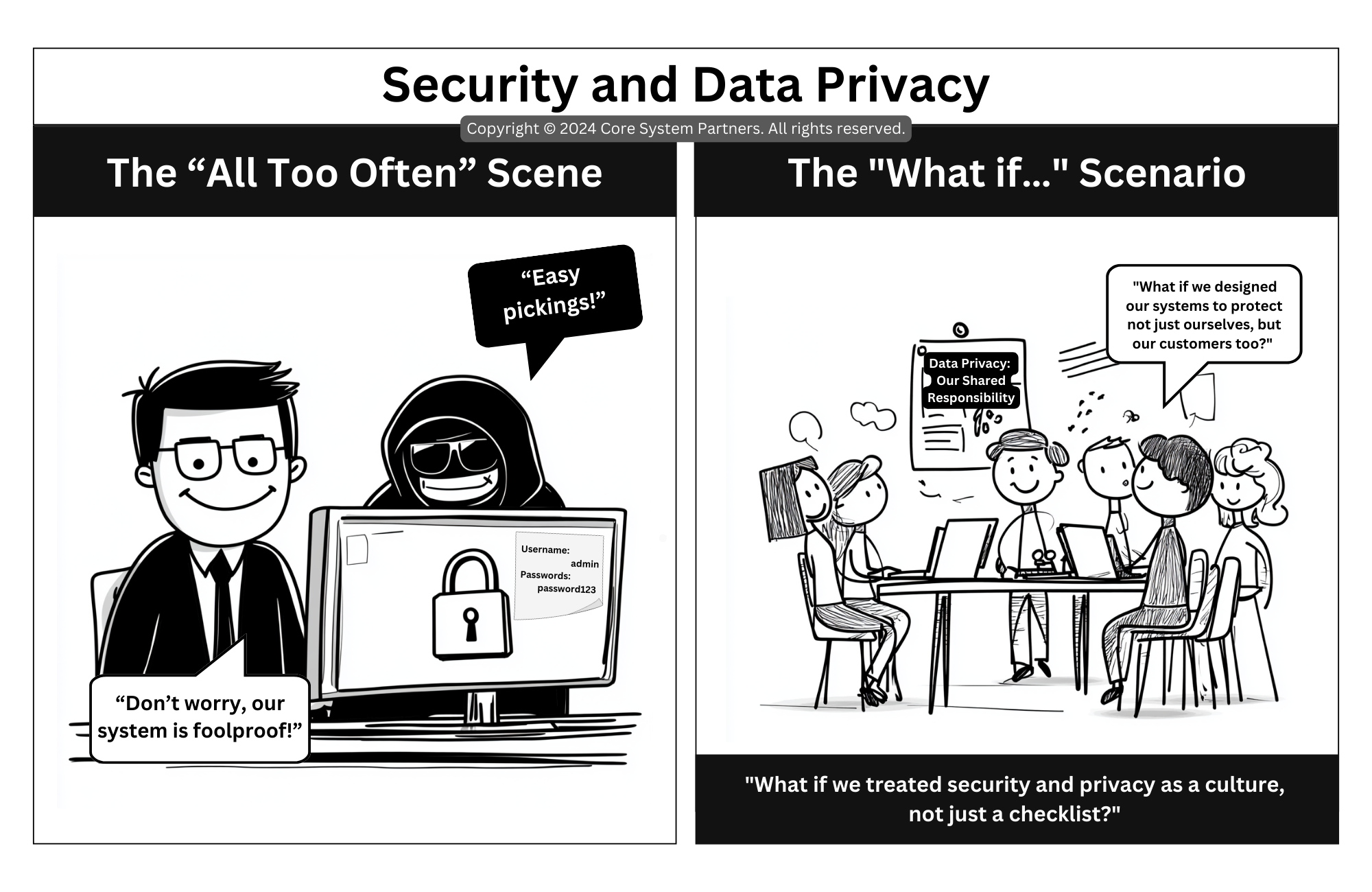

A comparison of poor security practices versus a collaborative, proactive security culture in core banking transformation.

Security and data privacy are more than technical challenges—they are matters of trust. In the world of core banking, where sensitive information is at stake, a single lapse can have devastating consequences. Yet, many organizations fall into the trap of treating security as a checklist, as humorously depicted in “The All Too Often” Scene. A smug leader claims, “Don’t worry, our system is foolproof!” Meanwhile, a hacker grins, gleefully accessing a system secured by the password “password123.” The scene highlights the risks of unstructured responsibilities and overconfidence.

Now picture “The What If…” Scenario, where teams come together to design systems that protect not just the organization but its customers as well. A team member proudly states, “What if we treated security and privacy as a culture, not just a checklist?” This proactive, coordinated approach demonstrates the power of shared responsibility and robust planning.

Let’s explore how to transition from reactive defenses to a security culture that inspires trust and resilience.

The Cost of Treating Security as a Checklist

Security breaches don’t just expose systems—they expose weaknesses in responsibility and coordination. When security is treated as an afterthought, the risks multiply.

The “All Too Often” Scene: What Goes Wrong?

- Reactive Defenses: Systems are patched after vulnerabilities are exploited, rather than being designed with security in mind.

- Unclear Accountability: No one knows who owns security, leading to gaps in processes and oversight.

- Customer Distrust: Breaches erode trust, causing long-term damage to brand reputation and customer loyalty.

I’ve seen organizations scramble to fix breaches that could have been prevented with basic measures. The costs—financial, operational, and reputational—are always higher than anticipated.

The Power of a Coordinated Security Culture

In contrast, “The What If…” Scenario shows how a proactive, team-oriented approach can create a culture of security. When security is embedded in every decision, it becomes a shared responsibility that protects the organization and its customers.

What Makes a Security Culture Work?

- Shared Responsibility: Every team member understands their role in maintaining security, from IT to customer service.

- Proactive Design: Systems are built with security and privacy at the forefront, reducing vulnerabilities before they arise.

- Customer-Centric Focus: Security measures prioritize customer protection, building trust and loyalty.

This approach doesn’t just reduce risks—it fosters a culture of vigilance and accountability that strengthens the entire organization.

From Chaos to Coordination: Steps to Build a Security Culture

Creating a culture of security requires intentional effort and collaboration. Here’s how banks can make the shift:

1. Define Roles and Responsibilities

Establish clear accountability for security across all teams. Make security everyone’s responsibility, not just IT’s.

- Example: Appoint a Chief Information Security Officer (CISO) to lead security strategy, with designated champions in each department.

2. Build Security into System Design

Incorporate security and privacy measures into every stage of system development, from planning to deployment.

- Example: Use multi-factor authentication (MFA) and encryption as default features in all new systems.

3. Conduct Regular Training

Educate employees on security best practices, emerging threats, and their role in maintaining security.

- Example: Host quarterly workshops on phishing prevention, password management, and secure data handling.

4. Implement Continuous Monitoring

Use tools to monitor systems for vulnerabilities and unauthorized access in real time. Proactively address issues before they escalate.

- Example: Deploy intrusion detection systems (IDS) to identify and block potential breaches.

5. Involve Customers in Security

Educate customers about security practices, such as strong password creation and recognizing phishing attempts. Make them partners in protection.

- Example: Provide clear, simple guidance during account setup, including password tips and MFA activation.

The Benefits of a Security Culture

A robust security culture delivers far-reaching benefits for organizations, employees, and customers alike:

1. Reduced Risk of Breaches

Proactive measures and continuous monitoring prevent vulnerabilities from being exploited.

2. Increased Customer Trust

When customers see that security is a priority, they’re more likely to trust the organization with their information.

3. Enhanced Employee Awareness

Training and clear accountability empower employees to act as the first line of defense against threats.

4. Long-Term Resilience

A security culture ensures that the organization is prepared to adapt to evolving threats, reducing the impact of future challenges.

In my experience, organizations that prioritize security as a shared responsibility are not only safer—they’re more confident in their ability to navigate the digital landscape.

From Checklist to Culture

In core banking, security and privacy are non-negotiable. The difference between “The All Too Often” Scene and “The What If…” Scenario is stark: one treats security as an afterthought, while the other embeds it into the organization’s DNA.

So, ask yourself: Are we treating security as a checkbox, or are we building a culture that protects everyone involved? By defining roles, designing secure systems, and fostering a culture of vigilance, banks can move from reactive defenses to proactive protection. It’s time to take security seriously—not just as a requirement, but as a responsibility. Let’s build a safer future together

#CoreBankingTransformation #CoreBankingReadiness