Streamlining workflows and clarifying roles turns chaos into clarity, boosting productivity, collaboration, and customer satisfaction.

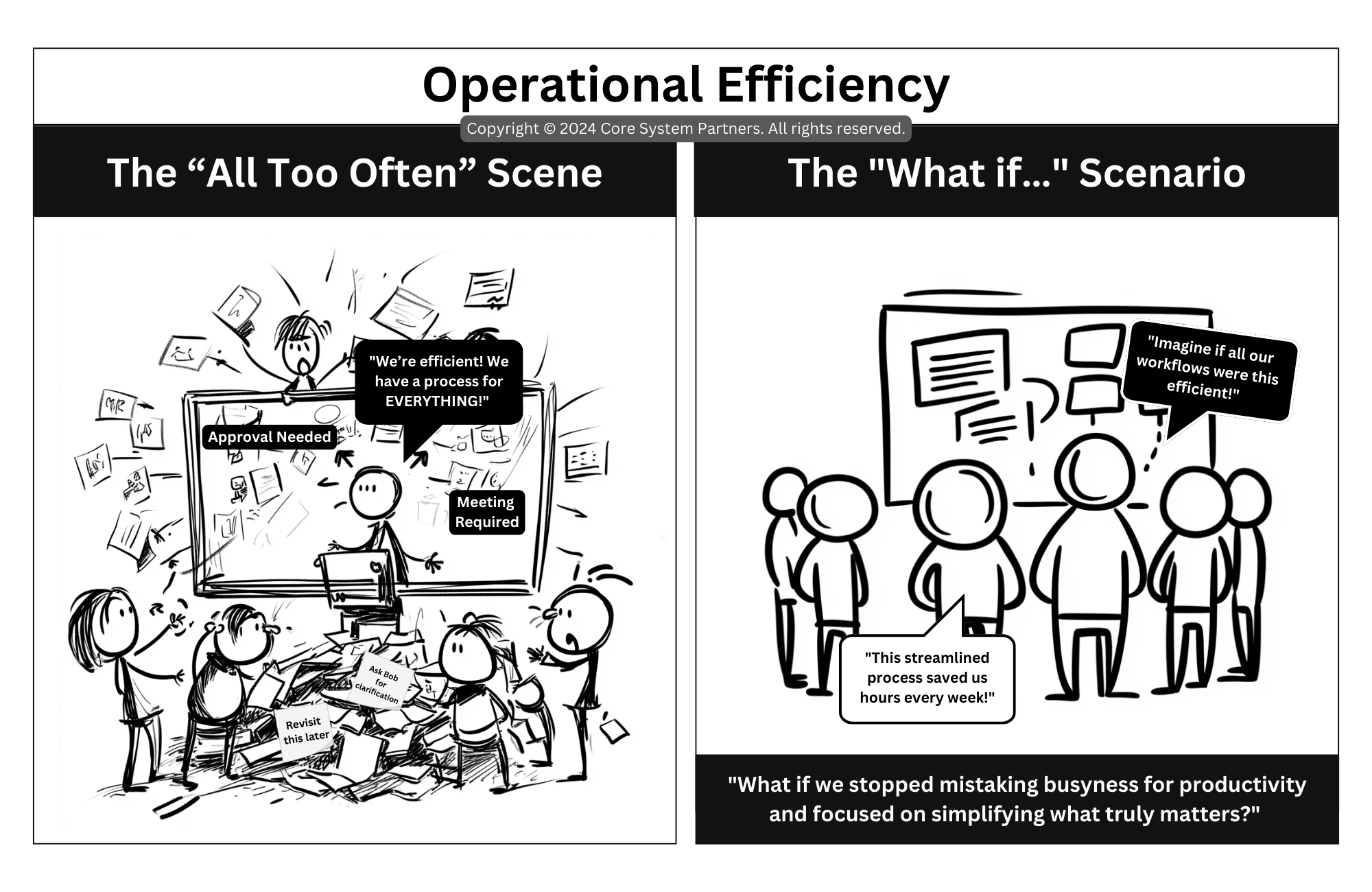

In the fast-paced world of core banking, efficiency is more than a buzzword—it’s a necessity. Yet, many organizations mistake busyness for productivity, as shown in “The All Too Often” Scene. Picture this: a chaotic room filled with people juggling piles of papers, attending endless meetings, and struggling to navigate a labyrinth of processes. A leader exclaims, “We’re efficient! We have a process for EVERYTHING!” But beneath the layers of approvals, meetings, and rework, it’s clear that productivity is buried under the weight of inefficiency.

Contrast this with “The What If…” Scenario, where a team gathers around a simplified workflow. Smiles replace frowns as one member remarks, “This streamlined process saved us hours every week!” Another envisions the broader potential: “Imagine if all our workflows were this efficient!” This transformation—from chaos to clarity—highlights the power of a coordinated team approach.

The Pitfalls of Unstructured Responsibilities

When processes multiply without strategy, they create complexity rather than clarity. Unstructured responsibilities lead to frustration, delays, and wasted resources.

What Happens in “The All Too Often” Scene?

- Duplication of Efforts: Without clear accountability, tasks are often repeated or forgotten entirely.

- Endless Meetings: Miscommunication leads to excessive check-ins and approvals, stealing time from meaningful work.

- Overwhelmed Teams: Too many processes create confusion, leaving teams exhausted and disengaged.

I’ve been in those meetings where half the room wonders, “Why am I here?” and the other half is buried in unrelated tasks. It’s not just inefficient—it’s counterproductive.

The Power of a Coordinated Team Approach

Now let’s explore “The What If…” Scenario, where a coordinated approach transforms inefficiency into streamlined workflows. In this setting, each team member knows their role, and processes are designed to eliminate unnecessary steps. The focus shifts from checking boxes to achieving results.

What Makes Coordination Work?

- Clear Responsibilities: Every team member understands their role, reducing duplication and confusion.

- Simplified Workflows: Processes are designed for clarity, with only essential steps included.

- Collaborative Tools: Teams use shared platforms to track progress, reducing the need for constant updates.

This approach doesn’t just save time—it fosters trust. When teams see the value in their work and the impact of their contributions, morale improves and productivity soars.

Steps to Streamline Operational Efficiency

Transforming from chaotic busyness to streamlined productivity requires deliberate action. Here’s how banks can make the shift:

1. Audit Existing Processes

Start by mapping out all current workflows. Identify bottlenecks, redundancies, and unnecessary steps.

- Example: Use a process mapping tool to visualize approvals, meetings, and handoffs, highlighting areas for improvement.

2. Define Clear Roles and Responsibilities

Assign ownership for each step of the process. Ensure that every team member understands their role and how it contributes to the broader goal.

- Example: Create a responsibility matrix that outlines who’s accountable, responsible, consulted, and informed for each task.

3. Eliminate Unnecessary Steps

Streamline workflows by removing steps that don’t add value. Focus on simplifying rather than adding complexity.

- Example: Replace lengthy email chains with automated approval systems to reduce back-and-forth communication.

4. Leverage Technology

Invest in tools that support efficient workflows. Look for solutions that centralize information, automate repetitive tasks, and provide real-time updates.

- Example: Implement a project management platform like Monday.com or Trello to track progress and deadlines.

5. Foster a Culture of Continuous Improvement

Encourage teams to regularly review and refine their processes. Celebrate small wins and incorporate feedback to build momentum.

- Example: Host monthly “efficiency workshops” where teams share improvements they’ve made and brainstorm new ideas.

Why Simplifying Workflows Matters

Streamlined workflows don’t just save time—they create a ripple effect of benefits throughout the organization:

1. Increased Productivity

Simplifying processes frees up time for high-value work, enabling teams to focus on strategic priorities.

2. Enhanced Collaboration

Clear roles and efficient workflows reduce friction, fostering stronger teamwork and alignment.

3.Improved Morale

When teams spend less time navigating bureaucracy, they’re more engaged, motivated, and satisfied.

4. Better Customer Experience

Efficiency behind the scenes translates to faster service and better outcomes for customers.

In my experience, the most successful teams aren’t the busiest—they’re the ones who know how to focus on what truly matters.

Focus on What Matters

In core banking, operational efficiency is the key to staying competitive in a rapidly evolving landscape. The difference between “The All Too Often” Scene and “The What If…” Scenario is clear: one traps teams in complexity, while the other empowers them to thrive.

So, ask yourself: Are we mistaking busyness for productivity? By auditing processes, clarifying responsibilities, and embracing simplicity, banks can move from chaos to coordination. It’s time to stop spinning our wheels and start making progress—because true efficiency isn’t about doing more; it’s about doing better. Let’s begin today.

#CoreBankingTransformation #CoreBankingReadiness