What your vendor won’t tell you.

What your team needs to hear.

One issue a week.

🌐 Spotlight: Colin Cramer Strengthens CSP Advisory Bench

🌐 This Week’s Sketch: A Final Alert Leaders Can’t Ignore

🌐 News: Regulatory Pressure Reshapes Cores

🌐 Strategy: CB RADAR™ 2025: Market Reality

🌐 Workflow Fix: The Cloud Mirage Unpacked

🌐 Careers: Now Hiring: DevOps & UAT Leaders

🌐 Next Week: This issue challenges the idea that “going live” equals success

Strategy meets execution here. Don’t miss what could spark your next big move.

Advisor Spotlight

Welcoming Colin Cramer

“Structure, not shortcuts, delivers outcomes.”

We’re excited to welcome Colin Cramer as Senior Advisor at Core System Partners. With over 20 years leading core banking transformations across Europe, the Middle East and Africa, Colin brings the structure, pragmatism and delivery assurance that high-stakes programs demand.

Known for turning around complex regulatory initiatives and guiding enterprise-wide operating model shifts, Colin’s calm, rigorous approach is exactly what clients need when timelines tighten and execution matters most.

Final Wake-Up Call

That “transformation dashboard” you launched two quarters ago? It’s still blinking and still ignored. This sharp cartoon nails a too-familiar moment: leadership hitting snooze while risks quietly pile up in the background.

The OCC gives Circle, Ripple, Paxos, BitGo, and Fidelity Digital Assets the green light to launch national trust banks, forcing crypto firms to stand up full, regulated core banking operations.CFG Bank selects Jack Henry to modernize its end-to-end core, supporting rapid growth in healthcare lending and scaling after a fivefold asset expansion since 2019.FCA’s Digital Securities Sandbox is driving banks to upgrade their core systems for stablecoin custody, compliance, and real-time digital asset settlement.Ready to explore? Dive into the highlights to see how leaders in the banking space are tackling innovation, efficiency, and scalability head-on. Let these stories inspire your own transformation journey. |

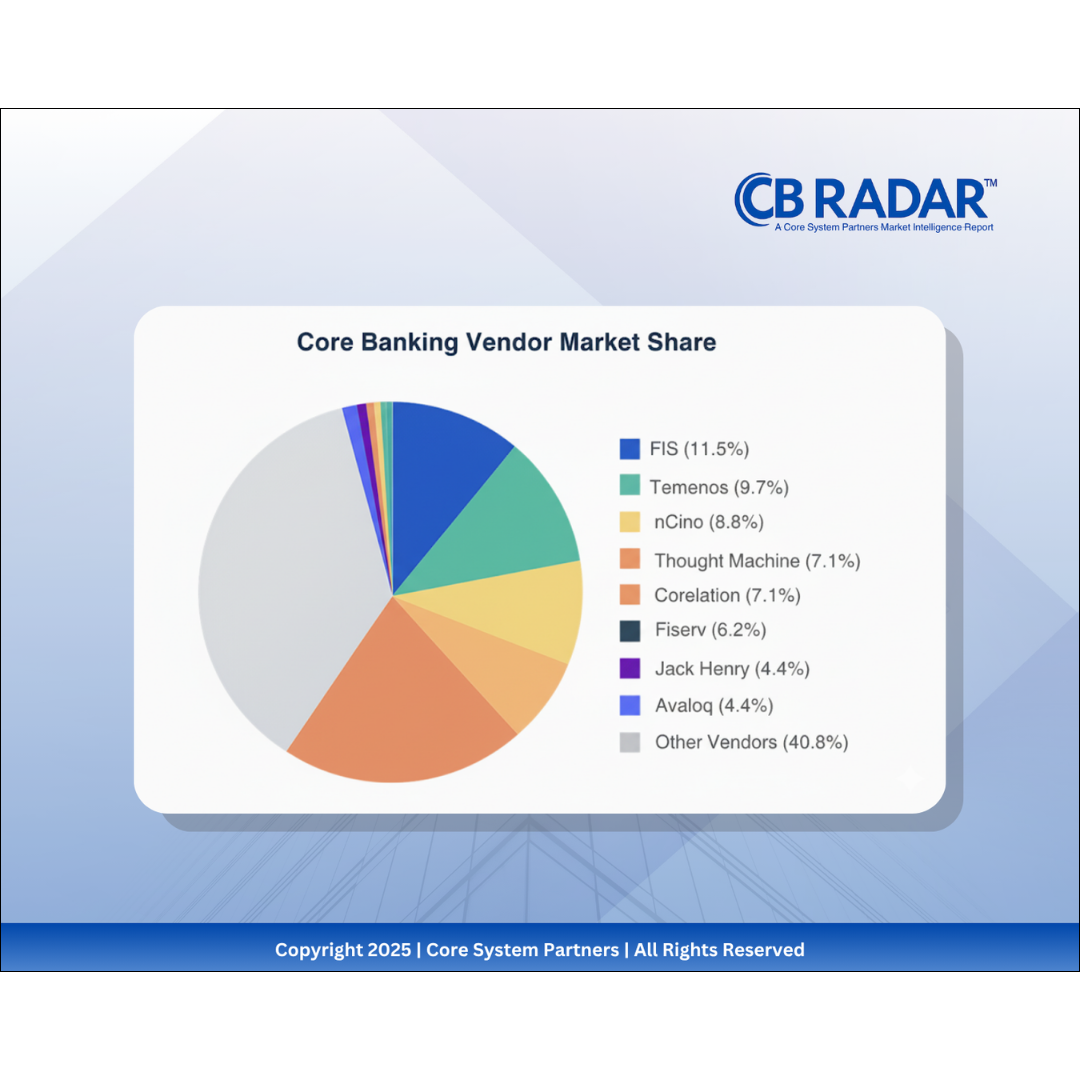

CB RADAR™ 2025 The core transformation landscape is shifting and fast. Drawing from 113 real-world projects, CB RADAR™ 2025 reveals what’s really happening behind vendor claims and shiny success stories. From cloud confusion to fragmented vendor ecosystems, this edition breaks down where banks stand, what’s working, and what’s dangerously misunderstood.

The core transformation landscape is shifting and fast. Drawing from 113 real-world projects, CB RADAR™ 2025 reveals what’s really happening behind vendor claims and shiny success stories. From cloud confusion to fragmented vendor ecosystems, this edition breaks down where banks stand, what’s working, and what’s dangerously misunderstood.

The Cloud Mirage

If your “cloud migration” still relies on on-prem infrastructure and endless server checklists, you’re not transforming, you’re rebranding. This article dives into why many core banking programs stall at the surface and what it really takes to move beyond the illusion of progress.

Stay Connected with Core Insider

Thank you for being a part of our Core Insider community! Stay ahead in core banking transformation with our expert insights, actionable strategies, and curated news.

Explore More:

- Visit Our Blog for in-depth articles and thought leadership.

- Follow Us on LinkedIn for daily tips and industry updates.

- Contact Us for collaboration inquiries or to learn more about our services.

Join the Conversation:

Have insights to share or questions about today’s newsletter? Reply to this email or join the discussion on our LinkedInPage.

Looking for Talent or Opportunities?

Check out our Careers Page for exciting opportunities in core banking transformation.

Spread the Word:

Enjoyed this issue of Core Insider? Forward it to a colleague or friend who would benefit from these insights.

Transformation starts with insight. Stay sharp. Stay Core.