Core system bottlenecks—such as innovation delays, integration limitations, and compliance gaps—can quietly constrain banking growth.

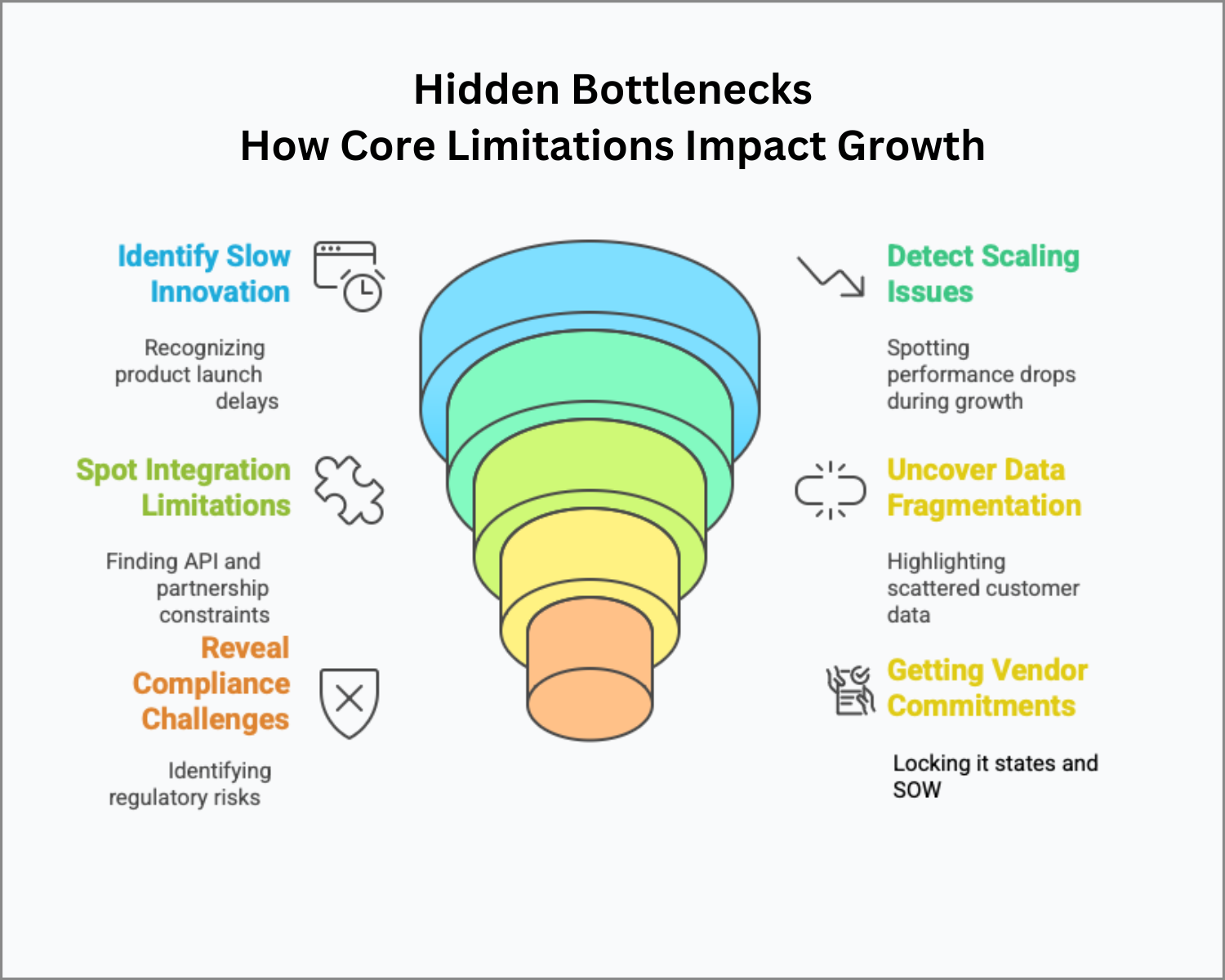

TL;DR – Hidden Bottlenecks: How Core Limitations Impact Growth

- Legacy Constraints Block Agility – Outdated core systems make it hard to respond quickly to market demands.

- Workarounds Create Risk and Waste – Patching over limitations with manual or shadow systems adds cost and complexity.

- Scalability Hits a Ceiling – As your business grows, your core may not be able to keep up with volume or innovation.

- Innovation Gets Stuck in the Back Office – Even great digital ideas fail if your core can’t support them.

- Why It Matters – Recognizing hidden bottlenecks early helps unlock sustainable growth, operational efficiency, and true transformation potential.

The Growth Killers You Don’t See Coming

Let’s be honest: if your core system hasn’t crashed recently, it’s tempting to think everything’s fine. But the truth is, the most damaging barriers to growth rarely show up as big red alerts. Instead, they sneak in—delaying product launches, complicating integrations, slowing operations, and putting compliance teams in constant catch-up mode.

And here’s the kicker: these bottlenecks aren’t always about old technology. In many cases, the real problem lies in how the system is configured, integrated, or (not) used.

Before your bank spends millions replacing its core, it’s worth asking: *Can we get more out of what we already have?*That’s exactly where the OptimizeCore® Scorecard comes in—it helps you identify hidden constraints and chart the right path forward.

1. Slow Product Innovation & Time-to-Market Delays

Signs You’re Stuck:

- New products take months—or years—to launch

- Simple tweaks still require custom development or coding

- You can’t keep up with trends like real-time payments or embedded finance

Real-World Story:

A mid-sized bank tried launching a digital lending product, only to hit a 12-month delay because its core couldn’t support product changes without heavy customization. Meanwhile, a competitor using modern APIs rolled out a similar product in under six months.

What to Do:

Look at your product development timelines. If innovation always hits the wall, you may not need a new core—you may need modular upgrades, API layers, or cloud-based middleware to give you room to move.

2. Struggling to Scale with Customer Growth

Signs You’re Outgrowing Your System:

- Performance tanks during peak hours

- Transactions get slower as customer numbers rise

- IT costs spike just to keep things running

Real-World Story:

A digital-first bank saw massive growth—but their legacy system used batch processing that couldn’t keep up. Transfers lagged. Complaints piled up.

What to Do:

A Core System Health Check can tell you if this is a scalability issue or a configuration problem. In many cases, performance tuning or selective infrastructure upgrades can resolve slowdowns—no rip-and-replace required.

3. Limited API and Integration Capabilities

Signs You’re Falling Behind:

- No support for open APIs

- Every fintech partnership demands expensive custom development

- Integration delays cost you market momentum

Real-World Story:

A regional bank wanted to plug in a real-time fraud detection tool. Their core didn’t support APIs, so they had to build a custom connector—for six figures.

What to Do:

You don’t need to swap out your entire system. Introducing an API gateway or middleware layer can open up new fintech partnerships without disrupting what’s already working.

4. Fragmented Data, Poor Insights

Signs Your Data Is a Liability:

- Customer information lives in multiple unlinked systems

- No 360° view of the customer, hurting personalization

- Reporting takes too long and often feels unreliable

Real-World Story:

One retail bank had customer data scattered across platforms. Relationship managers were manually compiling profiles, which slowed down service and left sales opportunities on the table.

What to Do:

Run a Data Readiness Assessment to see if this is a system issue or a data architecture one. Many banks fix this by creating a central analytics layer or real-time data hub, extending what their core already offers.

5. Compliance & Regulatory Headaches

Signs You’re at Risk:

- Reporting is manual and labor-intensive

- Adapting to new regulations requires expensive workarounds

- You’re exposed to security vulnerabilities due to outdated compliance features

Real-World Story:

One institution was flagged during a regulatory audit for gaps in AML transaction monitoring. Their core didn’t support the workflows—but the fix wasn’t replacement. It was integration with a regtech platform they hadn’t considered.

What to Do:

Before overhauling the core, ask if the issue can be addressed with system configuration, module upgrades, or external compliance tools. Many can—and are far less disruptive than a total rebuild.

Final Thought: You Can’t Grow What You Can’t See

Hidden bottlenecks don’t just slow operations—they stall innovation, frustrate teams, and quietly kill growth. But the fix isn’t always a big-budget replacement.

With the OptimizeCore® Scorecard, you can uncover:

- Whether your core system is truly the bottleneck—or if it’s the way it’s used

- Where optimization can buy you more time, value, and performance

- When to double down on upgrades—and when to start planning for replacement

Ready to find the blockers slowing your bank down?

Take the OptimizeCore® Scorecard and get a custom assessment of your core system’s limitations—and how to turn them into growth opportunities.

#CoreBankingTransformation #CoreBankingOptimization