Innovating the bank: Embracing digital transformation to enhance customer experience, streamline operations, and drive growth.

The article “Changing the Bank: Adapting to Evolving Market Dynamics” explores strategies for banks to remain competitive in a rapidly shifting financial landscape.

The article “Innovating the Bank: Pioneering the Future of Financial Services” explores how banks can stay ahead in the rapidly evolving financial landscape.

TL;DR – Innovating the Bank: Pioneering the Future of Financial Services

- Embrace Digital Transformation – Adopt cutting-edge technologies to enhance operational efficiency and customer experience.

- Leverage Artificial Intelligence – Utilize AI to personalize services, streamline processes, and mitigate risks.

- Implement Blockchain Solutions – Integrate blockchain to improve transaction transparency, security, and speed.

- Foster a Culture of Innovation – Encourage continuous learning and agility to adapt to market changes.

- Enhance Customer-Centric Services – Develop tailored financial products that meet evolving client needs.

By focusing on these strategies, banks can lead the future of financial services and maintain a competitive edge.

As fast-moving and competitive an industry as banking, standing still simply is not an option. While operational excellence and managing transformation are key, it’s innovation that moves a bank onward into new dimensions. “Innovate the Bank” is more than incrementally improving; it needs to reimagine the future of banking and create new value propositions that set the institution apart from competitors.

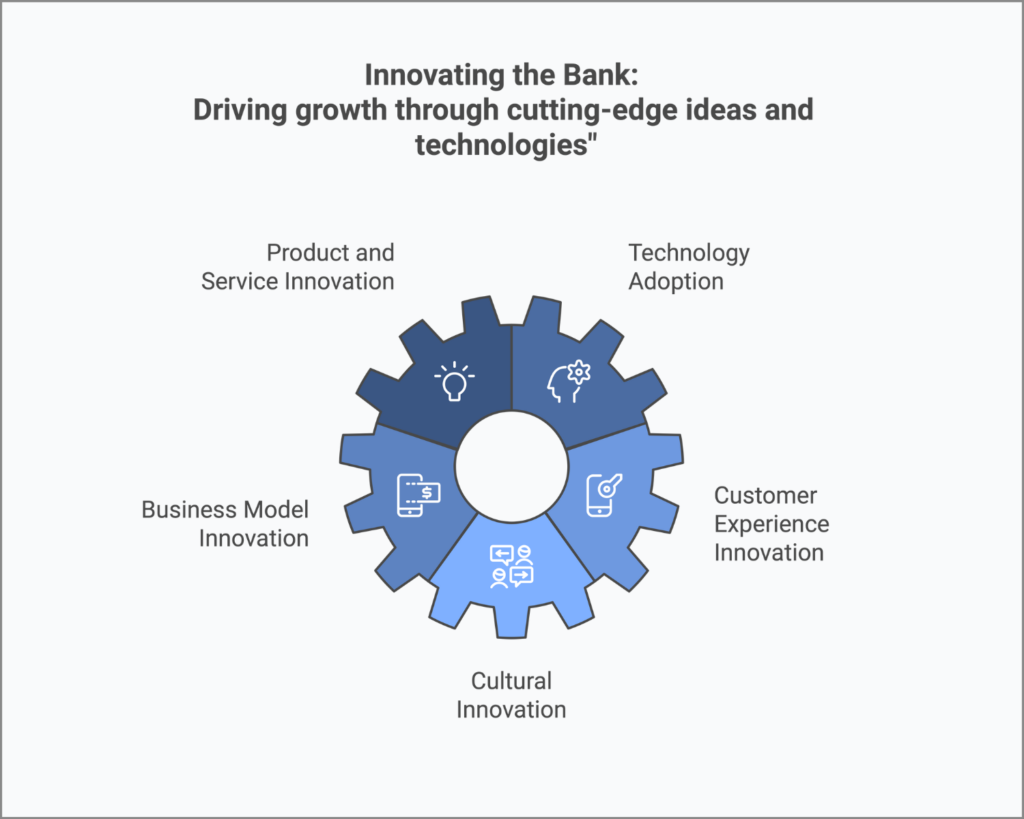

What Does “Innovating the Bank” Entail?

Innovating the Bank means investigating and bringing forward new ideas, technologies, and business models that are likely to change the way in which banking services will be offered. Going beyond the status quo to create products, services, and experiences that exceed or meet new customer expectations leverage new technologies and new revenue streams.

Let us go into the following key areas of innovation as those really causing ripples in the banking segment:

- Product and Service Innovation: A newly developed banking product or service to leverage latent needs of customers or newer trends. That is, offering solutions to problems your customers are not aware they have. This could include, but is not limited to, a new online financial service, an enhanced mobile app, or even customized financial planning tools. The objective is to provide something meaningful that adds value in the lives of your customers.

- Technology Adoption: Innovation for today’s digital world should be ignited at the heart of technology. Technologies such as artificial intelligence, blockchain, and big data analytics are emerging and could facilitate efficiency, improvement in customer experiences, and the opening up of new business avenues. Be on the bleeding edge to adopt such technologies not when they hit the mainstream but well before anyone else out there has tried them. Only it is going to be more like finding a shortcut no one knew existed.

- Business Model Innovation: How you deliver services sometimes can be as important as what you’re delivering. Consider how changing market circumstances provide an opportunity for reimagining your bank’s business model. This may mean the adoption of platform-based business models, partnering with Fintech startups, or finding new sources of revenue as subscription-based services keep the cash coming in. It’s all about finding new ways to make money and value in an increasingly digital world.

- Customer Experience (CX) Innovation: In banking, the customer experience is all that matters. Always raising the ante on it through data-driven personalization of customer interactions to streamline processes and create value. That means understanding journeys and applying innovation to eliminate pain points and deliver better. Imagine making any interaction by a customer with the bank smooth and delightful-just the ultimate feat of CX Innovation.

- Cultural Innovation: Without the right culture, none of the above could take place. It means creating a culture that will allow creativity, experimentation, and risk-taking. It also means creating an environment where the employee will be told that they can share their ideas, generate new ways to perform work processes, and experience failure. Create a garden where new ideas can bloom.

The Challenges of Innovating the Bank

While innovation is key to long-term success, there are a couple of challenges that it presents:

- Risk and Uncertainty: Innovation, in nature and character, encompasses several risks and how to handle uncertainty. Not all new ideas work; the prospect of failure can indeed be a pretty strong deterrent. For handling such risk, what is required is a frame of mind that views failure as an opportunity for learning rather than defeat. It’s like playing some kind of game; sometimes you lose, but with each loss, you learn how you have to win the next time.

- Resource Allocation: Most often, innovations require huge investments in terms of time, money, and talent. These could be quite tough to manage together with the running requirements of day-to-day operations, especially in resource-constrained environments. In some way, it’s a little like running a marathon while wearing an extremely heavy backpack-you need to look for ways of lightening this load if you want to keep running.

- Regulatory Constraints: Banking is a very regulated industry, which really stifles innovation. Understanding regulatory constraints and taking the bull by the horns to remain compliant requires much insight into frameworks; therefore, it’s better to dance in a small space-you’ve got to be innovative with your moves so you don’t bump into the walls.

- Cultural Resistance: Like transformation, innovation too faces resistance from within. Employees may not be too keen on new ideas or technologies as they may see them as a threat to their roles or ways the bank has traditionally done business. This will require not just leadership but a change in mindset across organizations.

- Market Competition: There is high competition in the race of innovation. Several banks and fintech firms are racing to be the first in the market with the best offering. Catch up with, or run ahead of, competition, vigilance, and agility are the basic and continuous needs. It’s like running at high speeds when you have to not only run fast but also be prepared for those sudden turns and obstacles coming right ahead.

Best Practices for Innovating the Bank

The best practices that banks should look toward to drive innovation effectively include:

- Foster an Innovation Culture: Provide a culture where thinking out of the box and experimentation are nurtured. This can be enabled through various means, such as innovation labs, hackathons, and a dedicated innovation team free from the burden of day-to-day work, where free-thinking would allow room for creativity to bloom.

- Embrace Agile Methodologies: Agile methodologies enable banks to innovate faster, evolve with market conditions, and get early mover advantage. Working in short iterative cycles will help test an idea, garner feedback, build improvements, and scale up innovations. Think of building a prototype and then refining it rather than building the perfect prototype out of the gate.

- Collaborate with Fintechs and Startups: As such, engaging in this sector will grant the bank access to State of Art technologies from these fintech firms as well as a plethora of innovative ideas. This helps to fast-track their innovation and new product development through such partnerships. Imagine having a partner at your side who moves fast and thus pushes you ahead.

- Invest in Technology: Be ahead of the competition by investing in new and emerging technologies that have the power to change the face of banking. This includes not only adopting existing technologies but also experimenting with new ones which may or may not be widely adopted as yet. It’s being the first to try new tools that could actually change the way you do business.

- Customer-Centric Innovation: Give special importance to the needs and preferences of the customer in designing products and services. A bank that places the customer at the heart of its innovation drive can come up with offerings that will be much more attractive to their target audience, thus assuring brand loyalty on a long-term basis. “Just like creating a tailored suit-perfectly fitted to meet your customer’s needs.”

- Balancing Innovation with Risk Management: While innovation needs taking a risk, stringent risk management practices become very important to balance the same. That means understanding plausible risks from new initiatives and ensuring controls to mitigate such risks. It is about walking the fine line between being bold and being careful.

Innovating the Bank as a Catalyst for Growth

Innovation will be the differentiator that enables the bank to remain relevant in an increasingly competitive, rapidly changing marketplace. Embracing a culture of innovation, leveraging emerging technologies, and focusing on customer-centric solutions now make better differentiation possible, unlock new channels, and develop innovative ways to grow the bottom line.

But innovation doesn’t happen in a vacuum; it’s founded on operational excellence-run the bank-and the agility imparted by successful transformation-changing the bank-innovate around the bank. Individually important, all three drive a complete strategy to help banks not just survive disruption but thrive under its forces.

In the final analysis, banks that succeed at innovating are those that strike a proper balance between the need for creativity and experimentation with the discipline required to manage risks and resources. Thus, they will be leading the way into a new future of financial services and sustainable value for customers, employees, and shareholders.

Found this article interesting? Want a deeper dive? Check out our book on how to create the Strategic Flywheel or, Continue reading some of our articles