What your vendor won’t tell you.

What your team needs to hear.

One issue a week.

🌐 Spotlight: Finding the Sweet Spot: Medium-core migrations drive better results.

🌐 This Week’s Sketch: Emerging markets surge, U.S. lags.

🌐 News: Core Banking News: AI scales, gaps widen..

🌐 Strategy: Adjacent platforms now drive transformation.

🌐 Careers: Hybrid core roles now open.

🌐 Next Week: Unpacks how false progress and fuzzy metrics derail transformation.

Strategy meets execution here. Don’t miss what could spark your next big move.

Finding the sweet spot

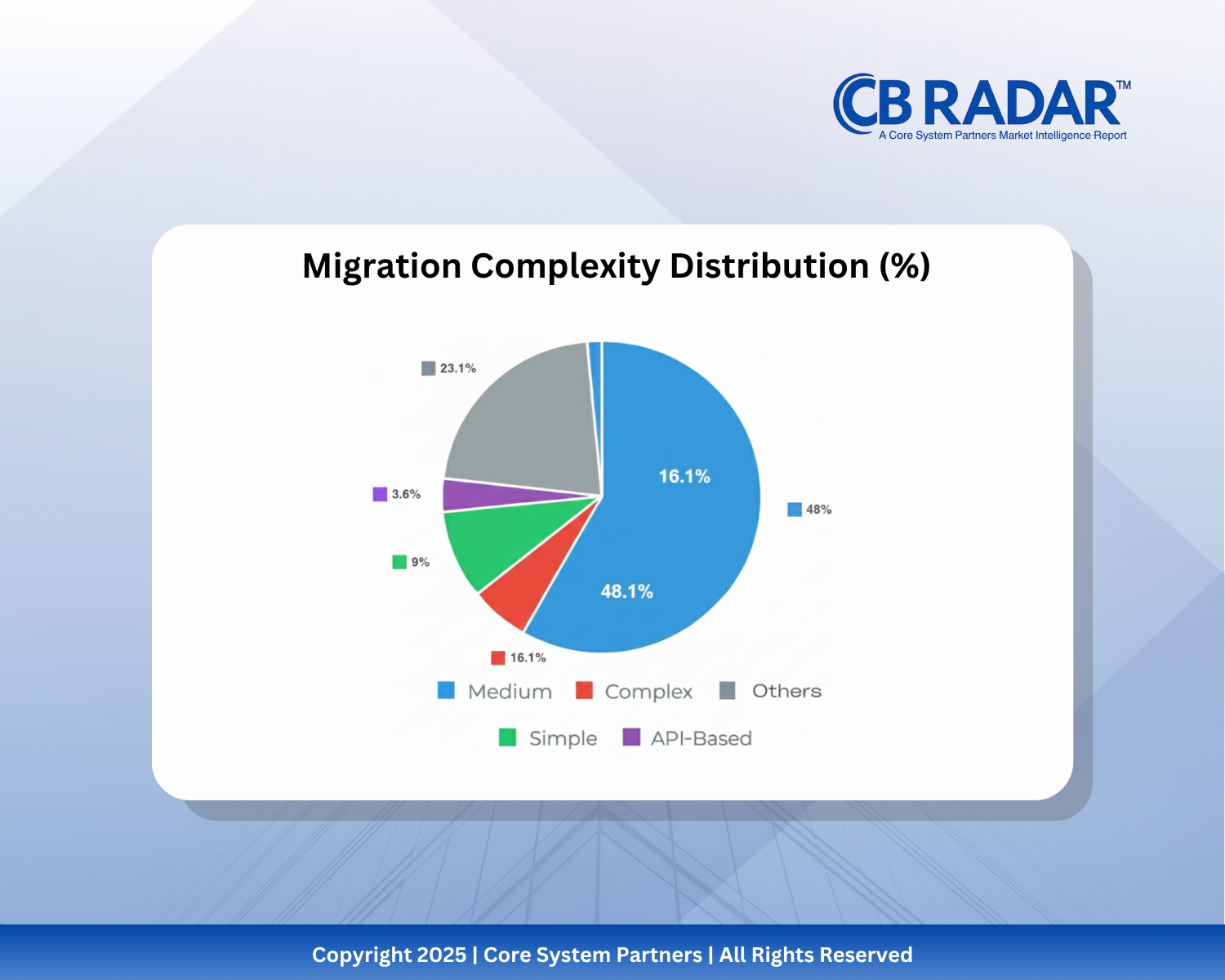

CB RADAR™ 2025 uncovered a clear pattern: the most successful core banking transformations aren’t the biggest or the smallest, they’re the ones with medium complexity. Banks that avoid both “quick patch” upgrades and sprawling multi-year overhauls are hitting the right balance of scope, control and momentum.

In core modernization, focus beats ambition and the smartest programs are built to deliver real change without overwhelming the organization.

Explore why the “Goldilocks zone” is where transformation wins.

The U.S. leads – But for how long?

Half of all transformations are happening in the U.S. but is that leadership or just late-stage modernization? As emerging markets leap ahead with cloud-native cores, U.S. banks risk mistaking scale for progress.

JPMorgan Chase is now using AI-powered Proxy IQ to make real-time shareholder voting decisions, no third-party advisors needed.

With deepfakes, bots, and synthetic scams rising, 53% of banks are making AI/ML security a top 2026 priority. The arms race is on, and vigilance is non-negotiable.

While leaders embed agentic AI into risk, fraud, and credit with up to 35% productivity gains, laggards remain stalled in pilots, proving real ROI takes more than tech, it takes leadership.Ready to explore? Dive into the highlights to see how leaders in the banking space are tackling innovation, efficiency, and scalability head-on. Let these stories inspire your own transformation journey. |

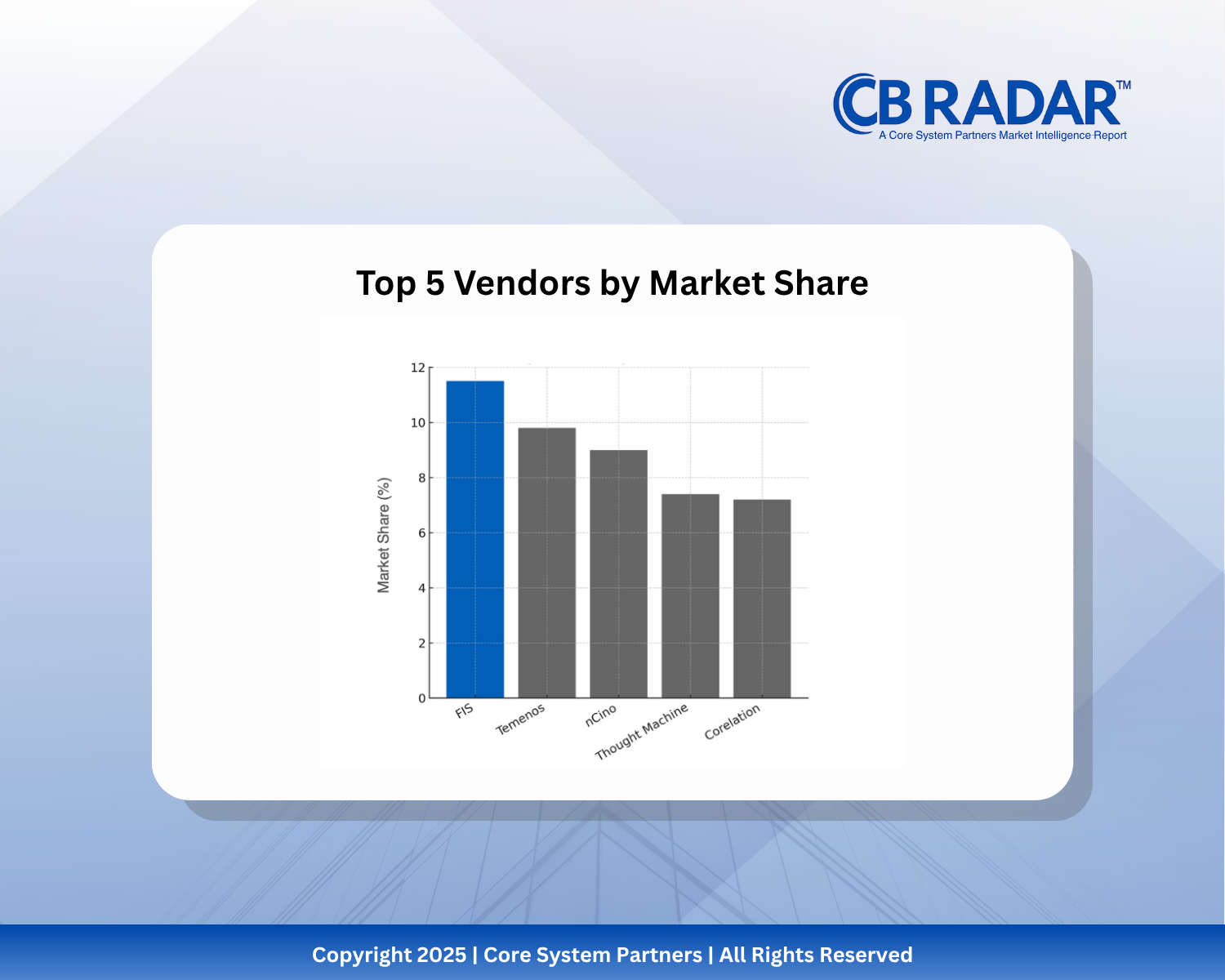

Redefining Core

CB RADAR™ 2025 reveals a shift in how banks define “core”, moving from monolithic systems to modular ecosystems. Platforms like nCino, once considered adjacent, are now seen as central to transformation. The takeaway? Core is no longer a product’s the strategic heart of your architecture.

Stay Connected with Core Insider

Thank you for being a part of our Core Insider community! Stay ahead in core banking transformation with our expert insights, actionable strategies, and curated news.

Explore More:

- Visit Our Blog for in-depth articles and thought leadership.

- Follow Us on LinkedIn for daily tips and industry updates.

- Contact Us for collaboration inquiries or to learn more about our services.

Join the Conversation:

Have insights to share or questions about today’s newsletter? Reply to this email or join the discussion on our LinkedInPage.

Looking for Talent or Opportunities?

Check out our Careers Page for exciting opportunities in core banking transformation.

Spread the Word:

Enjoyed this issue of Core Insider? Forward it to a colleague or friend who would benefit from these insights.

Transformation starts with insight. Stay sharp. Stay Core.