Vol. 2 #2

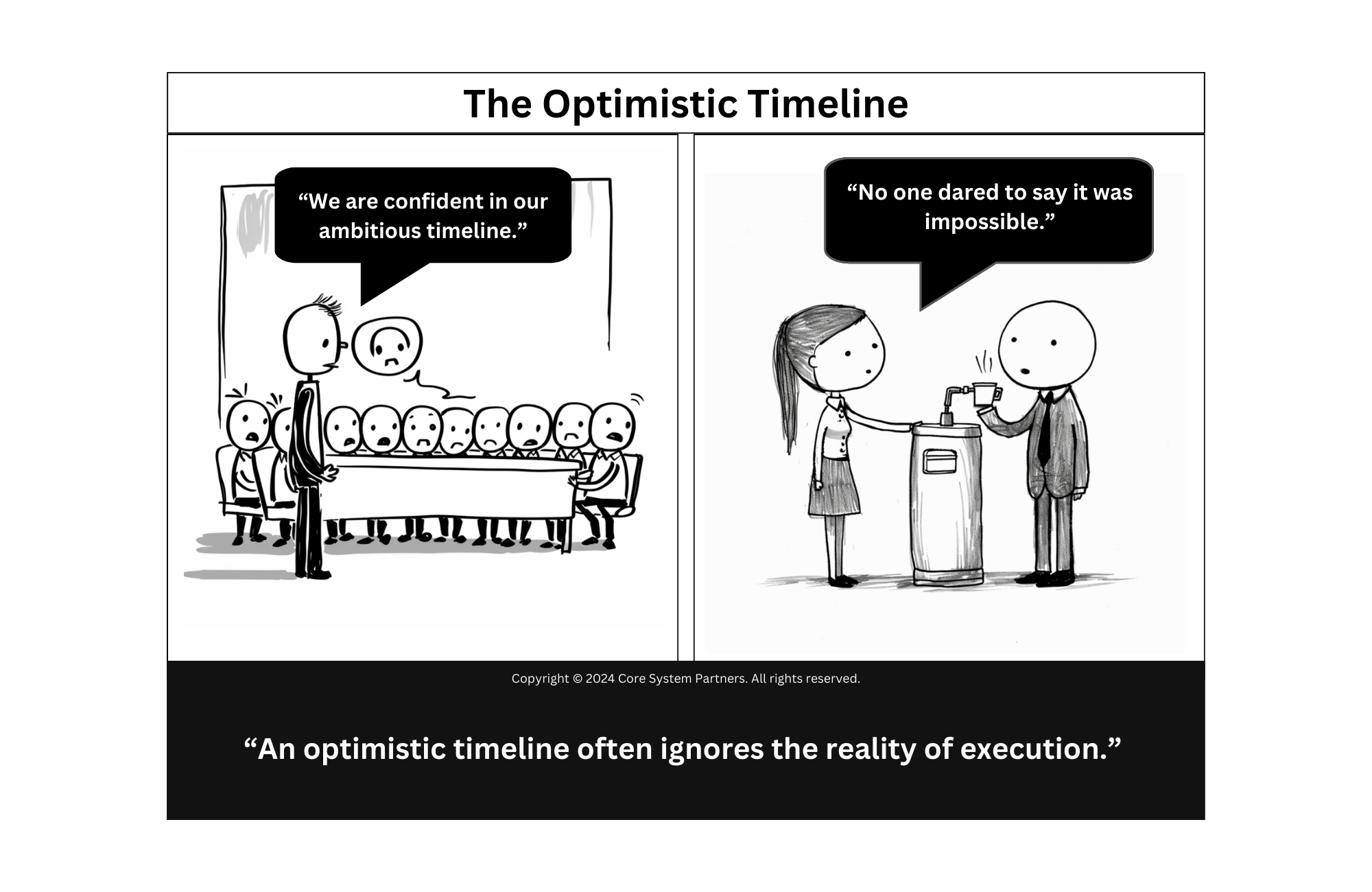

Optimism becomes infectious with the opening remarks of a new core banking project. The timeline put up will be incredibly tight, but no one will question the ability of the schedule to be met. Why? No one wants to throw cold water on the enthusiasm of the team. Overly optimistic timelines equal disaster, especially in core banking where the level of complexity and regulatory requirements demands a very conservative approach.

Anecdote: In a midsize bank, the core banking transformation program was initiated with an extremely aggressive timeline. The executive team, under pressure to show quick results to the board, championed an aggressive timeline. The murmurs of apprehension were overlooked as the team forged ahead. As it got closer to the deadline, it was apparent that critical testing phases had been hurried through at the expense of substantial system downtime and dissatisfied customers. That was a hard lesson the bank learned: Time schedules should be based on fact, not optimism.

Antidote: Infusing Realism into

Planning

Of course, the best place to start in avoiding this optimistic timeline trap is to make sure people feel safe sharing concerns about feasibility. Leaders who display a bias toward realism versus naive optimism set the tone for everyone else.

All stakeholders should be allowed to speak in the planning sessions. Those people doing the actual work are best placed to know what time and resources elements of a project are likely to take, so their input should be given the most weight. Their feedback is just as important in being listened to.

An anonymous feedback system for the timeline would definitely help the team members to raise their concerns in terms of voicing out their views and sentiments without the fear of being judged, which makes it more within reach.

Flexibility is another key constituent. Drawing up timelines on a continuous cycle of feedback and on-going project progress keeps the plan attuned to reality. Quite often, it is observed in core banking projects that only those that adapted to changing circumstances go on to succeed, rather than sticking rigidly to an outdated plan.

Found this article interesting? Check out these three related reads for more.

- Corporate candor: The impact of overconfidence in project teams A new series

- Corporate candor: Overcoming silence in meetings to address underlying disagreements (A new series)

- Corporate candor: The official vs. real reasons behind workplace decisions (A new series)

#CoreBankingTransformation #TimelineChallenges