Ever wonder what steering a ship through tumultuous seas feels like?

That’s akin to handling a core banking transformation in-house. This route echoes a commitment to control and direct oversight across every segment of the transformation process. In this discussion, we’re diving deep into the in-house conversion strategy for core banking systems, exploring its benefits, challenges, and when it best serves your banking institution.

Defining In-House Conversion

In an in-house conversion, your bank’s internal team leads every step, from migrating data and integrating systems to testing and user training. This approach keeps all hands within your institution, giving you full reign over the transformation’s pace, scope, and nuances.

Why Choose In-House?

- Complete Control:

- In-house conversion puts you at the helm, allowing real-time adjustments and bespoke customization to meet your needs.

- Utilizing Internal Expertise:

- Your team likely already deeply understands the bank’s systems and processes. Using in-house resources means tapping into this deep well of institutional knowledge, ensuring that every solution is tailor-made for your operational needs.

- Cost Management:

- Initially resource-intensive, this strategy could lead to significant cost savings. You avoid the premium prices of external consultants and gain the ability to manage future updates independently.

Navigating the Challenges

However, taking the reins doesn’t come without its hurdles:

- Resource Demand:

- The major challenge is balancing transformation duties with everyday operations. Overburdening your IT team can lead to burnout or errors.

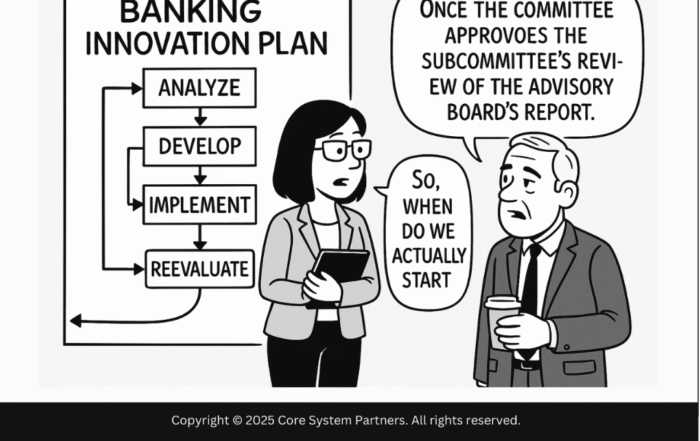

- Extended Timelines:

- External specialists are necessary for your team to avoid a steep learning curve, which can extend timelines and affect overall project momentum.

- Potential Expertise Gaps:

- Your team might excel in daily operations, but transforming core banking systems might introduce them to uncharted waters that require swift upskilling or temporary external support.

Is In-House Right for You?

This strategy fits like a glove for institutions with:

- Robust IT, business support units and experienced program management teams.

- Specific, complex customization needs that off-the-shelf solutions can’t meet.

- A strategic preference for maintaining tight control over all transformation aspects.

Implementing an In-House Strategy Successfully

To tilt the odds of a successful in-house conversion in your favor, consider these best practices:

- Robust Resource Allocation:

- Ensure your IT team is adequately staffed and has explicit time allocations for daily operations and transformation tasks.

- Consider back filling to free up subject matter experts to work on the transformation.

- Comprehensive Training:

- Invest in training to update your team on the latest technologies and methodologies crucial for the transformation.

- Detailed Planning:

- Map out each conversion phase with specific milestones and timelines to maintain clarity and focus throughout the project.

- Effective Communication:

- Foster open lines of communication across departments to ensure all stakeholders are aligned and informed about the transformation’s progress and their roles.

- Flexibility in Execution:

- Prepare to pivot strategies as needed, especially when encountering unforeseen challenges that require adaptive measures.

- Veteran Advisors:

- If your transformation program does not have leadership that have lead similar transformation consider the hybrid approach.

Choosing an in-house conversion strategy places immense power—and responsibility—in your hands. It promises a tailored fit to your institution’s unique contours but demands a significant commitment to navigate successfully.

Looking Ahead

As we wrap up, consider whether your institution has the foundation for this monumental task. With the proper preparation, team, and execution strategy, in-house management, your core banking transformation can lead to a new banking platform and a rejuvenated operational structure poised for future challenges.

Reflect on your resources, timeline, and goals: Is in-house conversion the path you’re ready to take? If so, gear up for an empowering journey that could redefine your institution’s technological landscape.

#CoreBankingTransformation #ConversionStrategy