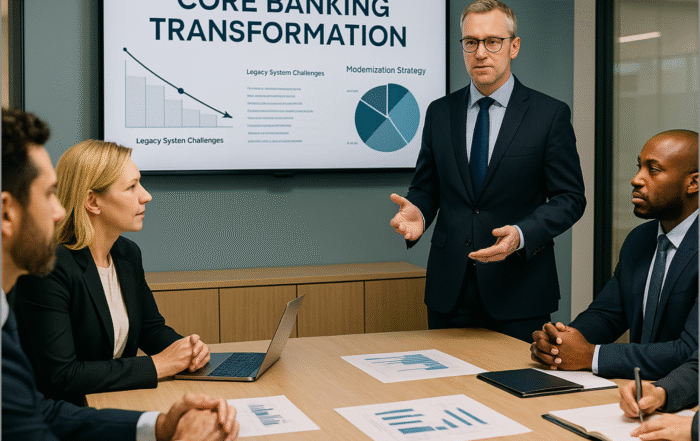

Integrating Core Banking Systems for Enhanced Business Operations

Core banking systems form the backbone of banking operations. All activities, from processing transactions to managing customer relationships, rely on the capabilities of the core platform. What are some key business functions enabled by robust core solutions?

Transaction Processing

The most fundamental role of a core banking system is transaction processing. Activities such as:

- Deposits and withdrawals

- Funds transfers

- Loan origination and payments

- Fee and interest application

- Clearing and settlement

are handled by the core system. It also maintains balance and liquidity while complying with regulations. Smooth transaction processing is essential for efficient operations.

Payment Services

Payment modules enable services like:

- Domestic and cross-border payments

- RTGS, NEFT, IMPS transfers

- Cheque processing

- EMI transactions

- Integration with payment systems like UPI, IMPS, NACH

Seamless payment processing creates delightful customer experiences.

Lending and Credit Management

Key lending functions supported include:

- Loan origination, disbursement, and accounting

- Collateral management

- Credit assessment and approvals

- EMIs, interest accruals, fee calculations

- Securitization, syndication, credit monitoring

- Integrations with credit bureaus

Robust lending functionality is imperative for managing credit profitably.

Deposit Management

The core platform enables:

- Opening and managing deposit accounts

- Interest calculations and accruals

- Renewals management

- Integration with valuables management systems

Efficient deposit account management reduces costs.

Customer Relationship Management

CRM capabilities like:

- Interaction tracking

- Campaign management

- Analytics and segmentation

- Integration with engagement channels

provide personalized engagement and improve customer satisfaction.

Regulatory Compliance

The system must support:

- KYC and AML monitoring

- FATCA, CRS reporting

- Basel capital adequacy compliance

- RBI, central bank regulations

Regulatory non-compliance leads to heavy penalties.

Reporting and Analytics

Robust BI, analytics, and visualization capabilities provide insights for:

- Portfolio analysis

- Profitability management

- Fraud monitoring

- ALM and liquidity reporting

- Regulatory reporting

Data-driven decision-making depends on comprehensive reporting.

Omni-Channel Banking

Seamless CRM integrations enable:

- Unified engagement across channels

- Personalized outreach across web, mobile, branches

- Workflow digitization

Omni-channel integration is essential for superior customer experience.

By expertly automating these critical functions, the core banking system creates significant operational efficiencies, reduces costs, enhances customer experience, and ensures compliance – unlocking strategic value.

While legacy systems support core operations, modern platforms based on agile architecture, open APIs, and cloud deliver exponential business benefits.

As banking grows more complex, competitive, and regulated, finding the right balance between stability and innovation through core transformation becomes imperative. With the right core solution powering business operations, banks gain a strategic advantage. Core modernization is mission-critical.

If you want to read a more in-depth account of how we define what a Core Banking System is, then read our previous post:

Exploring the True Essence of Core Banking Systems

Found this article interesting? Check out these three related reads for more.

- Core banking transformation – What it is and why it matters

- Navigating digital banking regulatory challenges

- Exploring the true essence of core banking systems

#CoreSystemSupport #BankingOpsRole