Vol. 2 #6

The Risk-Free Plan: Ignoring risks in core banking projects can lead to bigger challenges.

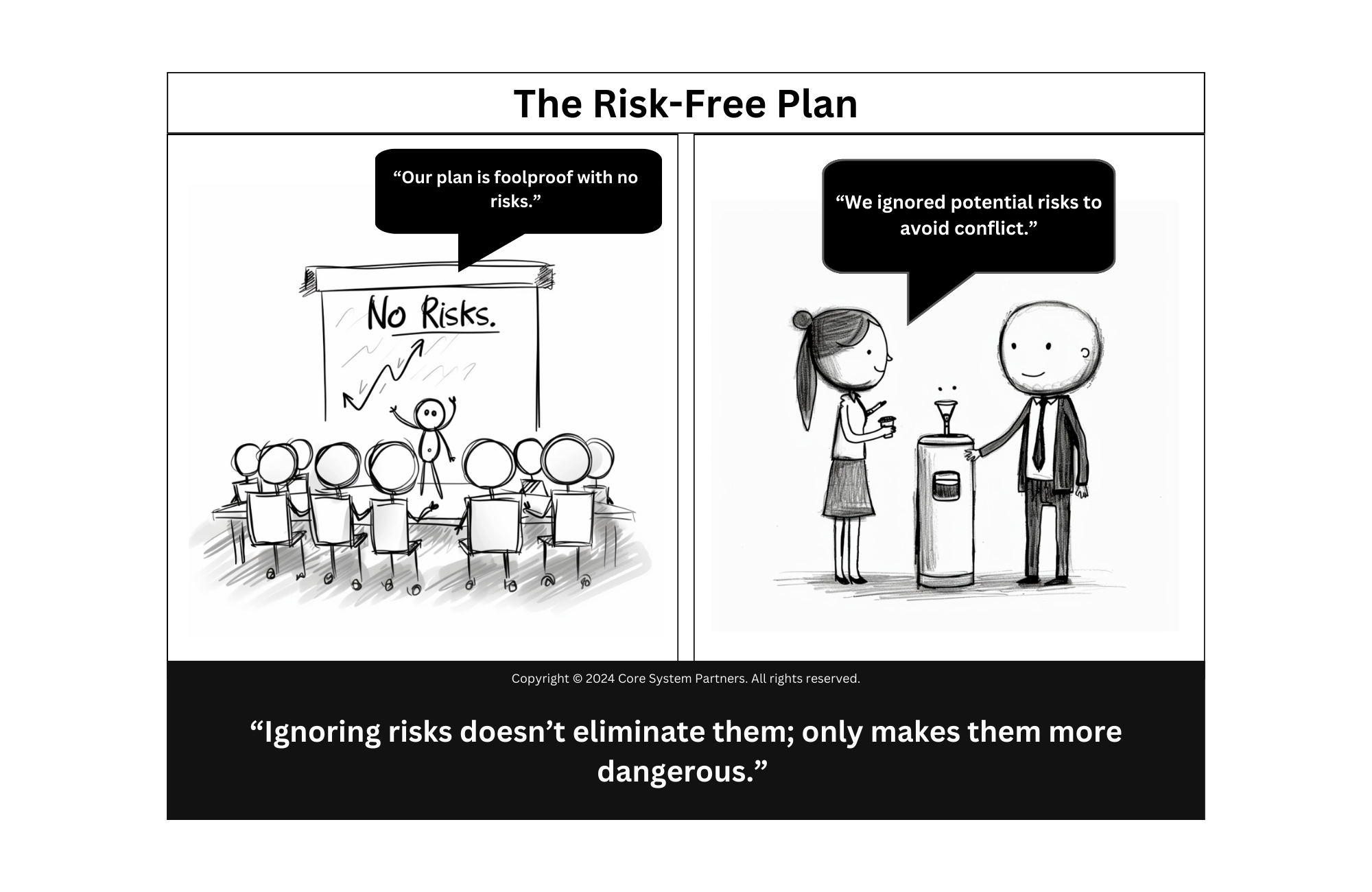

On the face of it, a risk-free plan does indeed sound like a go—after all, who doesn’t want a nice, smooth, trouble-free project? The thing is, in reality, there’s no such thing as a no-risk plan, most of all in such a tightly regulated environment as banking. If risks are ignored or downplayed to avoid conflict, it is indeed like sweeping dust under the carpet. It looks clean on the surface, but sooner or later, that dust will start piling up and be a big problem.

Anecdote: A leading bank embarked on a core banking transformation with a plan that seemed to be totally risk-free. To avoid alarming alarm bells, the team played down its assessment of the risks of welding new technologies to old systems. The thinking was that it was better not to focus on potential problems, to maintain project momentum. However, as the project rolled out, understated integration problems caused serious business disruption to the bank’s operations, customer dissatisfaction, and related financial losses. What it brought home was that avoiding risks is very different from managing them.

Antidote: Embracing Risk Assessment and Mitigation

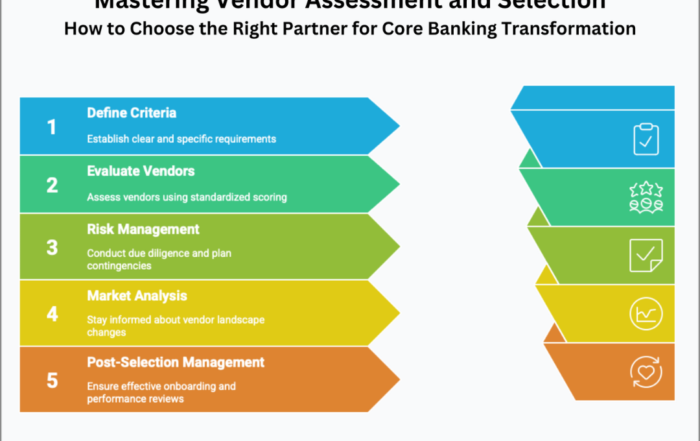

The very presence of risk should be recognized in any large transformation project. The goals should be to recognize, assess, and mitigate, not eliminate, the risk.

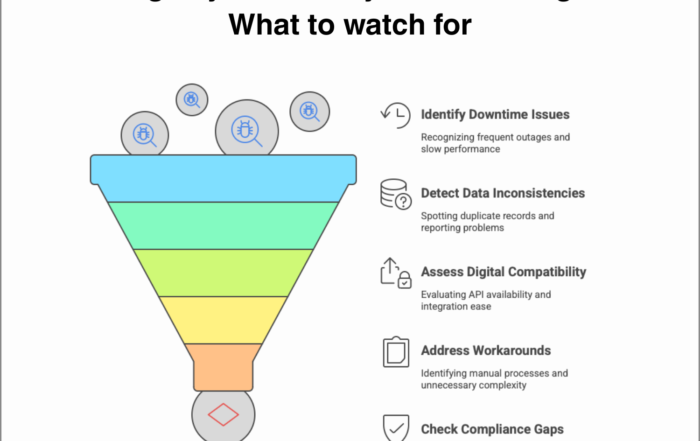

The process should specify mandatory risk assessment. Risk assessment tools may include SWOT analysis—a detailed breaking down of a situation into strengths, weaknesses, opportunities, and threats—and scenario planning, how teams can use it to think about specific risk events ahead of time, and prepare for them.

Inclusion in the project team of a dedicated risk manager to overview identification and mitigation of the risks ensures it gets the needed attention. He should be given powers to raise red flags, if need be, and that the risks are managed properly.

Very necessary also are the regular review sessions on risk. This would provide an opportunity for the members of the team to express themselves freely on probable risks and update mitigation plans where necessary. A little critical thinking on what could go wrong can help in being proactive in handling those kinds of risks.

Where the process involves risk assessment and mitigation, the projects have a high likelihood of success. Proactive risk management places teams better to deal with the challenges that will have to be met during a core banking transformation. Not about mitigating the risk but being prepared for its effective management.

Found this article interesting? Check out these three related reads for more.

- Corporate candor: Overcoming silence in meetings to address underlying disagreements (A new series)

- Corporate candor: Risks of optimistic timelines in project execution (A new series)

- Corporate Candor: The importance of diverse perspectives (A New Series)

#CoreBankingTransformation #RiskManagement