What your vendor won’t tell you.

What your team needs to hear.

One issue a week.

🌐 Spotlight: Fragmented Vendor Landscape Reshapes Core Strategy

🌐 This Week’s Sketch: The Success Paradox: Go-Live Isn’t Success

🌐 News: AI reshapes the core as banks strengthen defenses and close the digital gap.

🌐 Strategy: U.S. dominance faces global pressure.

🌐 Careers: Explore new hybrid opportunities at CSP.

🌐 Next Week: Why “medium complexity” is winning core transformation.

Strategy meets execution here. Don’t miss what could spark your next big move.

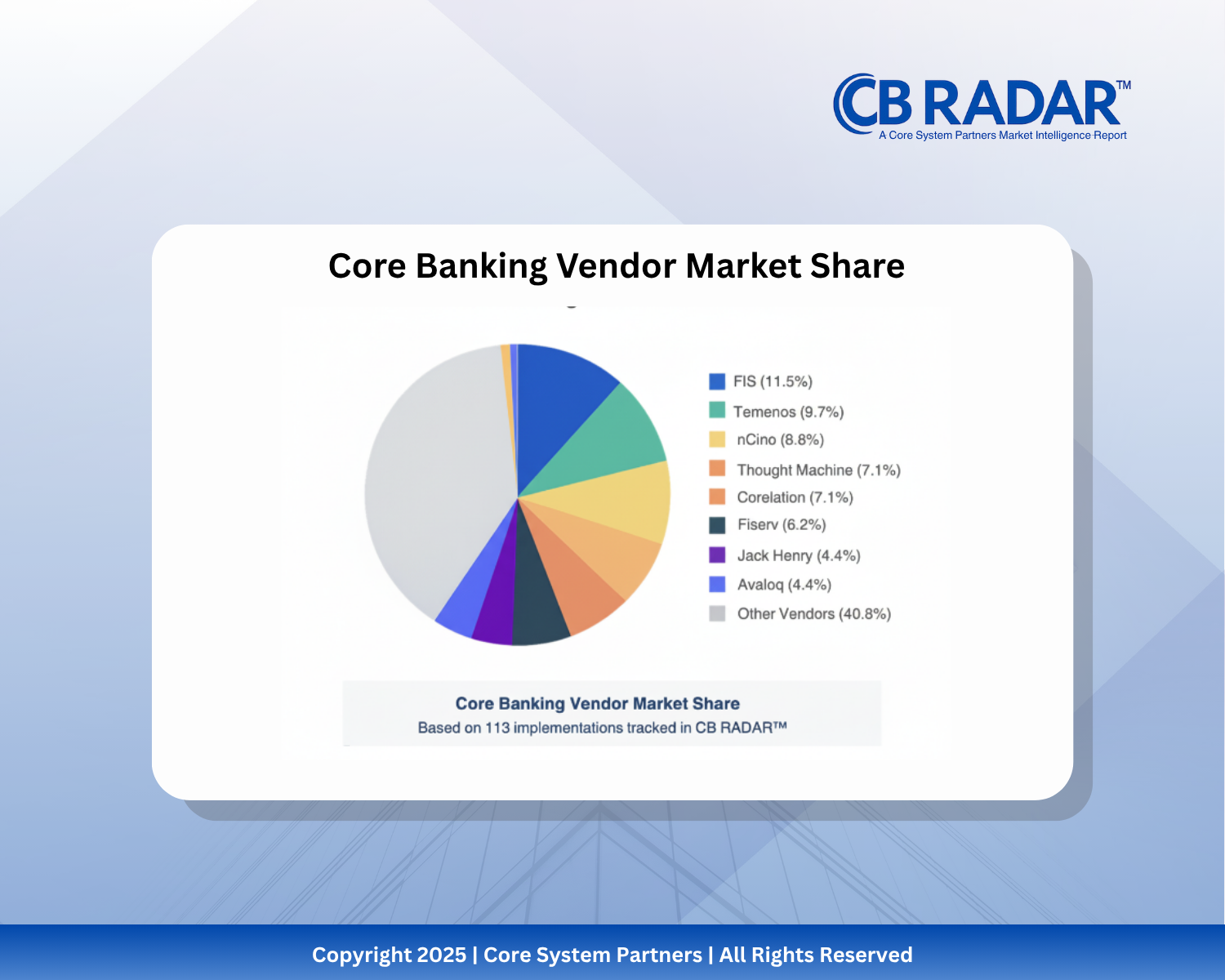

The Fragmented Vendor Landscape

CB RADAR™ 2025 shows the core banking market has officially splintered: the top three vendors make up just 30.1%of transformations, with 20+ players competing for the rest. That means more choice, but also more integration risk, tougher evaluations, and a bigger need to define what “core” really means for your bank.

Read the full piece to see why vendor selection is now a strategy decision, not a procurement exercise.

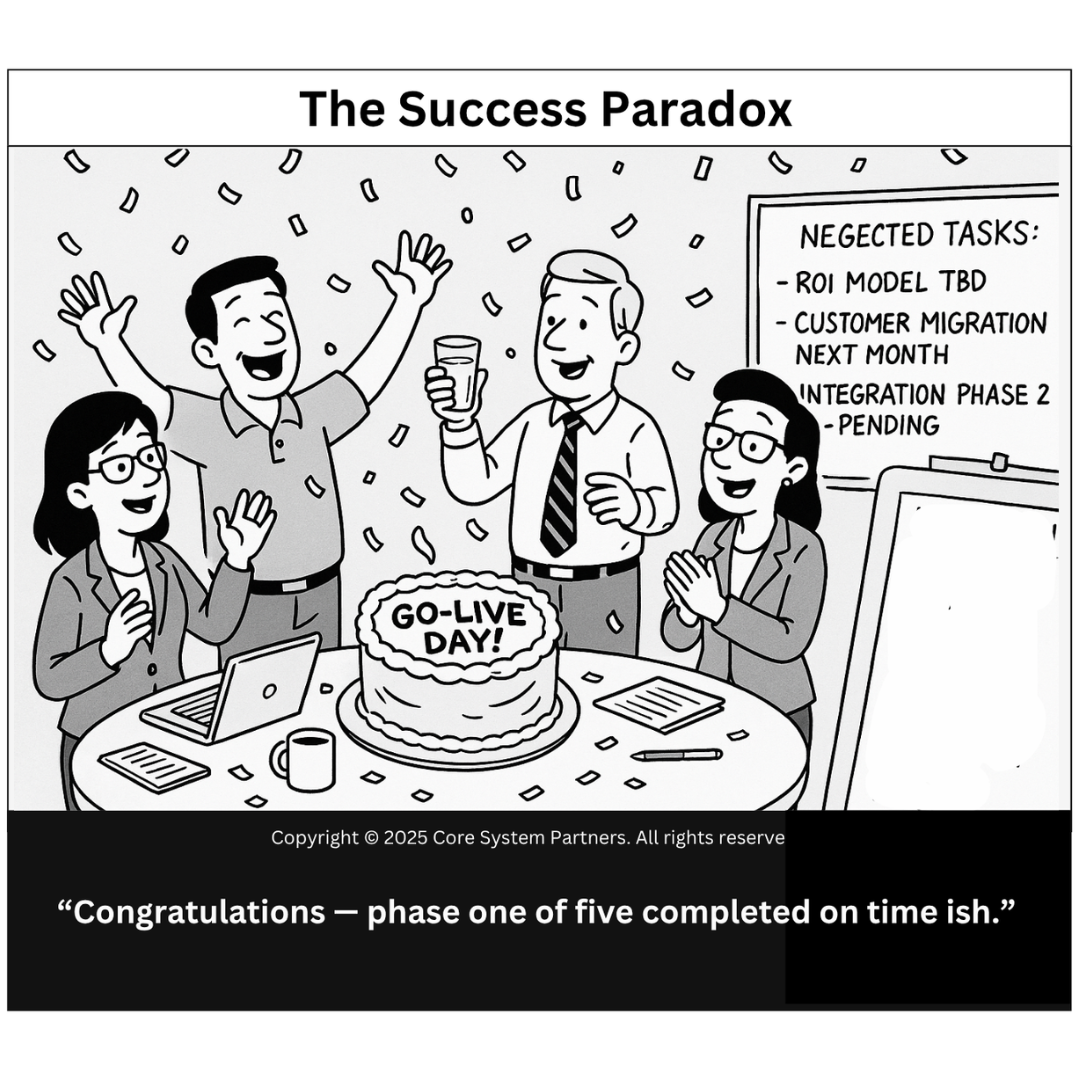

The Success Paradox

Go-live might feel like the finish line, but in core banking transformation, it’s often just the start of the hard part. This piece unpacks why “we launched” isn’t the same as “we delivered value” and what banks should measure next if they want real ROI, agility, and customer impact.

AI is no longer on the sidelines, it’s now powering real-time, autonomous banking workflows.

AI-driven scams surged in 2024, costing Americans $12.5B. Banks are responding by fast-tracking AI-powered, cloud-native fraud defenses to close the gap in real time.

Agentic AI is moving from pilot to production, leaders are seeing real gains, while laggards fall behind.Ready to explore? Dive into the highlights to see how leaders in the banking space are tackling innovation, efficiency, and scalability head-on. Let these stories inspire your own transformation journey. |

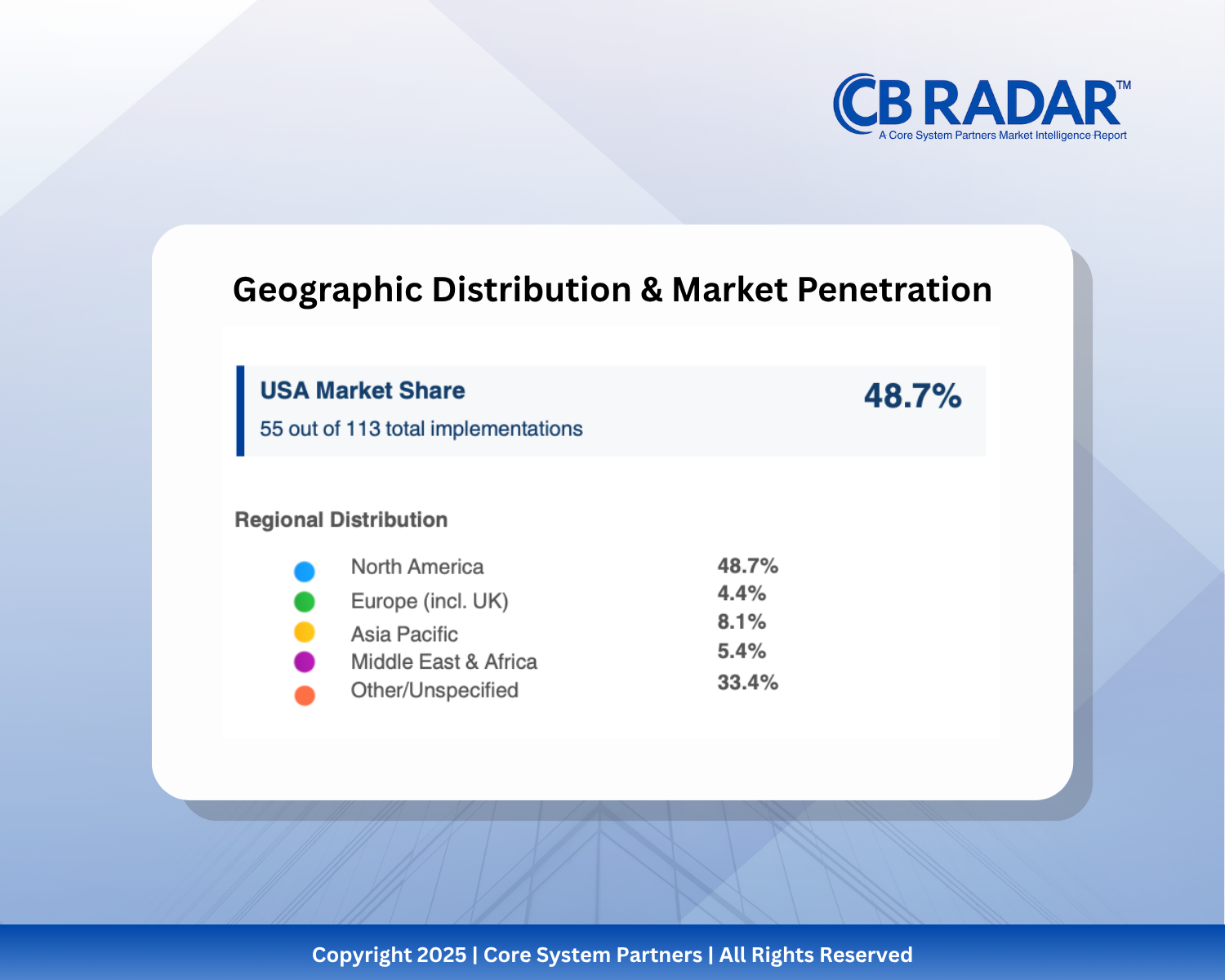

The U.S. Leads, But for How Long?

CB RADAR™ 2025 shows nearly half of all core banking transformations occurred in the U.S., but volume doesn’t always equal velocity. While American banks modernize at scale, nimble institutions in emerging markets are leapfrogging legacy tech with cloud-native cores. This piece explores whether U.S. leadership reflects strength or inertia and what the next phase of global modernization might look like.

Stay Connected with Core Insider

Thank you for being a part of our Core Insider community! Stay ahead in core banking transformation with our expert insights, actionable strategies, and curated news.

Explore More:

- Visit Our Blog for in-depth articles and thought leadership.

- Follow Us on LinkedIn for daily tips and industry updates.

- Contact Us for collaboration inquiries or to learn more about our services.

Join the Conversation:

Have insights to share or questions about today’s newsletter? Reply to this email or join the discussion on our LinkedInPage.

Looking for Talent or Opportunities?

Check out our Careers Page for exciting opportunities in core banking transformation.

Spread the Word:

Enjoyed this issue of Core Insider? Forward it to a colleague or friend who would benefit from these insights.

Transformation starts with insight. Stay sharp. Stay Core.