Core banking transformations don’t have to break the bank. Avoid hidden costs by planning smart, engaging stakeholders early, and using the right tools like the OptimizeCore® Scorecard to stay on budget.

Ever underestimated a renovation project?

Maybe you thought, “This should be simple,” and before you knew it, you were ankle-deep in unexpected expenses and delays. Core banking transformation isn’t all that different. Banks jump into big, shiny system overhauls with the promise of speed, efficiency, and future-proofing—only to find themselves stuck in a budget-blowing maze.

If you’re nodding your head, you’re not alone. We’ve seen even the most well-intentioned projects get derailed. But it doesn’t have to be this way. In this article, we’ll unpack the hidden costs that can sneak up on you during core system upgrades—and how to avoid them with practical strategies (and a little help from the OptimizeCore® Scorecard).

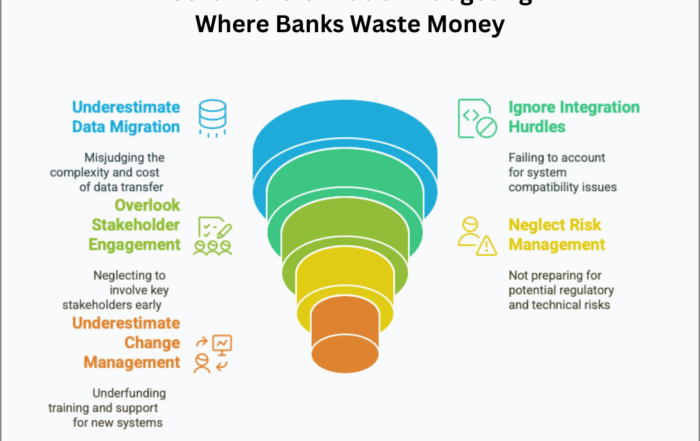

Where Banks Typically Blow the Budget

We’ve all heard the stories—or lived them. A bank launches a core modernization project and… whoops. Costs spiral. Timelines extend. Executives start getting nervous. Here’s where things often go sideways:

1. Underestimating Data Migration Costs

- What goes wrong?: Banks often think of data migration as dragging and dropping files into a new folder. Reality check: it’s more like moving an entire city. Complex legacy systems, incompatible data formats, and missing information can double or triple your costs.

- A real-world lesson: One mid-size bank budgeted for a “straightforward” migration, only to uncover tangled data dependencies that added six months and a seven-figure increase to their timeline.

- How to get it right: Run a deep-dive data assessment before you start. Know what’s lurking in those systems and plan accordingly.

2. Ignoring Integration Hurdles

- What goes wrong?: New core systems need to play nicely with your existing digital channels, CRM, payment gateways—the works. Skipping this step leads to expensive workarounds.

- A real-world lesson: A bank’s shiny new core went live… and promptly broke its mobile app. Fixing it cost them time, money, and customer goodwill.

- How to get it right: Map every integration point early. Test like your reputation depends on it (because it does).

3. Overlooking Stakeholder Engagement

- What goes wrong?: Teams aren’t looped in early. Business units feel sidelined. Surprise! Late-stage requirement changes send budgets (and tempers) soaring.

- A real-world lesson: One bank skipped involving front-line teams in early planning. Halfway through rollout, they realized critical workflows weren’t supported—and had to go back to the drawing board.

- How to get it right:Engage key stakeholders from day one. Make them partners, not spectators.

4. Neglecting Risk Management

- What goes wrong?: “We didn’t see that coming” is not something you want to say mid-project. Regulatory changes, vendor hiccups, and tech issues can turn into costly surprises.

- A real-world lesson: A bank ran over budget after new compliance mandates were announced mid-upgrade. Scrambling to adjust, they paid dearly in both time and resources.

- How to get it right: Build a robust risk management plan. Assign someone to play devil’s advocate and ask, “What if this goes wrong?”

5. Underestimating the Importance of Change Management

- What goes wrong?: You can’t just drop in a new system and expect everyone to love it. Without training and clear communication, productivity dips and frustration spikes.

- A real-world lesson: One bank launched their new core, but didn’t invest in adequate staff training. Employees reverted to manual workarounds, and efficiency tanked.

- How to get it right: Budget (generously) for change management. Think training, internal marketing, and ongoing support.

Smart Planning = Budget Success

Knowing where projects typically bleed money is half the battle. The other half? Using proven tools like the OptimizeCore® Scorecard to stay on track. It gives you a clear-eyed view of your current systems and shows where your next dollar will have the biggest impact.

Next Steps: Make Your Dollars Work Smarter

- Evaluate System EfficiencyT: he OptimizeCore® Scorecard will highlight inefficiencies and help you target high-impact improvements.

- Plan with Precision: Use those insights to craft a detailed transformation roadmap—one that factors in potential pitfalls and builds in risk mitigation from the start.

Final Thought: It Doesn’t Have to Be a Budget Nightmare

Core banking transformations can be messy. But they don’t have to be financial quagmires. With the right approach—and the right tools—you can modernize your systems without breaking the bank (pun intended).

Banks that plan well deliver on time, on budget, and with happy stakeholders. Those that don’t? Well, we’ve all seen that movie. Let’s make sure your story has a better ending.

Ready to take control of your transformation budget?

Take the OptimizeCore® Scorecard now and start budgeting smarter today.

#CoreBankingTransformation #CoreBankingOptimization