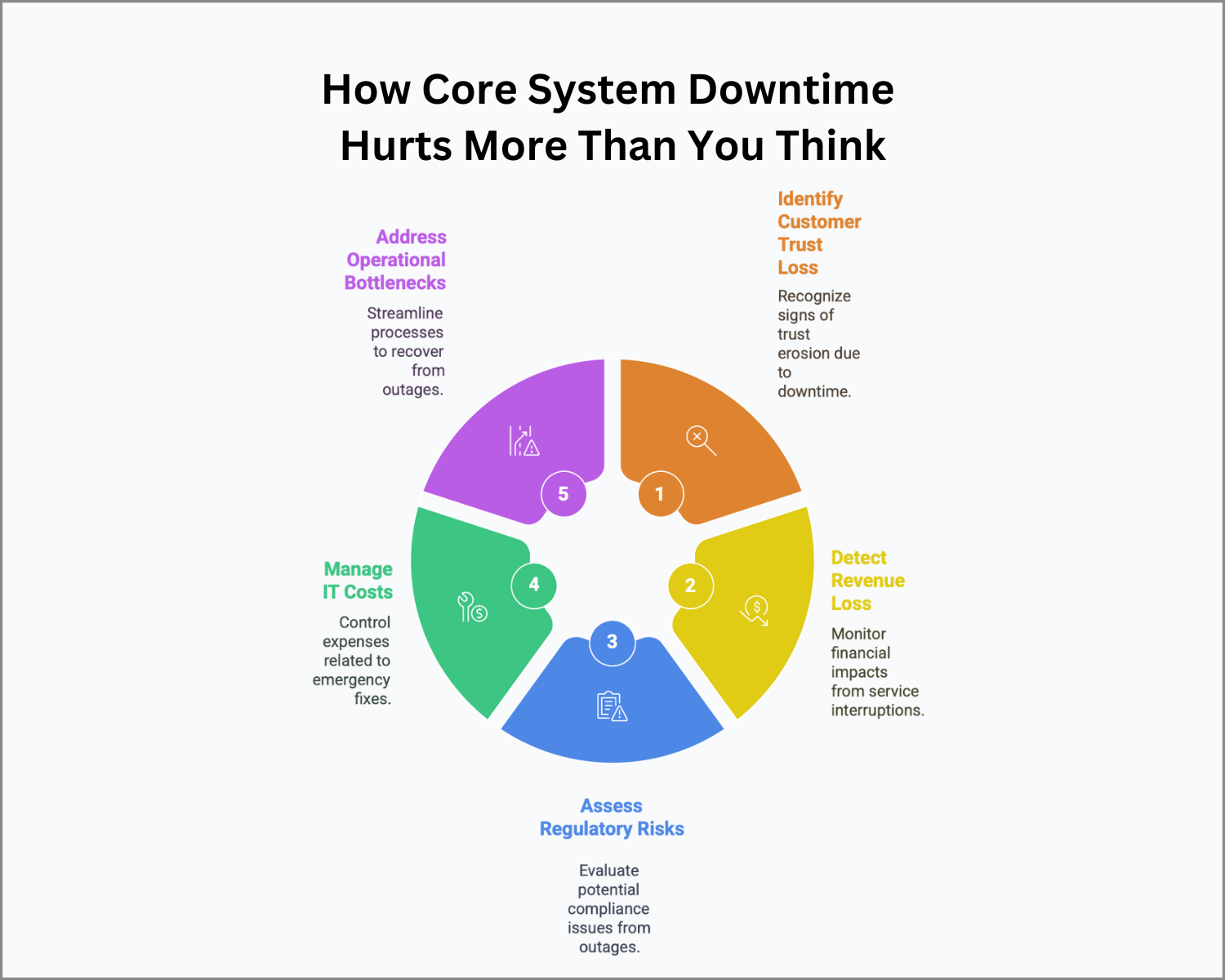

Core banking downtime isn’t just an inconvenience—it’s a hidden cost that impacts trust, revenue, compliance, and operations. Use the OptimizeCore® Scorecard to minimize disruptions and protect your bottom line.

The Hidden Cost of Downtime

Downtime doesn’t always come with flashing red lights or alarms. Sometimes, it sneaks in quietly—through missed payments, delayed logins, or that one Friday when everyone on payroll day couldn’t access their account.

But make no mistake: core banking downtime is more than a technical hiccup. It’s a reputational risk, a revenue leak, and a compliance liability—all rolled into one. And the longer you ignore it, the more it costs.

Let’s unpack how downtime really impacts your bank—and how the OptimizeCore® Scorecard can help you get ahead of it.

1. Customers Lose Trust Faster Than You Think

Signs You’re Losing Them:

- Account access is slow or blocked during key moments

- Repeat outages are becoming the norm

- Complaints show up in reviews, support calls, and social feeds

Real-World Example:

A national bank experienced a four-hour outage—on payroll day. Thousands of customers couldn’t access their funds. Within minutes, complaints hit social media. By the end of the week, competitors were offering incentives to switch. The result? A measurable spike in account closures that lasted into the next quarter.

What to Do:

Monitor how outages affect customer satisfaction and churn. Invest in redundancy and failover systems—especially during high-traffic periods like holidays or paydays. Reliability is retention.

2. Revenue Doesn’t Just Pause—It Slips Away

Signs It’s Costing You:

- Card swipes fail = lost interchange revenue

- Payments stall = delayed or missed disbursements

- Digital services go dark = zero revenue for hours

Real-World Example:

A digital-first bank suffered a three-hour outage, disrupting thousands of transactions. In the days that followed, user activity dropped—and transaction volumes didn’t fully bounce back for weeks. It wasn’t just a glitch. It was a revenue dip that lingered.

What to Do:

Run a Core System Health Check to figure out if your downtime is caused by outdated configurations, load-balancing issues, or infrastructure weak spots. Most performance pain points can be addressed before they become revenue drains.

3. Downtime Can Trigger Regulatory Trouble

Signs You’re at Risk:

- End-of-day or real-time filings get delayed

- Auditors raise flags about continuity planning

- Repeated outages are documented as operational risk

Real-World Example:

A regional bank extended a scheduled update by two hours. No big deal—except it delayed mandatory reporting, and regulators weren’t amused. The fallout? Fines and increased oversight, plus a formal warning about inadequate contingency planning.

What to Do:

Evaluate whether your current setup meets the uptime expectations of regulators—especially in areas like AML reporting or payment transparency. Consider how well your failover processes protect you when things don’t go to plan.

4. IT Costs Spike with Emergency Fixes

Signs It’s Bleeding Budget:

- Teams are in firefighting mode more than planning mode

- You’re paying premium vendor fees for urgent patches

- Legacy tools require manual workarounds just to stay afloat

Real-World Example:

A mid-sized bank missed a known vulnerability patch. Predictably, it broke. Fixing it required urgent vendor intervention—at triple the standard hourly rate. Add travel time, overtime, and lost productivity, and it wiped out weeks of the IT budget.

What to Do:

Use the OptimizeCore® Scorecard to assess your technical debt and vendor dependency. Then develop a modernization roadmap that shifts from reactive to proactive support.

5. Operational Bottlenecks Multiply After an Outage

Signs It’s Clogging the System:

- Branches and call centers are overloaded post-outage

- Employees are stuck in manual processing mode

- Recovery efforts slow down operations for days

Real-World Example:

After a weekday outage, branch staff had to manually reprocess two days of transactions. Customers waited longer. Support queues exploded. The cost? Employee burnout, customer frustration, and delayed service for everyone.

What to Do:

Run a Process Readiness Assessment to make sure your bank has backup workflows, offline playbooks, and testable recovery plans. The smoother the bounce-back, the less damage downtime does.

Final Thought: Downtime Isn’t Just a Glitch—It’s a Growth Killer

You may not feel every outage in real time. But the compounding effect—on customer trust, compliance posture, operating costs, and innovation—is very real.

The good news? You don’t have to wait for the next disruption to take action.

Ready to reduce downtime and protect your bottom line?

Take the OptimizeCore® Scorecard to evaluate your system’s performance, risk profile, and opportunities for smarter optimization.

Let’s stop admiring dashboards and start making decisions.

#CoreBankingTransformation #CoreBankingOptimization