Embrace agility in core banking transformation: Move from delays to dynamic innovation with short sprints, clear roles, and continuous feedback.

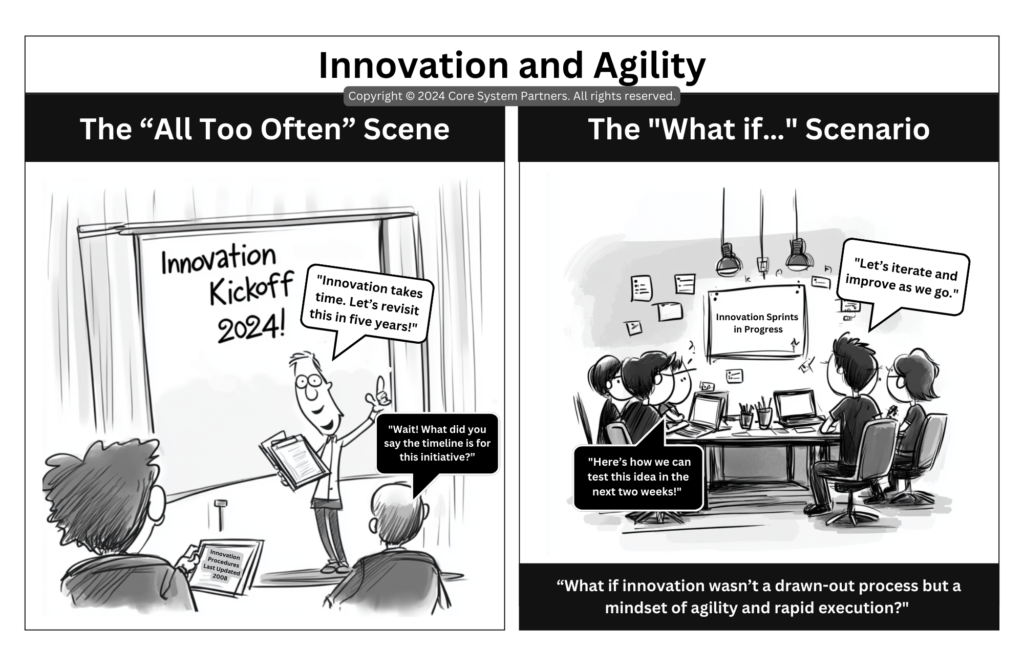

Innovation is often viewed as a long, drawn-out process, one that demands patience, planning, and years to implement. This perspective is humorously captured in the cartoon “The All Too Often” Scene, where a leader announces an “Innovation Kickoff 2024” only to follow it up with, “Innovation takes time. Let’s revisit this in five years!” In the room, stakeholders are left baffled, wondering, “Wait, what did you say the timeline for this initiative is?”

Now imagine a different approach. In “The What If…” Scenario, the same team gathers around a whiteboard marked “Innovation Sprints in Progress.” Instead of waiting years for results, they’re iterating quickly, testing ideas in weeks, and adapting as they go. One team member confidently says, “Here’s how we can test this idea in the next two weeks,” while another adds, “Let’s iterate and improve as we go.”

This shift—from unstructured delays to a coordinated, agile mindset—can revolutionize how banks approach innovation. Let’s explore the difference and how banks can embrace agility to drive meaningful change.

The Problem with Unstructured Innovation

In many organizations, innovation feels like an elusive goal. It’s discussed in lofty terms, often relegated to a distant future. But when responsibilities are unclear and timelines stretch indefinitely, innovation loses its impact before it even begins.

The “All Too Often” Scene: What’s Holding Innovation Back?

- Lack of Clear Ownership: Who is responsible for driving the innovation process? Without defined roles, projects stall.

- Overly Long Timelines: Stretching innovation over years makes it difficult to maintain momentum or measure progress.

- Fear of Failure: With no room for iteration, teams hesitate to take risks, fearing that failure will derail long-term plans.

I’ve been in those meetings where innovation feels more like a buzzword than a strategy. Plans are discussed endlessly, but action is postponed, leaving teams disengaged and skeptical about the outcome.

The Agile Alternative: Innovation in Action

Contrast this with the agile approach depicted in “The What If…” Scenario. Here, innovation is a dynamic process. Teams move quickly, test ideas, and learn from their experiments. It’s not about getting everything perfect on the first try—it’s about improving with each iteration.

What Makes Agility Work?

- Short, Iterative Sprints: Breaking innovation into smaller, manageable phases allows teams to deliver results faster.

- Collaborative Mindset: Teams work together, building on each other’s ideas and feedback to refine their approach.

- Focus on Action: Instead of endless planning, teams prioritize execution, learning as they go.

This agile mindset doesn’t just accelerate progress—it creates a culture of experimentation, where teams feel empowered to take risks and innovate.

From Delays to Agility: Steps to Embrace Innovation Sprints

Adopting an agile approach to innovation requires a shift in mindset and processes. Here’s how banks can make the transition:

1.Define Clear Roles and Responsibilities

Start by assigning ownership of the innovation process. Ensure that every team member knows their role and how they contribute to the initiative.

- Example: Designate an Innovation Sprint Lead to coordinate efforts and assign specific tasks to team members based on their expertise.

2. Break Projects into Manageable Sprints

Divide innovation initiatives into short sprints, typically 1–4 weeks long. Each sprint should have a clear goal, whether it’s testing a new idea, gathering customer feedback, or launching a prototype.

- Example: For a digital banking project, the first sprint could focus on building a simple mockup of the user interface, while the second gathers customer feedback on usability.

3. Create a Feedback Loop

After each sprint, hold a retrospective to discuss what worked, what didn’t, and what can be improved. Use this feedback to guide the next sprint.

- Example: At the end of a sprint, ask, “What did we learn from this test, and how can we apply those lessons to the next phase?”

4. Foster a Culture of Experimentation

Encourage teams to take risks and learn from failures. Make it clear that missteps are part of the process, not a reason to abandon innovation.

- Example: Celebrate lessons learned from failed experiments in the same way you celebrate successes, highlighting how they contribute to future improvements.

5. Use Visual Tools to Track Progress

Visualizing progress keeps teams focused and motivated. Use whiteboards, dashboards, or Kanban boards to show what’s been accomplished and what’s coming next.

- Example: Create a digital dashboard where teams can see completed sprints, upcoming tasks, and overall project status at a glance.

Why Agility Matters in Core Banking

The agile approach isn’t just faster—it’s smarter. By embracing iteration and collaboration, banks can unlock the full potential of innovation, delivering value more quickly and effectively.

Faster Time to Market

Short sprints mean that new ideas reach customers sooner, giving banks a competitive edge in a rapidly changing industry.

Increased Team Engagement

When teams see the immediate impact of their work, they’re more motivated to contribute and collaborate.

Better Outcomes

Continuous feedback ensures that innovation aligns with customer needs, leading to more effective solutions.

In my experience, teams that adopt an agile mindset don’t just innovate—they thrive. They become more adaptable, more creative, and more aligned with their organization’s goals.

Redefining Innovation in Banking

In core banking, innovation can no longer afford to be a slow, uncertain process. The difference between “The All Too Often” Scene and “The What If…” Scenario is clear: one delays progress, while the other embraces agility to drive meaningful change.

So, ask yourself: Are we stuck in endless planning, or are we ready to take action? By adopting an agile approach, you can transform innovation from a distant goal into a dynamic, ongoing process. It’s time to iterate, improve, and move forward—one sprint at a time. Let’s start today.

#CoreBankingTransformation #CoreBankingReadiness