Vendor selection in core banking transformation: Move beyond buzzwords and choose strategic partners through structured evaluation, collaboration, and due diligence.

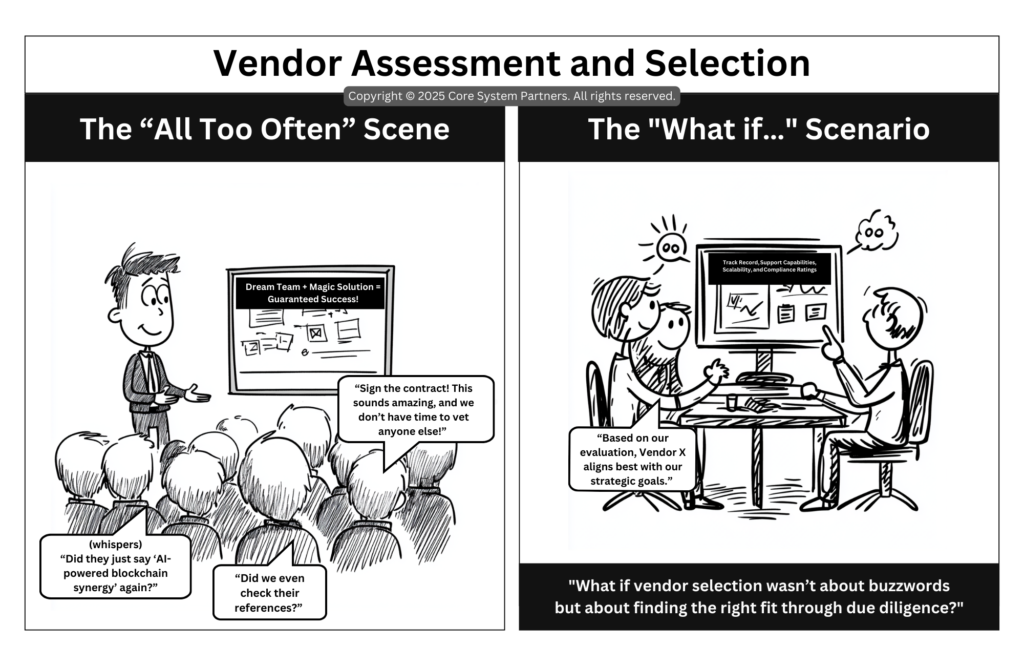

Vendor selection can be the make-or-break moment in any core banking transformation. Yet, it’s often rushed or based on flashy presentations, as depicted in “The All Too Often” Scene. A charismatic vendor presents their “magic solution,” promising guaranteed success with vague claims of “AI-powered blockchain synergy.” The audience murmurs in confusion: “Did we even check their references?” Despite the doubts, someone eagerly suggests, “Sign the contract! This sounds amazing, and we don’t have time to vet anyone else!”

Now imagine “The What If…” Scenario, where a thoughtful team evaluates vendors based on clear criteria like scalability, support capabilities, and track record. A team member confidently states, “Based on our evaluation, Vendor X aligns best with our strategic goals.” This shift—from hasty decisions to strategic partnerships—shows the value of a coordinated, data-driven approach.

Let’s explore how to transform vendor selection into a structured process that drives long-term success.

The Risks of Unstructured Vendor Selection

When vendor selection is rushed or based on buzzwords, the consequences can ripple across the entire organization. Misaligned priorities, hidden costs, and implementation delays are just the beginning.

What Happens in “The All Too Often” Scene?

- Overreliance on Marketing Hype: Decisions are influenced by slick presentations rather than rigorous evaluations.

- Lack of Due Diligence: References, compliance records, and scalability are often overlooked in the rush to decide.

- Misalignment with Goals: Vendors may deliver solutions that don’t fully address the organization’s needs, leading to costly adjustments.

I’ve seen projects derailed by vendors who overpromised and underdelivered. The excitement of signing a contract fades quickly when teams realize the solution doesn’t fit.

The Power of a Coordinated Vendor Selection Process

In contrast, “The What If…” Scenario demonstrates how a thoughtful, criteria-based approach ensures the right vendor is chosen. By prioritizing alignment, transparency, and due diligence, organizations can establish partnerships built on trust and shared goals.

What Makes a Structured Process Work?

- Clear Evaluation Criteria: Vendors are assessed on specific metrics, such as scalability, compliance, and customer support.

- Collaborative Decision-Making: Cross-functional teams bring diverse perspectives to the table, ensuring all needs are considered.

- Transparent Comparisons: Objective data, not subjective impressions, drives decisions.

This approach doesn’t just reduce risks—it lays the groundwork for successful implementations and long-term partnerships.

From Chaos to Coordination: Steps to Improve Vendor Assessment

A structured vendor selection process requires planning, collaboration, and accountability. Here’s how banks can make it happen:

1. Define Your Needs Upfront

Before evaluating vendors, clarify your organization’s priorities, goals, and requirements. This helps filter out options that don’t align.

- Example: Create a checklist that includes technical requirements, compliance standards, and customer success metrics.

2. Assemble a Cross-Functional Team

Involve stakeholders from IT, operations, legal, and customer experience to ensure all perspectives are represented.

- Example: Include an IT lead to assess technical capabilities and a compliance officer to evaluate regulatory fit.

3. Develop a Scoring Framework

Assign weights to key criteria based on their importance to the project. Use this framework to objectively compare vendors.

- Example: Allocate 30% of the score to scalability, 25% to support capabilities, and 20% to cost efficiency.

4. Conduct Thorough Due Diligence

Request references, review case studies, and verify compliance records. Dig deeper than the marketing material.

- Example: Contact at least three references to understand how the vendor performs in real-world scenarios.

5. Hold Collaborative Evaluation Sessions

Bring your team together to review findings, discuss trade-offs, and reach a consensus on the best fit.

- Example: Use a collaborative platform like Miro or Microsoft Teams to document insights and track decisions.

Why Thoughtful Vendor Selection Matters

A structured vendor selection process delivers benefits that extend far beyond the contract signing. It sets the stage for smoother implementations, stronger relationships, and better outcomes.

1. Alignment with Strategic Goals

Carefully chosen vendors understand your organization’s vision and are equipped to support it.

2. Reduced Implementation Risks

Thorough evaluations minimize surprises, ensuring the vendor can meet technical and operational requirements.

3. Improved Team Confidence

Collaborative decisions foster buy-in across departments, reducing resistance and enhancing engagement.

4. Long-Term Value

Strong partnerships with aligned vendors lead to ongoing support, innovation, and mutual growth.

In my experience, the best vendor relationships are those built on shared values, clear expectations, and open communication. They’re not just service providers—they’re strategic partners.

From Buzzwords to Business Value

In core banking transformations, vendor selection is too important to leave to chance. The difference between “The All Too Often” Scene and “The What If…” Scenario is stark: one relies on flashy promises, while the other is grounded in thoughtful evaluation.

So, ask yourself: Are we chasing buzzwords, or are we building partnerships based on trust and clarity? By defining criteria, involving diverse stakeholders, and conducting due diligence, banks can ensure they choose the right vendor for the job. Let’s make vendor selection a strategic advantage, not a gamble. Because when you choose the right partner, you set the stage for success.

#CoreBankingTransformation #CoreBankingReadiness