Transform chaos into collaboration by defining roles, aligning goals, and empowering every stakeholder in your core banking transformation journey.

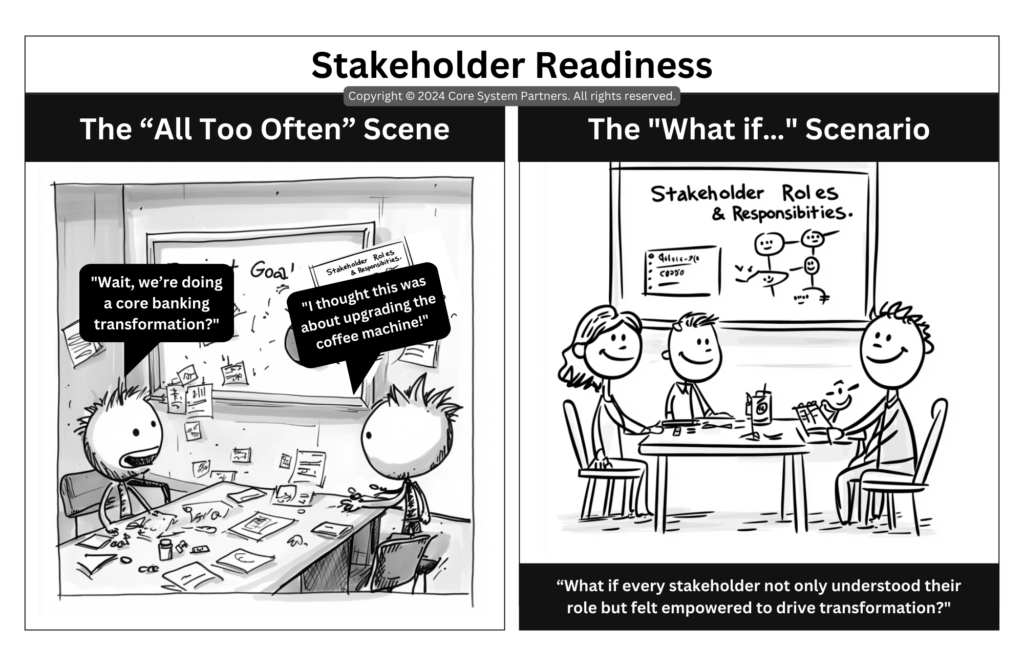

In the fast-paced world of core banking transformation, clarity is not just a luxury; it’s a necessity. Yet, many organizations find themselves in scenarios reminiscent of “The All Too Often” Scene, where confusion reigns. Stakeholders are unclear on their roles, goals remain vague, and the overall direction feels like a mystery. One team member might be wondering, “Wait, we’re doing a core banking transformation?” while another confuses a strategic initiative with upgrading the office coffee machine.

But imagine a different approach. In “The What If…” Scenario, every stakeholder not only understands their role but feels empowered to contribute to the transformation. The room buzzes with collaboration as the team works together toward a clear, shared goal. This shift from unstructured chaos to coordinated collaboration can make all the difference. Let’s explore how we can navigate this transformation and create an environment where every stakeholder plays their part with purpose.

The Cost of Unstructured Responsibilities

Unstructured responsibilities don’t just create chaos—they stall progress. When stakeholders are unsure of their roles, projects often flounder. Deadlines are missed, resources are wasted, and morale takes a hit. Sound familiar?

What Happens in “The All Too Often” Scene?

- Confusion Reigns: Without clear communication, stakeholders operate in silos, often unaware of what others are doing.

- Priorities Clash: When roles are undefined, stakeholders may unintentionally work at cross-purposes, leading to wasted effort.

- Lack of Accountability: When no one knows who’s responsible for what, tasks fall through the cracks.

I’ve been in those meetings where everyone nods along, but no one really knows what they’re supposed to do next. It’s frustrating and, more importantly, avoidable.

The Power of a Coordinated Team Approach

Contrast this with “The What If…” Scenario. Here, roles are clearly defined, and stakeholders work together like a well-oiled machine. Each person knows their responsibilities, understands the broader goals, and feels empowered to drive transformation.

What Makes Coordination Work?

- Clear Roles and Responsibilities: Every stakeholder knows their part in the process, reducing confusion and increasing efficiency.

- Shared Vision: Teams align around a common goal, ensuring that everyone’s efforts contribute to the bigger picture.

- Empowered Teams: When stakeholders feel valued and informed, they’re more likely to take initiative and collaborate effectively.

This approach doesn’t just streamline operations—it builds trust. When teams see that their contributions matter, they’re more engaged and motivated.

Moving from Chaos to Coordination: Steps to Success

Shifting from unstructured responsibilities to a coordinated approach requires intentional effort. Here’s how you can make it happen:

1. Define Stakeholder Roles Early

Start by identifying every stakeholder involved in the transformation. Outline their responsibilities and communicate them clearly.

- Example: Assign a Transformation Lead to oversee progress, with individual team leads for operations, change management, and innovation.

2. Establish a Shared Vision

Align stakeholders around a common goal. Use visuals, like the “Stakeholder Roles & Responsibilities” board from “The What If…” Scenario, to clarify objectives.

- Example: Develop a mission statement for the transformation, such as, “Modernize our banking systems to enhance customer experience and operational efficiency.”

3. Foster Open Communication

Regular updates and meetings keep everyone on the same page. Encourage stakeholders to ask questions and share updates.

- Example: Host weekly check-ins to review progress, address challenges, and adjust roles as needed.

4. Use Collaboration Tools

Leverage tools like project management software or shared dashboards to track progress and ensure transparency.

- Example: Use a tool like Trello or Asana to assign tasks, monitor deadlines, and celebrate milestones.

5. Celebrate Milestones Together

Recognize the contributions of each stakeholder and celebrate shared successes. This reinforces the value of collaboration.

- Example: When a key milestone is achieved, like completing a major system upgrade, host a team lunch or send a personalized thank-you note to each stakeholder.

The Benefits of a Coordinated Approach

The shift from unstructured responsibilities to a coordinated team approach delivers tangible benefits:

1. Improved Efficiency

With clear roles, teams spend less time figuring out what to do and more time doing it.

2. Enhanced Morale

Stakeholders who feel informed and valued are more engaged and motivated.

3. Better Results

When everyone is aligned, projects move forward smoothly, delivering better outcomes for the bank and its customers.

In my experience, these benefits compound over time. The more you invest in coordination, the more productive and cohesive your team becomes.

Embracing the “What If…” Scenario

In core banking transformation, the stakes are high. Unstructured responsibilities can derail progress, but a coordinated team approach can propel you toward success. By defining roles, aligning goals, and fostering collaboration, you can create an environment where every stakeholder is empowered to drive transformation.

So, ask yourself: Is your team stuck in “The All Too Often” Scene, or are you ready to embrace the “What If…” Scenario? With the right strategies, you can move from chaos to coordination, achieving milestones that benefit not just your team, but your entire organization. Let’s start building that collaborative future today.

#CoreBankingTransformation #CoreBankingReadiness