What your vendor won’t tell you.

What your team needs to hear.

One issue a week.

🌐 Spotlight: Gerry Scales joins CSP, bringing deep trust and vendor strategy expertise.

🌐 This Week’s Sketch: The Compounding Risk, delay quietly deepens disadvantage.

🌐 News: Core migrations highlight risk, innovation.

🌐 Strategy: Final Wake-Up Call urges action before risk compounds.

🌐 Workflow Fix: When Delay Becomes Risk.

🌐 Careers: Urgent hiring for Core Banking Business Analyst (Remote) position.

🌐 Next Week: Next issue tackles truth bombs, digital myths, and why transformation ≠ apps.

Strategy meets execution here. Don’t miss what could spark your next big move.

Advisor Spotlight

Welcoming Gerry Scales

We’re thrilled to welcome Gerald (Gerry) Scales as a Senior Advisor at Core System Partners.

With decades of leadership across JPMorgan Chase, Citi, and fintech ventures, Gerry brings a rare blend of hands-on trust operations, high-net-worth client service, and vendor strategy expertise. His calm, analytical style makes him a powerful asset for institutions navigating vendor consolidation, M&A, and regulatory change, especially in wealth, custody, and trust businesses.

Meet Gerry and explore his full story.

Compounding Risk

Putting off transformation may feel like a safe call, but every “strategic” delay quietly adds to your technical debt and competitive disadvantage. This piece explores how inaction compounds risk and outlines what proactive banks are doing to avoid the costliest mistake: standing still.

GTBank’s transition to Finacle affected over 32 million customers due to service outages, part of a larger trend in Nigerian banks upgrading aging cores.Garanti BBVA taps Maveric Systems to modernize its European core platform with a focus on performance, UX, and scalability.Banks are leveraging AI to de-risk legacy migrations by mapping system dependencies and planning phased, modular transitions.Ready to explore? Dive into the highlights to see how leaders in the banking space are tackling innovation, efficiency, and scalability head-on. Let these stories inspire your own transformation journey. |

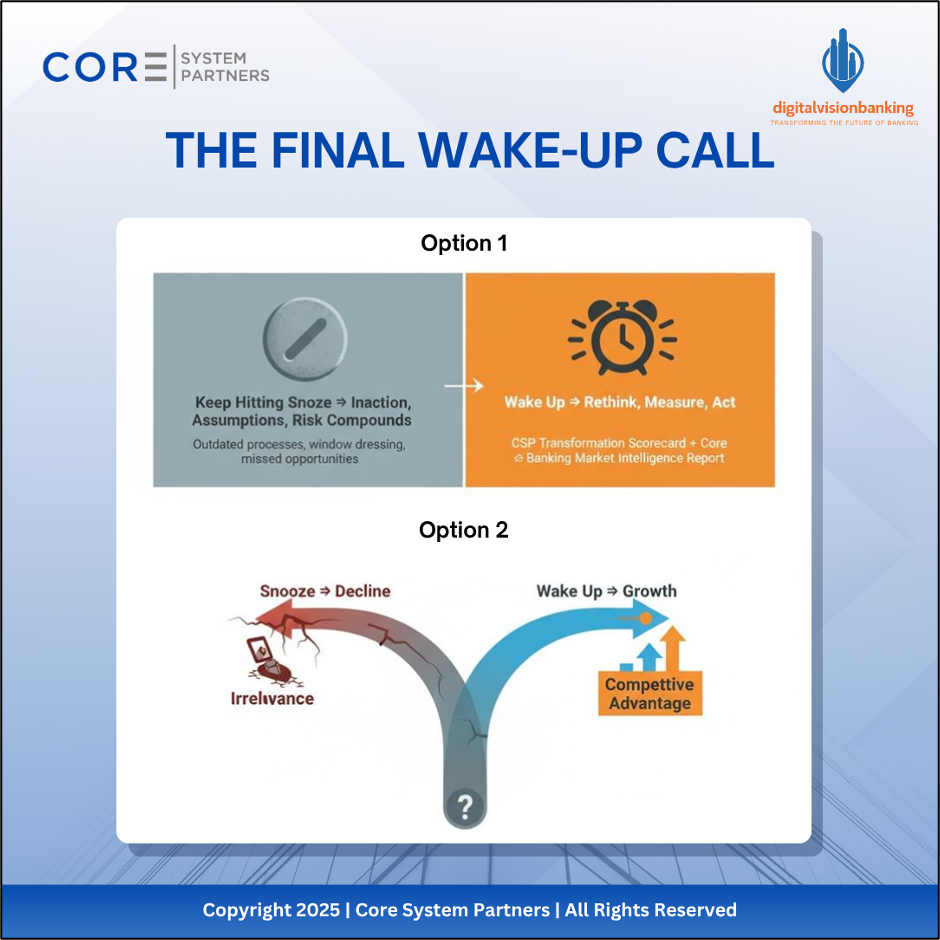

Final Wake-Up Call

Too many banks are still treating transformation as tomorrow’s problem. But while leadership waits, risk quietly compounds and so does competitive disadvantage. This wake-up call lays out why mindset, not just budget, is the true barrier and how to finally move from planning to progress.

When Delay Becomes the Bigger Problem

Endless planning cycles may feel safe, but the longer transformation stalls, the more risk stacks up. This article explores how inaction quietly compounds into a competitive threat, and why doing nothing is often the riskiest move of all.

Stay Connected with Core Insider

Thank you for being a part of our Core Insider community! Stay ahead in core banking transformation with our expert insights, actionable strategies, and curated news.

Explore More:

- Visit Our Blog for in-depth articles and thought leadership.

- Follow Us on LinkedIn for daily tips and industry updates.

- Contact Us for collaboration inquiries or to learn more about our services.

Join the Conversation:

Have insights to share or questions about today’s newsletter? Reply to this email or join the discussion on our LinkedInPage.

Looking for Talent or Opportunities?

Check out our Careers Page for exciting opportunities in core banking transformation.

Spread the Word:

Enjoyed this issue of Core Insider? Forward it to a colleague or friend who would benefit from these insights.

Transformation starts with insight. Stay sharp. Stay Core.