Exploring key technology trends in banking, including AI, blockchain, and cloud computing, to enhance customer experience, improve security, and ensure compliance in the digital transformation era.

The financial industry landscape is rapidly evolving, driven by digital transformation. Banks must stay at the forefront of technological advancements not only for growth and innovation but also for compliance and security. In this blog post, we will delve into the key technology trends shaping the future of banking and explore how they can be leveraged to create a better and safer banking experience.

Digitalization Drive: A Leap into the Future

Digital banking services have been a game-changer, revolutionizing the way we interact with our money. Banks are now embracing digital platforms that offer seamless and user-friendly experiences for their customers. It’s no longer about simply being present in the digital realm but about enabling an inclusive banking ecosystem that supports all people.

AI and Machine Learning: Personalizing the Banking Experience with a Human Touch

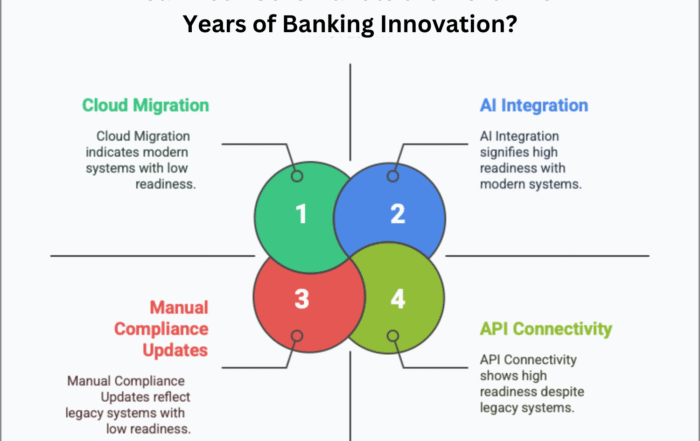

Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront of innovation in banking. Imagine a world where your bank understands your needs so well that it can offer personalized financial advice tailored just for you. AI and ML technologies are transforming customer service, fraud detection, and risk management, making banking smarter and safer.

Blockchain: The Backbone of Trust

Blockchain technology is hailed as a game-changer in the security world, where data breaches and cyber threats have made security indispensable. The blockchain-powered decentralized, transparent, and distributed ledger of transactions fundamentally changes the perception of trust in banking. Banks that leverage the trust ingrained in blockchain can benefit from secure and efficient cross-border payments, smart contracts, and even cryptocurrencies.

Cloud Computing: The Sky’s the Limit

Cloud computing is another transformative technology in the banking sector. Cloud services are expected to support reduced operational costs, improved data management, and enhanced customer experiences. The cloud is not a passing fad but a strategic element that will propel banks into an era of infinite opportunity.

Cybersecurity: Defend the Gates

As banks embrace digitalization, cybersecurity remains a paramount concern. Banks are primarily interested in securing sensitive customer data and ensuring safe financial transactions. Consequently, they are investing heavily in the latest security solutions, including advanced encryption, multi-factor authentication, and AI-powered threat detection. For the bank of tomorrow, cybersecurity is a way of life.

Navigating the Regulatory Landscape

Innovation and compliance must go hand in hand in the banking sector. As technology rapidly evolves, so too does the regulatory framework governing the industry. Banks must stay informed and ensure their innovations comply with all legal and ethical considerations. Striking the right balance between innovation and compliance is delicate yet critical for sustainable growth and customer trust.

The Human Touch: Merging Technology with Empathy

While embracing technological advancements, banks must not forget the human touch. The bank of the future is about understanding customers’ needs and aspirations, rather than solely relying on algorithms and automation. Blending technology with empathy will create a future where banks are truly customer-centric and inclusive.

Embracing the Future with Open Arms

The technology-driven transformation holds great promise for the future of the banking world. From here on, the bank of the future will be digital, secure, and customer-centered. Banks that can harness technology while ensuring compliance and security will confidently navigate this fast-evolving market, solidifying their legacies. Let’s embark on this adventurous odyssey and create a future where banking is not just a transaction but a lifelong partner.

Found this article interesting? Check out these three related reads for more.

- Trust as the core of true leadership

- Top 10 reasons why “That’s not how we do things around Here” will kill your core banking transformation

- Navigating digital banking regulatory challenges

#FutureBankingTech #ComplianceAndSecurity