Strong solution delivery is the key to successful core banking transformation—it’s not just about vision, but how you execute.

TL;DR – Enhancing Solution Delivery: How to Actually Get Core Banking Transformations Done

- Get Real About Execution – Transformation success hinges on delivery, not just strategy or vision.

- Design with Delivery in Mind – Build solutions that are executable, not just ideal on paper.

- Strengthen Cross-Functional Alignment – Bridge silos between business, IT, and vendors to maintain momentum.

- Establish Clear Governance and Ownership – Make accountability and decision-making transparent from the start.

- Why It Matters – Strong delivery execution turns ambitious core banking strategies into measurable outcomes—on time and on budget.

Ever been part of a project that looked great on paper but went sideways in the execution? I remember chatting with a project manager at a mid-sized bank who told me that their core banking transformation was well-funded, had clear leadership buy-in, and an ambitious timeline. Yet somehow, things unraveled. Missed deadlines, blown budgets, and stakeholders quietly losing faith. Sound familiar?

Their challenge wasn’t a lack of vision—it was a breakdown in solution delivery capabilities. And they’re not alone. Plenty of banks set bold transformation goals. Fewer actually deliver on them.

This is where robust solution delivery steps in. Not just what you deliver, but how you deliver it makes the difference between success and frustration.

Let’s unpack how banks can build and strengthen their solution delivery capabilities to navigate the complexities of transformation—and come out on top.

What Do We Mean by “Solution Delivery Capabilities”?

At its core, solution delivery capability is your bank’s ability to successfully plan, execute, and deliver transformation projects—on time, on budget, and to scope. It’s the intersection of good governance, skilled project management, resource alignment, and effective change management.

Think of it as the engine that drives your transformation strategy forward. Without it, even the sleekest vehicle isn’t getting far.

Why It Matters (Spoiler: Because Transformation Is Hard Enough Already)

Here’s the thing—without solid delivery capabilities, projects can (and often do) derail. And when they do, the costs aren’t just financial.

When delivery capability is high:

- Projects stay on track

- Costs are controlled

- Outcomes are predictable and high-quality

- Stakeholder confidence grows**, making future initiatives easier to launch and support.

When delivery capability is lacking:

- Projects fail—or worse, limp across the finish line over time and budget.

- Teams get burned out.

- Stakeholders lose trust.

- Your bank’s reputation takes a hit.

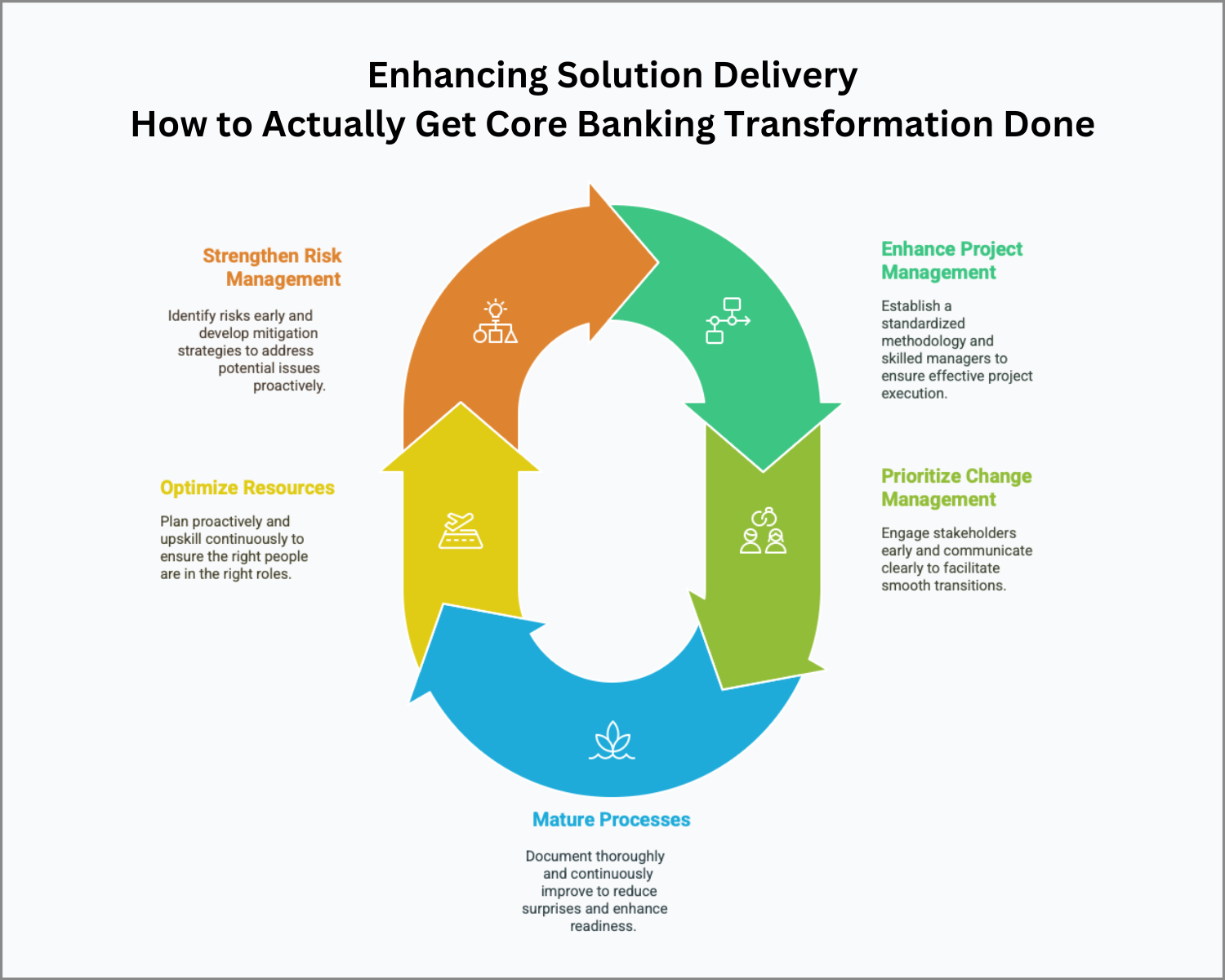

The Building Blocks of Strong Solution Delivery

1. Project Management Capability

- Standardize your methodology: Whether it’s PMBOK, PRINCE2, or an agile hybrid, pick a framework and stick to it.

- Skilled project managers: Not just certified, but experienced in banking transformation. There’s no substitute for scar tissue.

- Project governance that works: Decision-makers should be engaged, informed, and ready to make the tough calls. Avoid “steering committees” in name only.

2. Change Management (Yes, It’s Still Underrated)

- Engage stakeholders early: Bring them in when decisions are made, not after.

- Clear communication plans: No one likes surprises—unless they’re good ones. Keep everyone in the loop.

- Training and support: Don’t just hand over new tools. Make sure people know how (and why) to use them.

3. Methodology and Process Maturity

- Document everything: If it’s not written down, it’s not a process—it’s a hope.

- Continuously improve: Lessons learned aren’t valuable unless you apply them. After-action reviews should be baked into your process.

- Leverage the right tools: Project management platforms like ClickUp, JIRA, or MS Project aren’t nice-to-haves—they’re essentials for tracking, collaboration, and visibility.

4. Resource Availability and Skills

- Resource planning matters: Know who you need and when you need them. Forecast ahead.

- Close skill gaps: If you don’t have the expertise, invest in training or bring it in externally.

- Build cross-functional teams: The best solutions come from different perspectives working together—not silos.

5. Proactive Risk Management

- Early risk identification: Have structured processes for spotting potential pitfalls before they blow up.

- Assess impact and likelihood: Not every risk is worth losing sleep over—but some are.

- Mitigation strategies: Have plans in place, and revisit them often. Risks evolve—so should your responses.

Best Practices to Level-Up Your Solution Delivery

1. Adopt a Formal Project Management Framework

- Choose wisely: One size doesn’t fit all. Tailor your approach to your bank’s culture and project complexity.

- Consistency counts: Align teams on methodology, from initiation to closeout.

- Train the team: Certification is great, but application is better. Workshops, real-life case studies, and mentoring help bridge the gap.

2. Make Change Management a Priority

- Map out the plan: Don’t wing it. Build structured plans for engagement, communication, and adoption.

- Bring stakeholders in early: Early input leads to early buy-in.

- Track adoption like you track milestones: You can’t improve what you don’t measure.

3. Mature Your Processes

- Thorough documentation: From project charters to post-mortems, document everything.

- Implement quality controls: Audits and health checks keep projects on track.

- Use technology wisely: Make dashboards your friend. Visibility cuts down on guesswork.

4. Optimize Your Resource Pool

- Skills inventory: Know who’s available and what they’re good at.

- Proactive planning: Don’t wait until there’s a fire to find a firefighter.

- Continuous upskilling: Encourage certifications, workshops, and peer learning.

5. Strengthen Risk Management

- Maintain a risk register: Live documents that evolve with the project.

- Review often: Risks don’t wait for your next quarterly review.

- Promote a risk-aware culture: Make it safe (and expected) for teams to flag issues early.

Why This Matters for Core Banking Transformation

- Projects stay on track.

- Costs are controlled.

- Outcomes are predictable and high-quality.

- Stakeholder confidence grows, making future initiatives easier to launch and support.

- Projects fail—or worse, limp across the finish line over time and budget.

- Teams get burned out.

- Stakeholders lose trust.

- Your bank’s reputation takes a hit.

A Real-World Turnaround Story

That same bank I mentioned at the start? They made the pivot. They invested in project management training, adopted a structured delivery framework, and prioritized change management like never before. The next transformation initiative? It hit the mark—on time, on budget, and with rave reviews from both stakeholders and end-users.

What changed? They stopped hoping projects would succeed and started engineering them to succeed.

What’s Your Next Move?

Ready to see how your solution delivery capabilities stack up? We’ve built a practical tool that gives you a clear, objective view.

Take the Core Banking Transformation Readiness Assessment

It’s designed to help you evaluate where you are and where you need to go to build bulletproof solution delivery capabilities.

Final Thought

In transformation, vision matters—but execution delivers. Build the muscle of strong solution delivery, and you’ll transform more than your core banking systems. You’ll transform your bank’s ability to lead the future.

#CoreBankingTransformation #CoreBankingReadiness