathy, integration, and real-time support.

DXC integrates Splitit’s BNPL solution into its Hogan core platform, enabling 40+ banks to offer embedded installment payments by 2026.CSI acquires Apiture to combine core and digital banking into a unified experience—streamlining modernization, UX, and lending.Mambu partners with Ardeco to reduce implementation risks and speed up legacy core replacement with modern architecture.Ready to explore? Dive into the highlights to see how leaders in the banking space are tackling innovation, efficiency, and scalability head-on. Let these stories inspire your own transformation journey. |

Digital Transformation Vs.

Real Transformation

Many community banks mistake surface-level “digital projects” for true transformation, but a new app isn’t progress if your core and processes stay stuck in the past. This article exposes the red flags of false modernization and shows how real transformation starts with strategy, not cosmetics.

The Loan Decision… Someday

Delays in loan decisions don’t just frustrate customers, they damage your brand. Learn how leading banks are cutting approval times from 14 days to 2 with smarter automation and integrated credit systems.

Delays in loan decisions don’t just frustrate customers, they damage your brand. Learn how leading banks are cutting approval times from 14 days to 2 with smarter automation and integrated credit systems.

Stay Connected with Core Insider

Thank you for being a part of our Core Insider community! Stay ahead in core banking transformation with our expert insights, actionable strategies, and curated news.

Explore More:

- Visit Our Blog for in-depth articles and thought leadership.

- Follow Us on LinkedIn for daily tips and industry updates.

- Contact Us for collaboration inquiries or to learn more about our services.

Join the Conversation:

Have insights to share or questions about today’s newsletter? Reply to this email or join the discussion on our LinkedInPage.

Looking for Talent or Opportunities?

Check out our Careers Page for exciting opportunities in core banking transformation.

Spread the Word:

Enjoyed this issue of Core Insider? Forward it to a colleague or friend who would benefit from these insights.

Transformation starts with insight. Stay sharp. Stay Core.